Big U.S. banks are bracing for another adjustment, as the surge in revenue created by two years of wonky markets and exuberant dealmaking comes to an end. This time the cuts are likely to be shallower, but still traumatic: johnsfoley

, adding staff in the process. Even so, while overall income has risen by 40% since the end of 2019, the 12 biggest firms now have the same number of what are known as “front office producers” as they had then, based on Coalition data from the end of March. Effectively, banks just squeezed more rain from the same rainmakers – around $4.2 million per person in 2021 compared with under $3 million before the pandemic.

The first line of defense against falling revenue at investment banks is to pay people less. Employees are already bracing for stingy bonuses. But if revenue levels are permanently reduced, banks will have little choice but to cut staff. One response is to let people leave and not replace them. That’s not ideal: Banks end up losing people they’d rather not, and testing the patience of those that remain.

That leaves room for disappointment, as tumbling revenue butts against workforces that are difficult to reduce in size. The bank most likely to wield the axe might be Goldman, which has returned to its “rank-and-yank” model of jettisoning weak performers. Yet even that exercise is only likely to shrink the workforce by little more than 1%, according to a person familiar with the situation. Cutting staff in a bad market is tough for Wall Street bosses; having nobody to cut is tough on investors.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Hong Kong wins over Wall Street CEOs after lifting strict Covid rules | CNN BusinessHong Kong has finally secured commitments from some of the world's biggest banks to participate in a long-awaited summit, as it seeks to reaffirm its status as a global financial hub.

Hong Kong wins over Wall Street CEOs after lifting strict Covid rules | CNN BusinessHong Kong has finally secured commitments from some of the world's biggest banks to participate in a long-awaited summit, as it seeks to reaffirm its status as a global financial hub.

Weiterlesen »

U.S. fines 16 Wall Street firms $1.8 bln for talking deals, trades on personal appsU.S. regulators on Tuesday fined 16 financial firms, including Barclays , Bank of America , Citigroup , Credit Suisse , Goldman Sachs , Morgan Stanley and UBS , a combined $1.8 billion after staff discussed deals and trades on their personal devices and apps.

U.S. fines 16 Wall Street firms $1.8 bln for talking deals, trades on personal appsU.S. regulators on Tuesday fined 16 financial firms, including Barclays , Bank of America , Citigroup , Credit Suisse , Goldman Sachs , Morgan Stanley and UBS , a combined $1.8 billion after staff discussed deals and trades on their personal devices and apps.

Weiterlesen »

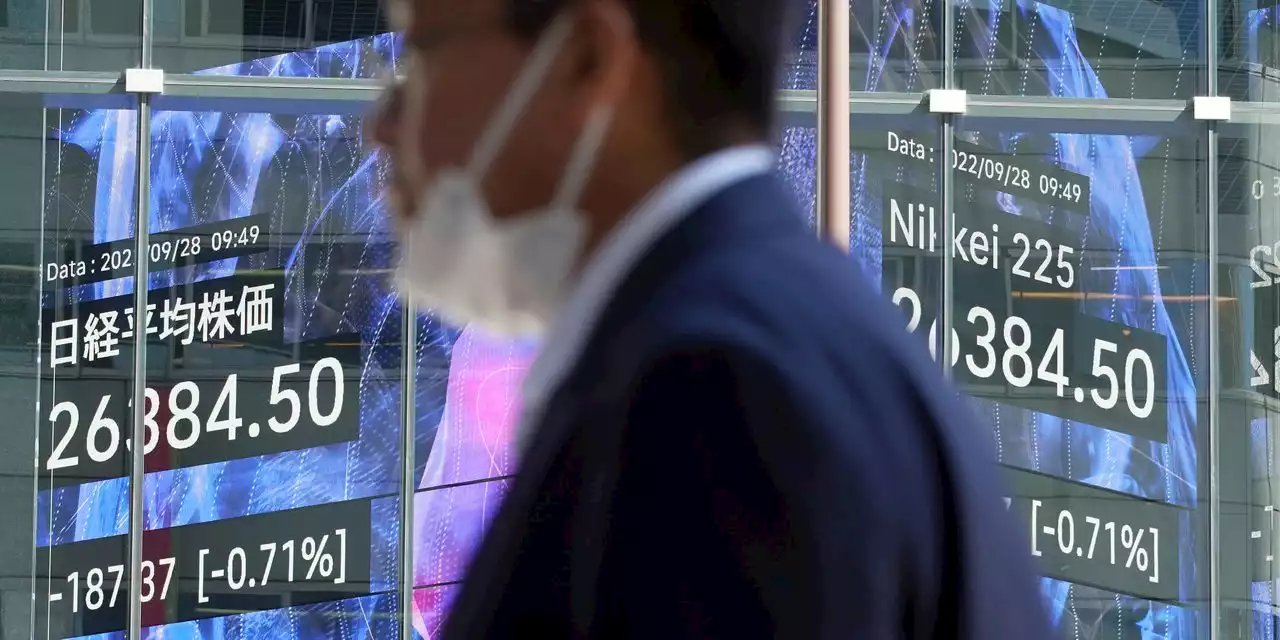

Asian markets sharply lower after wobbly day on Wall StreetAsian shares tumbled Wednesday after a wobbly day ended with mixed results on Wall Street as markets churn over the prospect of a possible recession.

Asian markets sharply lower after wobbly day on Wall StreetAsian shares tumbled Wednesday after a wobbly day ended with mixed results on Wall Street as markets churn over the prospect of a possible recession.

Weiterlesen »

Breakingviews - Wall Street sends regulators a poop emojiWhat’s the best response to an inconvenient, impractical rule? For Wall Street brokerages, one answer is simply to flout it. Eleven of the biggest names in finance just paid $1.8 billion to the U.S. Securities & Exchange Commission and the Commodity Futures Trading Commission over employees’ unapproved use of platforms like WhatsApp. It manages to be both trivial and disturbing.

Breakingviews - Wall Street sends regulators a poop emojiWhat’s the best response to an inconvenient, impractical rule? For Wall Street brokerages, one answer is simply to flout it. Eleven of the biggest names in finance just paid $1.8 billion to the U.S. Securities & Exchange Commission and the Commodity Futures Trading Commission over employees’ unapproved use of platforms like WhatsApp. It manages to be both trivial and disturbing.

Weiterlesen »

Biden not focusing on Wall Street means he's not focused on America's prosperity: Rep. Carlos GimenezRep. Carlos Gimenez, R-Fla., called out Biden for not focusing on the stock market selloff, arguing the president is not tied to the reality of how people retire.

Biden not focusing on Wall Street means he's not focused on America's prosperity: Rep. Carlos GimenezRep. Carlos Gimenez, R-Fla., called out Biden for not focusing on the stock market selloff, arguing the president is not tied to the reality of how people retire.

Weiterlesen »