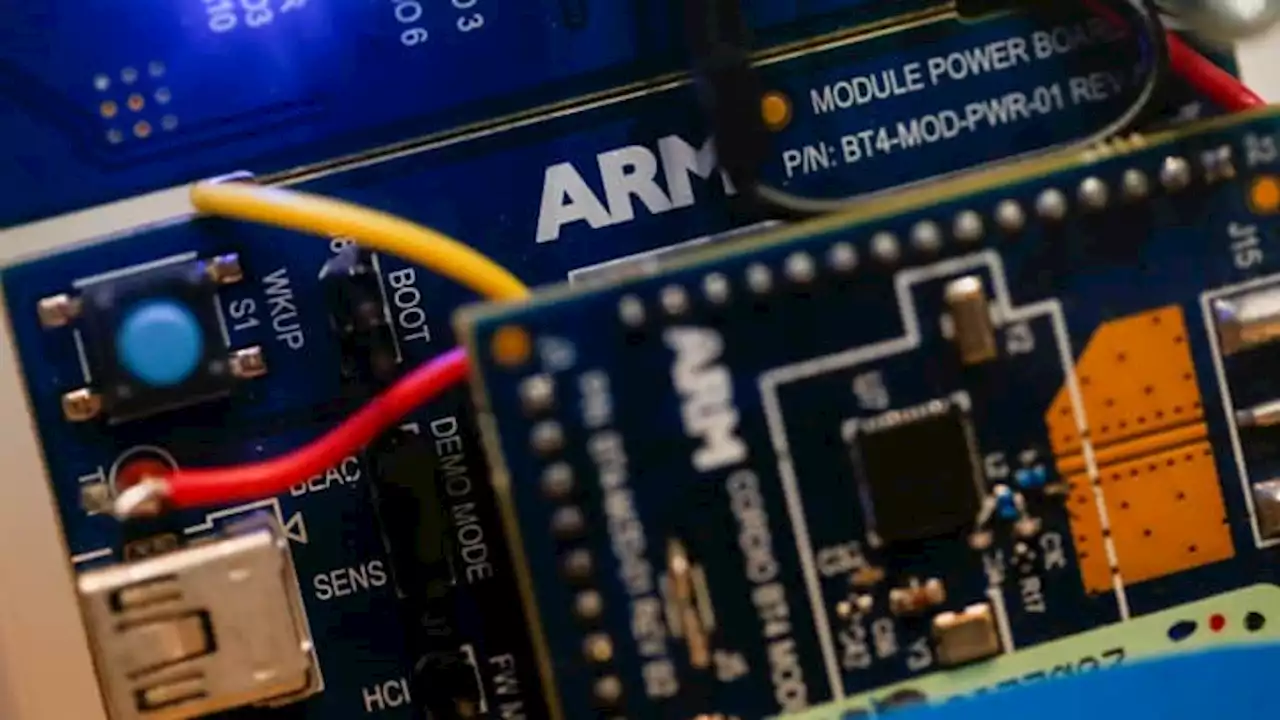

British chip designer Arm is targeting a valuation of around $52 billion for its IPO, according to a filing on Tuesday.

Arm Holdings is set for a blockbuster initial public offering which will test market appetite for an important technology company. However, its targeted valuation suggests it is accepting it won’t be the next Nvidia.

The target is below a $64 billion calculation of Arm’s value following a recent stake sale involving its current owner SoftBank . SoftBank is hoping to sell about 10% of total shares outstanding in the offering, The Journal reported. The company will issue 95.5 million American depositary shares from $47 to $51 each, with each ADS representing one ordinary share. With 1.03 billion ordinary shares to be outstanding after the IPO, the company would be valued between $48.23 billion and $52.33 billion.

read this That’s less than the 117 times trailing price-to-earnings ratio which Nvidia trades. However, Arm is still aiming for a hefty premium to other chip makers which share a heavy exposure to the sluggish smartphone market. For example, Qualcomm trades at a trailing P/E ratio of 15 times.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Chip design firm Arm seeks up to $52 billion valuation in blockbuster U.S. IPOArm was previously dually listed in London and New York, before SoftBank acquired it for $32 billion in 2016.

Chip design firm Arm seeks up to $52 billion valuation in blockbuster U.S. IPOArm was previously dually listed in London and New York, before SoftBank acquired it for $32 billion in 2016.

Weiterlesen »

Arm Targets More Than $52 Billion Valuation in Largest IPO of the YearApple, Intel and Nvidia are among the companies that plan to buy shares in the British chip maker’s initial public offering.

Arm Targets More Than $52 Billion Valuation in Largest IPO of the YearApple, Intel and Nvidia are among the companies that plan to buy shares in the British chip maker’s initial public offering.

Weiterlesen »

Renault CEO sees Ampere IPO valuation of up to 10 billion euros -FT By ReutersRenault CEO sees Ampere IPO valuation of up to 10 billion euros -FT

Renault CEO sees Ampere IPO valuation of up to 10 billion euros -FT By ReutersRenault CEO sees Ampere IPO valuation of up to 10 billion euros -FT

Weiterlesen »

Arm to be valued at up to $52.3 billion as IPO terms are setArm has set terms for its IPO, as the U.K.-based chip designer looks to sell up to $4.9 billion worth of shares to the public.

Arm to be valued at up to $52.3 billion as IPO terms are setArm has set terms for its IPO, as the U.K.-based chip designer looks to sell up to $4.9 billion worth of shares to the public.

Weiterlesen »