Crude oil prices may see higher-than-usual volatility ahead of the March OPEC meeting amid ongoing nuclear talks with Iran as well as tension between Russia and Ukraine. Get your market update from DimitriZabelin here:

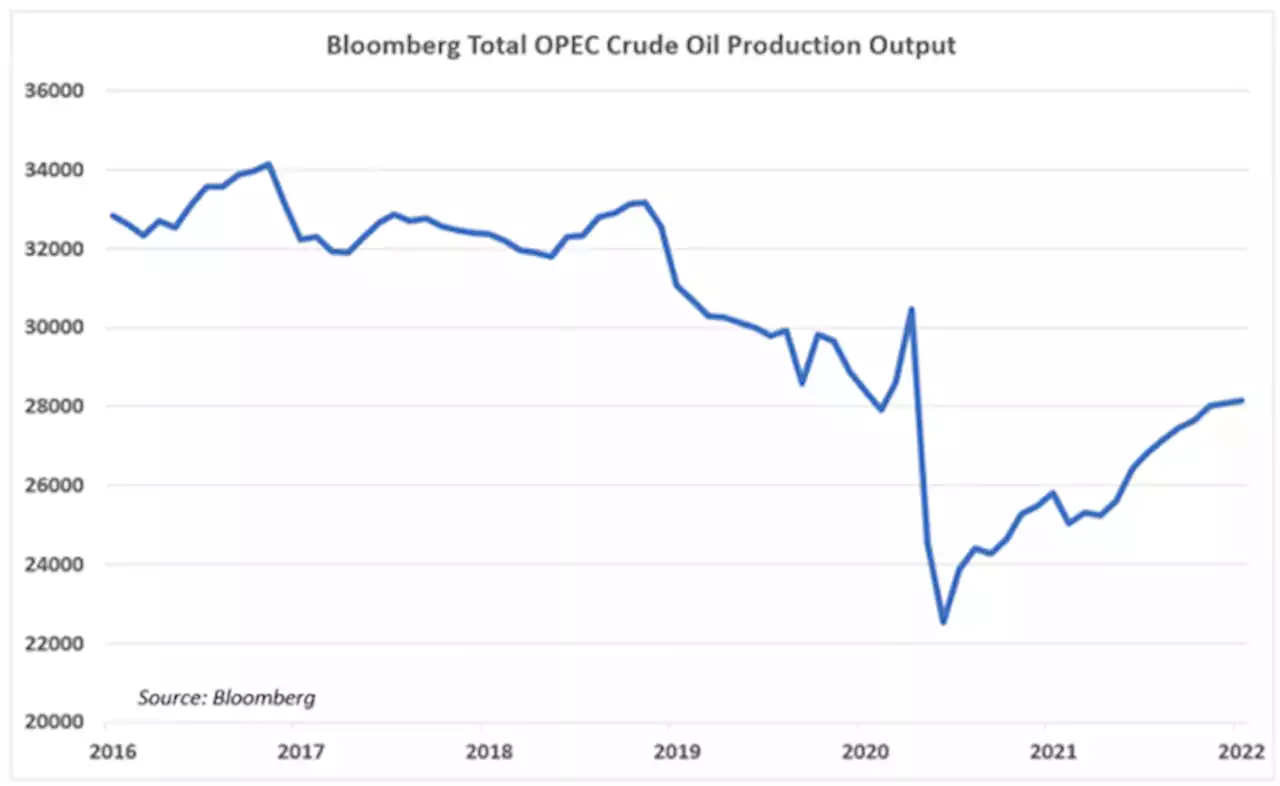

are up almost 20% year-to-date. The Brent benchmark is hovering at over $90 a barrel, with expectations that it could hit as high as $120 in 2022. Supply disruptions from COVID-19, resurgent demand, and geopolitical developments in Europe and Iran are stoking volatility. The bullish case seems strong, but which of these stories will have the most impact?The Organization of Petroleum Exporting Countries and its extended cartel associates will be convening on March 2.

The Iran nuclear deal is a critical foreign policy endeavor that the Biden administration is keen to achieve From an international point of view, coming up short here could stoke the narrative that the US is an unreliable partner who’s commitment to accords may radically change with a new administration. Allies and competitors alike may then start to look for more predictable counterparties to do business with – like China, for example – despite a lack of democratic norms that many Western states afford.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

WTI Crude Oil Forecast: Crude Oil Gives Up Early GainsThe West Texas Intermediate Oil market had rallied a bit on Thursday but has given back some of the gains to show less than favorable price action.

WTI Crude Oil Forecast: Crude Oil Gives Up Early GainsThe West Texas Intermediate Oil market had rallied a bit on Thursday but has given back some of the gains to show less than favorable price action.

Weiterlesen »

USD/CAD eyes WTI that seesaws between Iran nuclear deal and the Russia-Ukraine tensionsThe USD/CAD pair is hovering in the vicinity of 1.2700 with a high of 1.2714 recently printed as West Texas Intermediate (WTI), futures on NYMEX cappe

USD/CAD eyes WTI that seesaws between Iran nuclear deal and the Russia-Ukraine tensionsThe USD/CAD pair is hovering in the vicinity of 1.2700 with a high of 1.2714 recently printed as West Texas Intermediate (WTI), futures on NYMEX cappe

Weiterlesen »

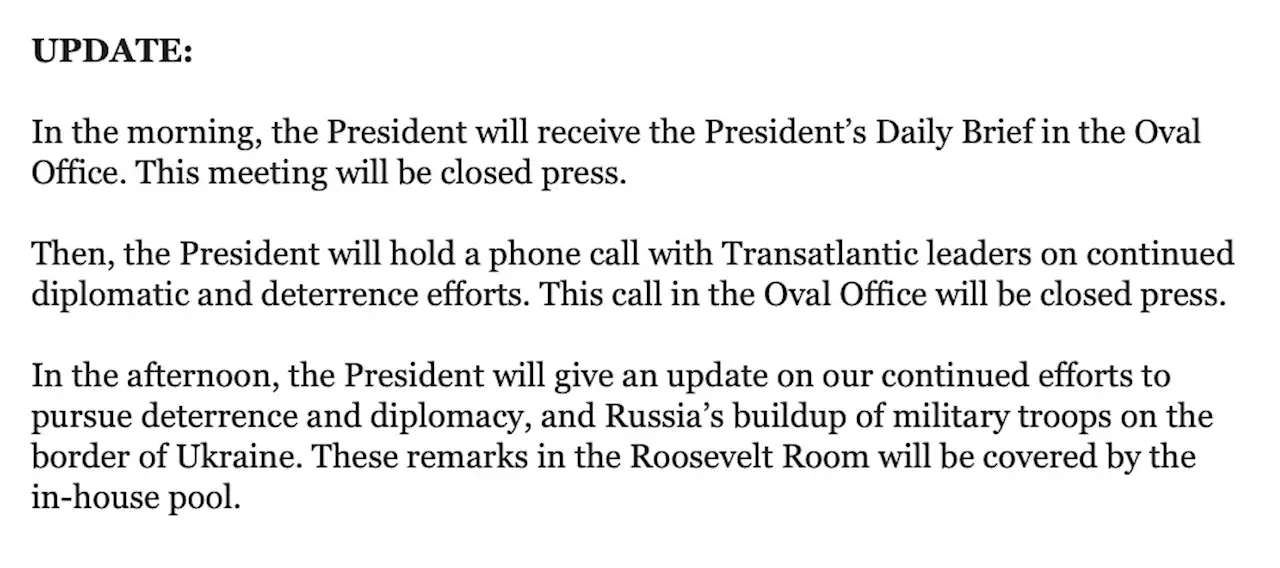

Russia-Ukraine live updates: Russia-backed separatists announce mass evacuationsJUST IN: Pres. Biden to give update 'on our continued efforts to pursue deterrence and diplomacy, and Russia’s buildup of military troops on the border of Ukraine' at 4 p.m. ET, White House says.

Russia-Ukraine live updates: Russia-backed separatists announce mass evacuationsJUST IN: Pres. Biden to give update 'on our continued efforts to pursue deterrence and diplomacy, and Russia’s buildup of military troops on the border of Ukraine' at 4 p.m. ET, White House says.

Weiterlesen »

Russia-Ukraine live updates: Russia adds as many as 7,000 troops, US official saysThe Ukrainian government has denied any intention to launch an offensive on the separatist-held areas.

Russia-Ukraine live updates: Russia adds as many as 7,000 troops, US official saysThe Ukrainian government has denied any intention to launch an offensive on the separatist-held areas.

Weiterlesen »

Crude Oil Price Fades on Iranian Discussions Despite Weak USDBrent crude opened slightly weaker this morning on the back of Iran re-entering the global supply market, outshining fears around Russian/Ukraine tensions which have driven brent above $95/barrel. Get your market update from WVenketas here:

Crude Oil Price Fades on Iranian Discussions Despite Weak USDBrent crude opened slightly weaker this morning on the back of Iran re-entering the global supply market, outshining fears around Russian/Ukraine tensions which have driven brent above $95/barrel. Get your market update from WVenketas here:

Weiterlesen »

Japanese Yen Weakness Against Crude Oil Could Provide Opportunities.Crude oil priced in Japanese Yen has been consistently appreciating of late despite elevated geopolitical risks. What does this say about the safe-haven status of the JPY? Get your market update from DanMcCarthyFX here:

Japanese Yen Weakness Against Crude Oil Could Provide Opportunities.Crude oil priced in Japanese Yen has been consistently appreciating of late despite elevated geopolitical risks. What does this say about the safe-haven status of the JPY? Get your market update from DanMcCarthyFX here:

Weiterlesen »