Analysts are expecting the S&P 500 to produce earnings per share of $49.96, a drop of roughly 6% from the first quarter of 2022.

The weekslong festival of conference calls that is earnings season has its informal start Friday morning.Analysts are expecting the S&P 500 to produce earnings per share of $49.96, a drop of roughly 6% from the first quarter of 2022.If that comes to pass, it'll be the second straight decline in year-over-year earnings growth, the first such "earnings recession" since the COVID crisis.Shrinking earnings aren't a tragedy.

If we do have two straight quarters of shrinking profits, you'll hear a lot of chatter about how such an "earnings recession" bodes ill for the health of the U.S. economy. Ignore it. Analysts expect that corporate earnings will be strained not by a drop in top-line sales — which can be a decent measure of economic activity — but by shrinking margins.When inflation was ripping hard in 2021-22 companies were able to jack up prices with ease., despite public bellyaching from executives about the higher costs of virtually everything, including labor.As price increases have slowed, companies have had a harder time passing along cost increases to consumers.

But big surprise losses, or profits that trounce expectations, can set the background mood music for the markets. Also, comments by corporate executives in conference calls with analysts can gin up new worries for investors or ease concern about known issues.That's because their estimates are driven by conversations with corporate executives, who typically like to underpromise on earnings, and then over-deliver with a better-than-expected number, thus generating a satisfying pop in the share price.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

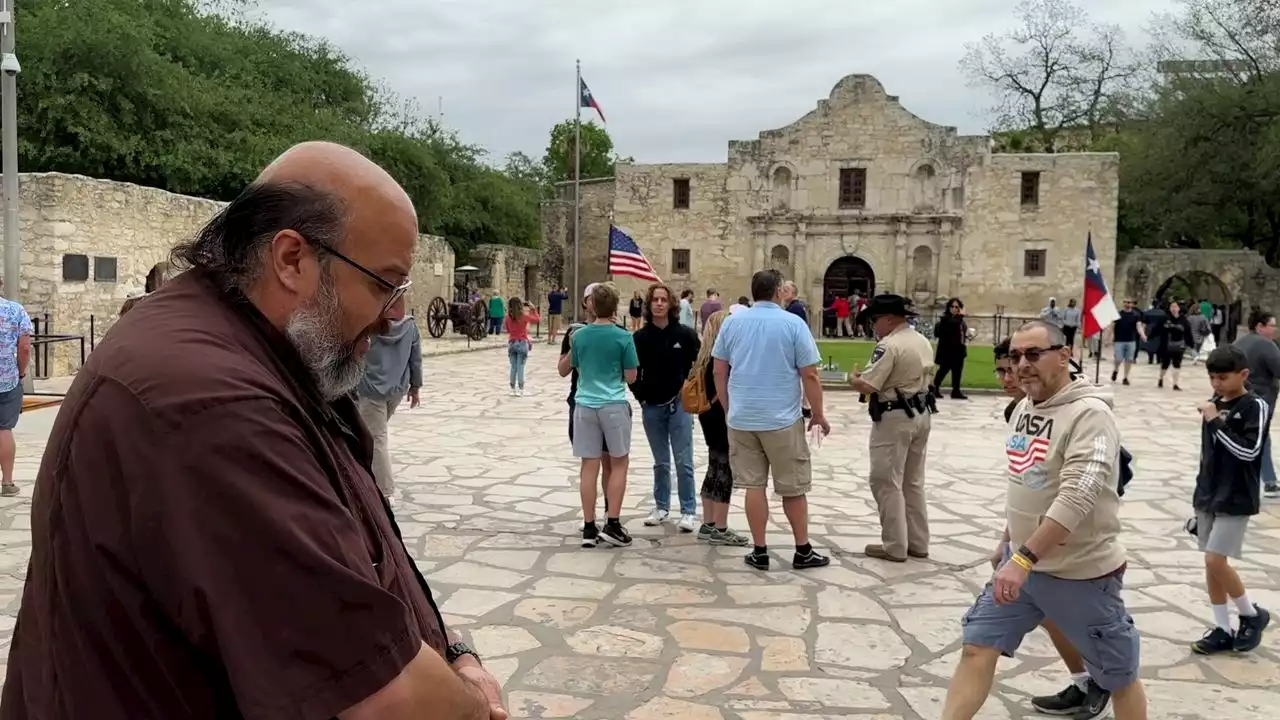

Alamo Collections Center adds new layers to historical landmarkIn the past, only around 1% of the total artifacts discovered at the Alamo could be displayed. Now, more than 500 items are available for public viewing.

Alamo Collections Center adds new layers to historical landmarkIn the past, only around 1% of the total artifacts discovered at the Alamo could be displayed. Now, more than 500 items are available for public viewing.

Weiterlesen »

India’s Rayzon Plans 500 Megawatt Solar Module Fab In The US - CleanTechnicaRayzon Solar, an India-based solar module manufacturer, has announced plans to set up module production line in the United States.

India’s Rayzon Plans 500 Megawatt Solar Module Fab In The US - CleanTechnicaRayzon Solar, an India-based solar module manufacturer, has announced plans to set up module production line in the United States.

Weiterlesen »

S&P 500 Futures improve amid steady yields, Fed talks, inflation concerns in focusRisk profile remains mildly positive as traders take a breather during early Thursday, after a volatile Wednesday. In doing so, the market players che

S&P 500 Futures improve amid steady yields, Fed talks, inflation concerns in focusRisk profile remains mildly positive as traders take a breather during early Thursday, after a volatile Wednesday. In doing so, the market players che

Weiterlesen »

Stock Market Today: Dow Futures Creep HigherU.S. stock futures edged up ahead of the release of the producer-price index. Follow the latest markets updates.

Stock Market Today: Dow Futures Creep HigherU.S. stock futures edged up ahead of the release of the producer-price index. Follow the latest markets updates.

Weiterlesen »

Over 500 Creative Agencies Have Now Pledged Not to Work for Fossil Fuel Industry'Every agency still working with fossil fuel clients is putting their reputations on the line,' says CleanCreatives' duncanwrites as the climate campaign announces 500 agencies have committed to stop working with fossil fuel polluters.

Weiterlesen »

Stocks close higher Thursday, S&P 500 notches highest close since February: Live updatesStocks jumped Thursday, with Big Tech leading, as traders cheered another report pointing to cooling U.S. inflation. The Dow popped 1.14%. The S&P 500 gained 1.33%. The Nasdaq surged 1.99%.

Stocks close higher Thursday, S&P 500 notches highest close since February: Live updatesStocks jumped Thursday, with Big Tech leading, as traders cheered another report pointing to cooling U.S. inflation. The Dow popped 1.14%. The S&P 500 gained 1.33%. The Nasdaq surged 1.99%.

Weiterlesen »