From Breakingviews - Deposit insurance is addiction not medication

Though the FDIC has only promised to make SVB and Signature’s customers whole, the idea that it has set a template for the industry helped take the heat out of the crisis. The question is what happens next. At some point, the authorities will have to spell out their position. There are broadly three choices they could make.

One is to try and throw a bigger and more permanent protective net around savers. When the financial crisis struck in 2008, the FDIC heroically pledged to back all deposits in non-interest bearing accounts that weren’t already covered. It can’t do that this time. The Dodd-Frank Act of 2010 restricts the FDIC to offering unlimited guarantees to depositors of an individual bank, which must be in receivership.

The trouble is that deposit insurance is like Novocaine – the higher the dose, the more the patient becomes numb. SVB’s wealthy clients already turned a blind eye to the bank’s fickle funding and losses in its investment portfolio. If they knew their deposits were riskless, they would have been even more supine. Conversely, if SVB’s managers believed their patrons could flee, they might have been more careful about loading up on long-dated securities they couldn’t easily sell.

For that reason the best option is probably to do nothing – or better still, lower the deposit insurance limit. That might seem cruel. Deposit guarantees, with their aura of protecting the small saver, have a folksy appeal reinforced by the cinematic lesson in banking that is “It’s a Wonderful Life.” But most Americans have far less than $250,000 in their bank. At JPMorganFor tens of millions of customers, the $250,000 limit is a benefit they do not need, but still help fund.

With savers and investors jittery, regulators will need to tread carefully. It’s hard to get uninsured depositors to understand the dangers they face. If SVB’s venture capital and technology startup customers were oblivious to the risks, others are unlikely to be more vigilant. And if savers find themselves on the hook for small banks’ losses, funds will

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

![]() Opinion | After Silicon Valley Bank, scrap the bank deposit insurance limitThe time has come for Congress to scrap the $250,000 cap on deposit insurance coverage and charge banks more for operating a government-backed deposit business.

Opinion | After Silicon Valley Bank, scrap the bank deposit insurance limitThe time has come for Congress to scrap the $250,000 cap on deposit insurance coverage and charge banks more for operating a government-backed deposit business.

Weiterlesen »

First Republic Bank cut to junk status by S&P on deposit outflow riskFirst Republic Bank was cut to junk by S&P Global Ratings amid concern that clients pull holdings, after U.S. regulators pledged support for the banking sector.

First Republic Bank cut to junk status by S&P on deposit outflow riskFirst Republic Bank was cut to junk by S&P Global Ratings amid concern that clients pull holdings, after U.S. regulators pledged support for the banking sector.

Weiterlesen »

First Republic Bank stock tumbles on credit downgrade and deposit worriesFirst Republic Bank's credit rating was downgraded on Wednesday by both Fitch Ratings and S&P Global Ratings on concerns that depositors could pull their cash despite the federal intervention.

First Republic Bank stock tumbles on credit downgrade and deposit worriesFirst Republic Bank's credit rating was downgraded on Wednesday by both Fitch Ratings and S&P Global Ratings on concerns that depositors could pull their cash despite the federal intervention.

Weiterlesen »

Breakingviews - Bank runs don’t change Fed’s focus on high pricesThe past two weeks have been a roller-coaster ride for interest rate forecasts. At the start of the month, most investors expected the U.S. Federal Reserve to raise rates by another 25 basis points later in March, bringing them to a range of 4.75% to 5%. Silicon Valley Bank’s collapse turned that harmony into discord. Some economists now expect Fed chair Jerome Powell to pause hikes, or even cut rates, to relieve stress on banks. With inflation still running too hot, such a reversal would do more harm than good.

Breakingviews - Bank runs don’t change Fed’s focus on high pricesThe past two weeks have been a roller-coaster ride for interest rate forecasts. At the start of the month, most investors expected the U.S. Federal Reserve to raise rates by another 25 basis points later in March, bringing them to a range of 4.75% to 5%. Silicon Valley Bank’s collapse turned that harmony into discord. Some economists now expect Fed chair Jerome Powell to pause hikes, or even cut rates, to relieve stress on banks. With inflation still running too hot, such a reversal would do more harm than good.

Weiterlesen »

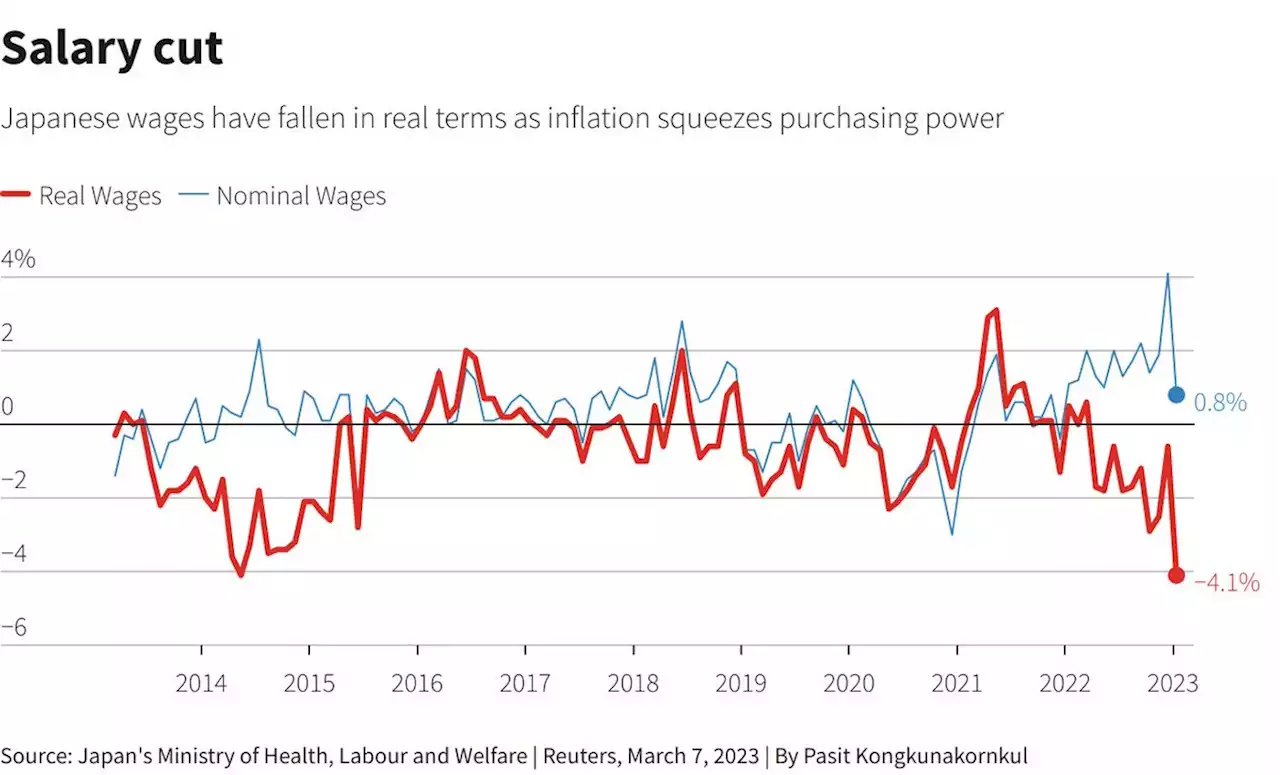

Breakingviews - Bad news salvo gives Bank of Japan some coverIncoming Bank of Japan Governor Kazuo Ueda can breathe a sigh of relief; things aren’t going very well. The conclusion of annual wage negotiations between major industrial unions and employers resulted in average salary rises of around 3%, the highest since 1997 but still slower than consumer prices. Ripples from the collapse of Silicon Valley Bank have shoved down sovereign bond yields, inadvertently driving off an attack by traders who believed global inflation made rate hikes unavoidable. Avoidable is now the precise word.

Breakingviews - Bad news salvo gives Bank of Japan some coverIncoming Bank of Japan Governor Kazuo Ueda can breathe a sigh of relief; things aren’t going very well. The conclusion of annual wage negotiations between major industrial unions and employers resulted in average salary rises of around 3%, the highest since 1997 but still slower than consumer prices. Ripples from the collapse of Silicon Valley Bank have shoved down sovereign bond yields, inadvertently driving off an attack by traders who believed global inflation made rate hikes unavoidable. Avoidable is now the precise word.

Weiterlesen »

SVB, Signature Bank failure explained - USA TODAYHow worried should Americans be about recent bank collapses? usatodaymoney reporter Medora Lee puts things in perspective with 5 Things podcast host atltwil:

SVB, Signature Bank failure explained - USA TODAYHow worried should Americans be about recent bank collapses? usatodaymoney reporter Medora Lee puts things in perspective with 5 Things podcast host atltwil:

Weiterlesen »