Citibank sees 2.1% rise in DXY in three months – Bloomberg – by anilpanchal7 DollarIndex Banks RiskAppetite Fed

of preliminary readings of the Michigan Consumer Sentiment Index and the next week’s Federal Open Market Committee meeting.

The update also mentioned, “With global equities already down $23 trillion in 2022, the greenback’s inverse relationship to risk assets makes it the only game in town for at least the rest of the year, the strategists wrote in a note dated Sept. 15.” If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

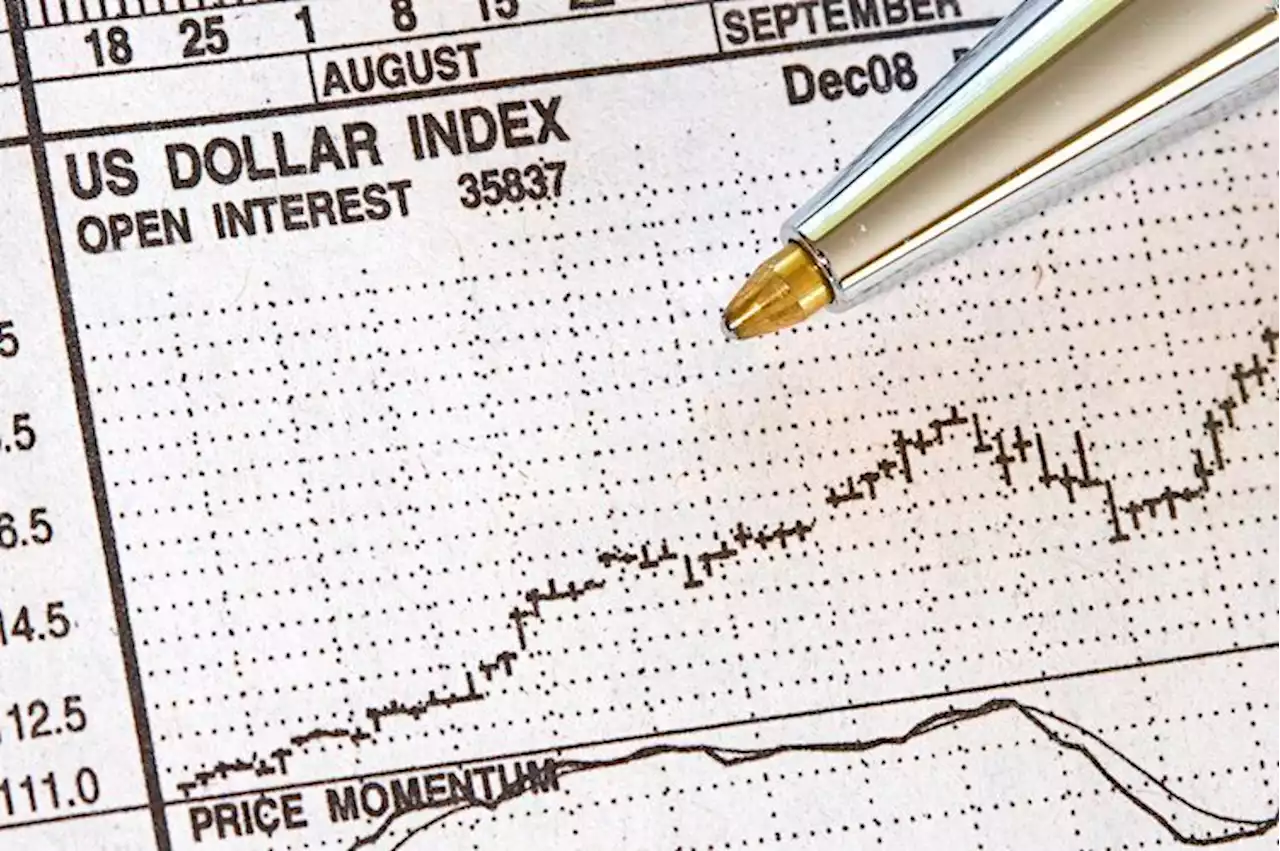

US Dollar Index Price Analysis: Next on the upside comes the 2022 highDXY gives away some gains following the post-CPI sharp upside to the 110.00 region on Wednesday. Despite the ongoing knee-jerk in the dollar, its shor

US Dollar Index Price Analysis: Next on the upside comes the 2022 highDXY gives away some gains following the post-CPI sharp upside to the 110.00 region on Wednesday. Despite the ongoing knee-jerk in the dollar, its shor

Weiterlesen »

US Dollar Index Price Analysis: Another visit to the 2022 top remains in placeUS Dollar Index Price Analysis: Another visit to the 2022 top remains in place – by pabspiovano DollarIndex Technical Analysis Currencies Majors

US Dollar Index Price Analysis: Another visit to the 2022 top remains in placeUS Dollar Index Price Analysis: Another visit to the 2022 top remains in place – by pabspiovano DollarIndex Technical Analysis Currencies Majors

Weiterlesen »

US Dollar Index rebounds towards 110.00 with eyes on US Retail SalesUS Dollar Index (DXY) picks up bids to pare the previous day’s losses around 109.70 during Thursday’s Asian session. In doing so, the greenback’s gaug

US Dollar Index rebounds towards 110.00 with eyes on US Retail SalesUS Dollar Index (DXY) picks up bids to pare the previous day’s losses around 109.70 during Thursday’s Asian session. In doing so, the greenback’s gaug

Weiterlesen »

EUR/USD bounces off weekly lows though stays below parity, amid US dollar weaknessThe EUR/USD slightly recovers from yesterday’s losses, advancing almost 0.31%, due to a soft US dollar after August’s US Producer Price Index (PPI) dr

EUR/USD bounces off weekly lows though stays below parity, amid US dollar weaknessThe EUR/USD slightly recovers from yesterday’s losses, advancing almost 0.31%, due to a soft US dollar after August’s US Producer Price Index (PPI) dr

Weiterlesen »

Forex Today: Persistent US Inflation Boosts Dollar, Sinks StUS CPI Data Higher Than Expected; US Dollar Gains Strongly; 2-Year Treasury Yields Exceed 3.8%; Bank of Japan Signals Intervention.

Forex Today: Persistent US Inflation Boosts Dollar, Sinks StUS CPI Data Higher Than Expected; US Dollar Gains Strongly; 2-Year Treasury Yields Exceed 3.8%; Bank of Japan Signals Intervention.

Weiterlesen »