The Terra team details that it is working closely with centralized exchange partners like Bybit and Binance in order to support LUNA holders who left funds on exchanges.

” that has said a class action lawsuit is being planned in order to get compensation for the class of LUNA and UST victims.

Fatman said the action will be free to join and the team is researching jurisdictions like Singapore where investment protection is laxer. FatmanI am happy to announce that three law firms have offered to commit over $15m to this historic fight for justice – they are looking to fund the case and will collect fees on a contingency basis. This could never have happened without all of you.

But that’s not all Fatman has been doing, as the Twitter account has published accusations about specific Terra-based projects and partners. In onewritten by Fatman, the social media account says Terra’s Mirror Protocol, a decentralized and synthetic stock exchange, was “really just a farce designed to enrich Do Kwon/VCs.” The Twitter thread discusses how Mirror Protocol’s governance system was allegedly rigged.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

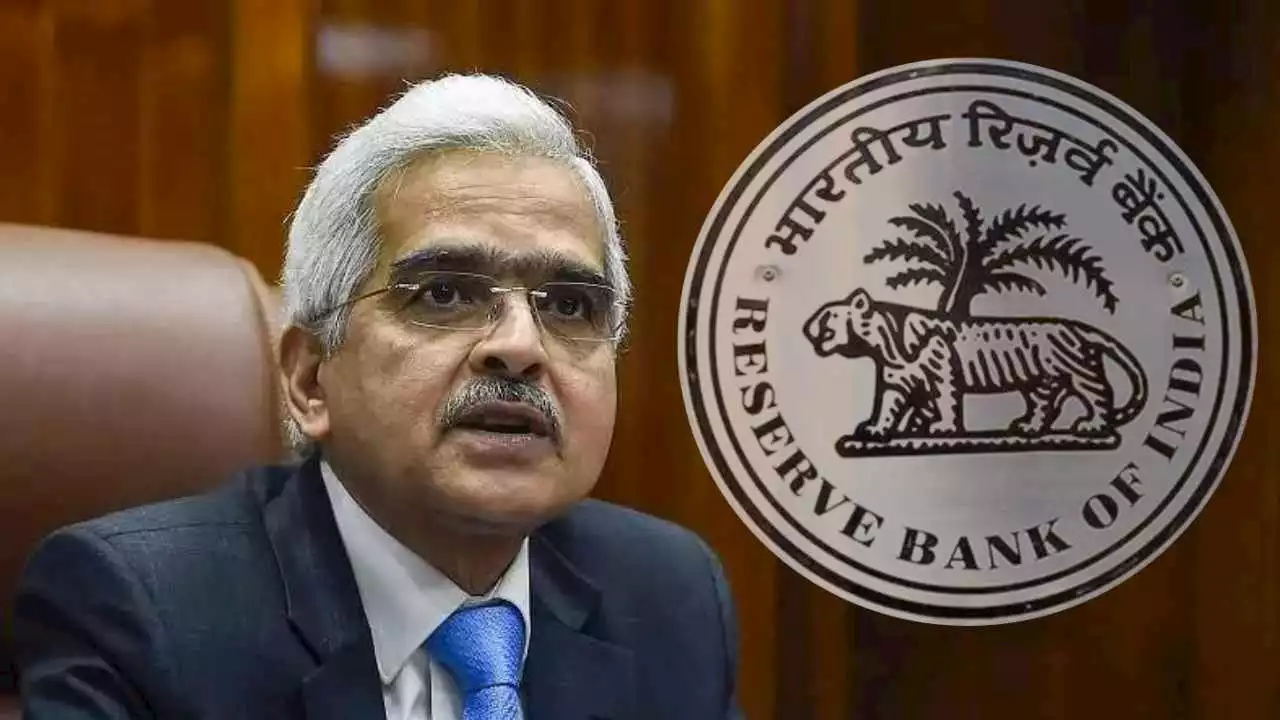

India's Central Bank Governor Warns About Crypto After Collapse of Terra LUNA, UST – Regulation Bitcoin NewsIndia's central bank has warned about investing in the crypto market following the collapse of terra (LUNA) and stablecoin terrausd (UST).

India's Central Bank Governor Warns About Crypto After Collapse of Terra LUNA, UST – Regulation Bitcoin NewsIndia's central bank has warned about investing in the crypto market following the collapse of terra (LUNA) and stablecoin terrausd (UST).

Weiterlesen »

WEF 2022: Terra were offering unsustainable yields; DeFi can support financial inclusionCoral Capital’s Horsman shared that the Terra (LUNA) crisis partly occurred because “they were essentially offering yields that were unsustainable, and [that] there were venture capital firms that were bootstrapping those yields in order to bootstrap an ecosystem.”

WEF 2022: Terra were offering unsustainable yields; DeFi can support financial inclusionCoral Capital’s Horsman shared that the Terra (LUNA) crisis partly occurred because “they were essentially offering yields that were unsustainable, and [that] there were venture capital firms that were bootstrapping those yields in order to bootstrap an ecosystem.”

Weiterlesen »

OCC's Hsu reiterates 'careful and cautious' approach after Terra collapseActing OCC Head Michael Hsu is doubling down on the bank regulator's careful approach to crypto, though he says he sees potential in crypto.

OCC's Hsu reiterates 'careful and cautious' approach after Terra collapseActing OCC Head Michael Hsu is doubling down on the bank regulator's careful approach to crypto, though he says he sees potential in crypto.

Weiterlesen »

After Terra, Luna crashes, regulators count cost of cryptoLUNA and UST's crash came right as Singapore, where the company is registered, is rethinking its regulatory approach to crypto. CoinDesk's Asia Markets Reporter thesamreynolds appeared on AJEnglish to discuss how it would affect the rest of the market.

Weiterlesen »

Crypto Investor and Influencer Arrested for Visiting Terra Founder Do Kwon's ApartmentThe unknown person visiting Terraform Labs' founder Do Kwon has been identified as a streamer called 'Chancers' who lost $2.4 million in the LUNA crash.

Crypto Investor and Influencer Arrested for Visiting Terra Founder Do Kwon's ApartmentThe unknown person visiting Terraform Labs' founder Do Kwon has been identified as a streamer called 'Chancers' who lost $2.4 million in the LUNA crash.

Weiterlesen »

Do Kwon’s plan to rebirth the Terra blockchain gets approvedThe governance vote on Do Kwon's proposal to relaunch the Terra blockchain and create LUNA 2.0 tokens has passed.

Do Kwon’s plan to rebirth the Terra blockchain gets approvedThe governance vote on Do Kwon's proposal to relaunch the Terra blockchain and create LUNA 2.0 tokens has passed.

Weiterlesen »