Blish believes the biggest challenge would emerge if the SEC decides that no U.S. citizen should interact with crypto staking protocols.

to pay a civil penalty of $30 million and immediately shut down its staking platform in the U.S.

Commenting on the SEC’s action, Blish opined that although the move could benefit on-chain liquid staking providers, the final resolution could bring up new challenges for DeFi.“I have been getting a lot more questions about ‘does this impact Lido, what are your thoughts on this? I personally think this is a net benefit for on-chain permissionless liquid staking or staking providers, but it really depends on what the final resolution is,” he said.

“The biggest risk I personally see as a US-based person is if they come down and say you can no longer even interact with or contribute to these types of protocols. Then me as a contributor to the DAO, does that mean I can’t work on Lido anymore? Do I have to go leave and do something else?” Blish also asserted that regulators’ request for transparency on the industry’s part should match the transparency on how decisions are made.is currently the largest ether staking protocol, with over 4.8 million ETH valued at about $7.2 billion staked on the platform. Blish believes that Lido serves a “plumbing” function in ETH staking.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

SEC's crypto staking crackdown has uncertain consequences for DeFi: Lido FinanceAccording to a member of the DAO that manages Lido Finance, crackdowns from the SEC on crypto staking could result in a shaky future for decentralized finance (DeFi) in the United States.

SEC's crypto staking crackdown has uncertain consequences for DeFi: Lido FinanceAccording to a member of the DAO that manages Lido Finance, crackdowns from the SEC on crypto staking could result in a shaky future for decentralized finance (DeFi) in the United States.

Weiterlesen »

DeFi Degens | CoinMarketCapCMCGlossary: DeFi Degens✨ DeFi degenerates. A subculture associated with a disreputable corner of decentralized finance known for pump and dump schemes. Details:

DeFi Degens | CoinMarketCapCMCGlossary: DeFi Degens✨ DeFi degenerates. A subculture associated with a disreputable corner of decentralized finance known for pump and dump schemes. Details:

Weiterlesen »

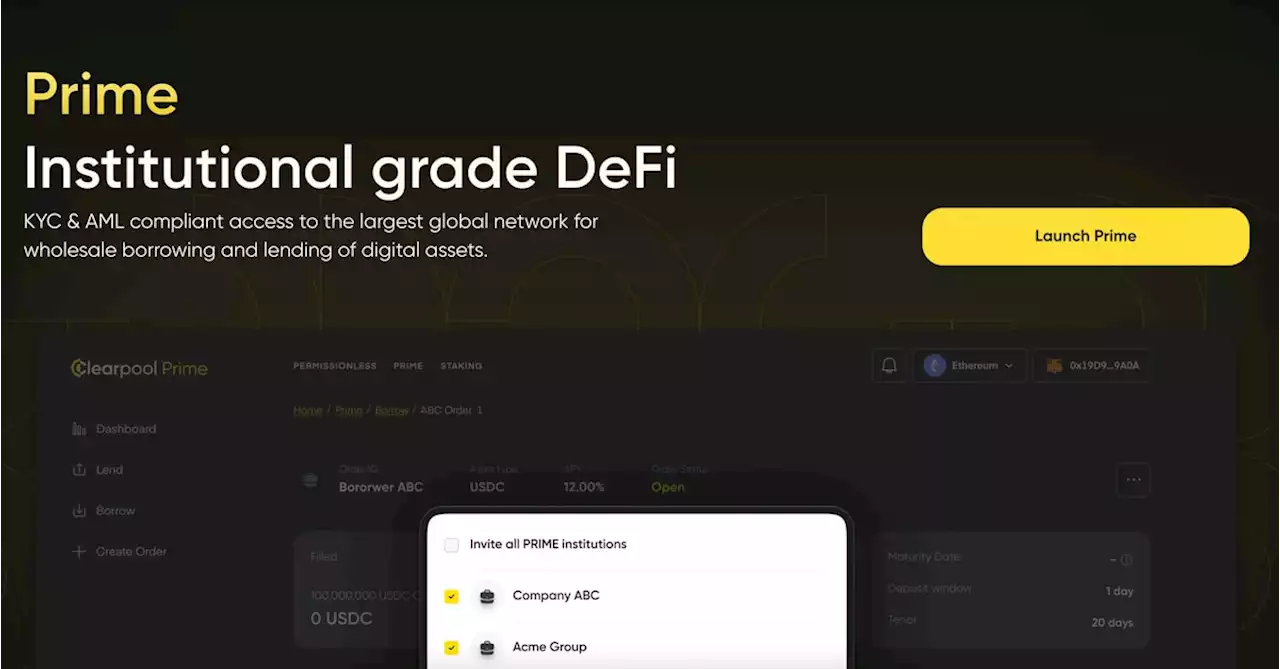

DeFi Protocol Clearpool Chooses Polygon Network for Its Institutional Lending Platform.ClearpoolFin will deploy its institutional credit platform Prime exclusively on 0xPolygon and has opened the onboarding and whitelisting process for institutional borrowers and lenders to Prime. sndr_krisztian reports

DeFi Protocol Clearpool Chooses Polygon Network for Its Institutional Lending Platform.ClearpoolFin will deploy its institutional credit platform Prime exclusively on 0xPolygon and has opened the onboarding and whitelisting process for institutional borrowers and lenders to Prime. sndr_krisztian reports

Weiterlesen »

Guest Post by zkLend: How DeFi lending rates are set differently than in TradFi | CoinMarketCap

Guest Post by zkLend: How DeFi lending rates are set differently than in TradFi | CoinMarketCap

Weiterlesen »

Huobi Cloud Wallet no more: Exchange pulls plug on DeFi multi-token walletHuobi Cloud Wallet will stop being upgraded and maintained from Feb. 13, with the platform set to be shut down by May 2023.

Huobi Cloud Wallet no more: Exchange pulls plug on DeFi multi-token walletHuobi Cloud Wallet will stop being upgraded and maintained from Feb. 13, with the platform set to be shut down by May 2023.

Weiterlesen »

Bernstein Says Regulatory Backlash Will Lead to More DeFi and Offshore Crypto.BernsteinBuzz says regulatory overreach of the crypto market will lead to further movement towards decentralized finance apps, built directly on-chain by anonymous teams. willcanny99 reports. BernsteinGautam

Bernstein Says Regulatory Backlash Will Lead to More DeFi and Offshore Crypto.BernsteinBuzz says regulatory overreach of the crypto market will lead to further movement towards decentralized finance apps, built directly on-chain by anonymous teams. willcanny99 reports. BernsteinGautam

Weiterlesen »