The Dow Jones and S&P 500 are vulnerable as Ukraine tensions have been driving retail investors to increase their upside exposure. What are key technical levels to watch for? Get your market update from ddubrovskyFX here:

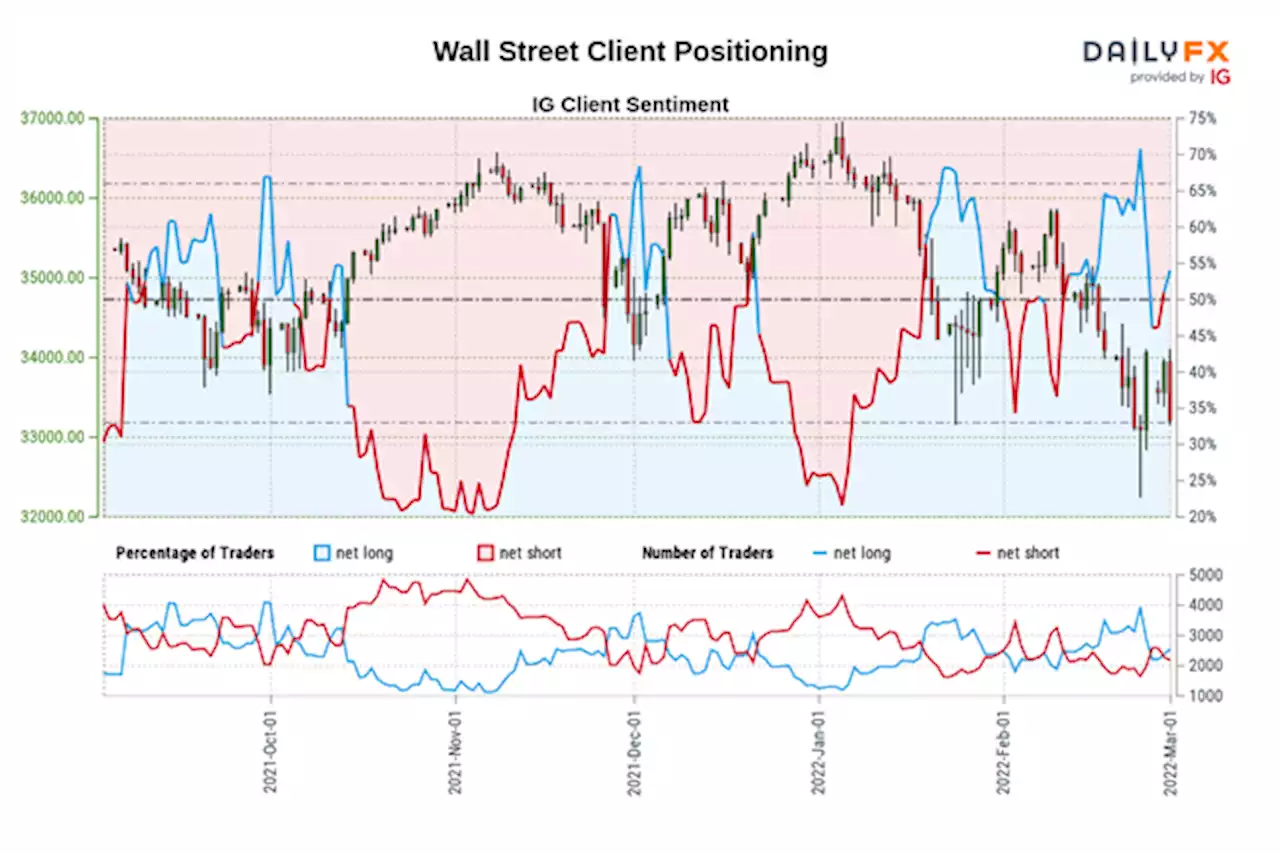

Amid geopolitical tensions in Ukraine, data from IG Client Sentiment shows that retail traders are increasingly betting that the Dow Jones and S&P 500 may rally ahead. Upside exposure has been on the rise. At times, IGCS can behave as a contrarian indicator. If this trend in positioning continues, then the road ahead for Wall Street could be tough. For a more comprehensive overview, check out the recording of my webinar above.

Since most traders are biased to the upside, this hints that prices may continue falling. This, plus recent shifts in positioning, are offering a stronger bearish contrarian trading bias.Dow Jones futures appear to be trading within the boundaries of a Falling Wedge chart formation, which could spell weakness in the near term if prices remain within the boundaries of it. The index is consolidating around the 32902 – 33623 support zone after a. The latter spells indecision.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Dow, S&P 500 rise for second straight day in choppy trade as oil rally relentsU.S. stocks trade higher Thursday, finding support as a breakneck rally in oil prices took a break, while investors continue to monitor Russia's invasion of...

Dow, S&P 500 rise for second straight day in choppy trade as oil rally relentsU.S. stocks trade higher Thursday, finding support as a breakneck rally in oil prices took a break, while investors continue to monitor Russia's invasion of...

Weiterlesen »

Dow Rises as Investors Eye Ukraine, Interest RatesStock indexes rose and oil prices jumped, as Russia pounded Ukrainian cities and investors evaluated testimony from Federal Reserve Chairman Jerome Powell.

Dow Rises as Investors Eye Ukraine, Interest RatesStock indexes rose and oil prices jumped, as Russia pounded Ukrainian cities and investors evaluated testimony from Federal Reserve Chairman Jerome Powell.

Weiterlesen »

Dow Jumps 700 Points, Oils Hits 11-Year High As ‘Investors Are Whipsawed’ By Rate Hikes And Russia-Ukraine ConflictThe Dow jumped 700 points, oils hit an 11-year high as ‘investors are whipsawed’ by rate hikes and the Russia-Ukraine conflict by skleb1234

Dow Jumps 700 Points, Oils Hits 11-Year High As ‘Investors Are Whipsawed’ By Rate Hikes And Russia-Ukraine ConflictThe Dow jumped 700 points, oils hit an 11-year high as ‘investors are whipsawed’ by rate hikes and the Russia-Ukraine conflict by skleb1234

Weiterlesen »