EUR/USD clings to mild losses near parity as ECB hawks, Fed’s Powell flex muscles – by anilpanchal7 EURUSD ECB Fed Recession RiskAppetite

Chair Jerome Powell’s speech. Also supporting the greenback could be the recent pause in the US Treasury yields, after reversing from the multi-day high, as well as hawkish Fed bets.

US Dollar Index pares the biggest daily loss in a month around 109.80 as the US 10-year Treasury yields pause Wednesday’s downside by taking rounds to 3.27%, after taking a U-turn from the highest levels since mid-June. On the other hand, S&P 500 Futures fade bounced off the lowest levels since July 19 as it seesaws around 3,980 by the press time.

It should be noted that covid fears emanating from China and the likely escalation in the Sino-American tussles also on the market sentiment and the EUR/USD prices. Recently, Reuters came out with the news stating that Taiwan President Tsai Ing-wen told a delegation of US lawmakers on Thursday that the island will continue to work with the United States to forge closer trade and economic ties.

On Wednesday, the market’s optimism spread by the firmer data from the major economies and Fed’s Beige Book, not to forget the mixed Fedspeak, seemed to have triggered the EUR/USD pair’s rebound from the multi-year low. Looking forward, EUR/USD traders may witness a volatile day wherein the 0.75% ECB rate hike can offer short-term recovery before the fresh downside, in a case where Fed’s Powell sounds hawkish. Overall, the pair is likely to remain on the bear’s radar as the European energy crisis is far from over and hence the ECB’s capacity to tighten

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

EUR/USD: Some wait-and-see approach ahead of the ECB meeting – INGEUR/USD hovers around the 0.99 level. In the view of economists at ING, the pair may enter Thursday’s European Central Bank (ECB) meeting from this le

EUR/USD: Some wait-and-see approach ahead of the ECB meeting – INGEUR/USD hovers around the 0.99 level. In the view of economists at ING, the pair may enter Thursday’s European Central Bank (ECB) meeting from this le

Weiterlesen »

EUR/USD: ECB to reinforce euro weakness if delivers another 50 bps hike – MUFGThe next key event for the euro in the week ahead will be the European Central Bank’s (ECB) upcoming policy meeting on Thursday. Economists at MUFG Ba

EUR/USD: ECB to reinforce euro weakness if delivers another 50 bps hike – MUFGThe next key event for the euro in the week ahead will be the European Central Bank’s (ECB) upcoming policy meeting on Thursday. Economists at MUFG Ba

Weiterlesen »

EUR/USD Price Analysis: Bears taking on critical H4 supportAs per the prior analysis from the start of the week, EUR/USD Price Analysis: Bulls eye a 50% mean reversion near 0.9950, the price moved into the key

EUR/USD Price Analysis: Bears taking on critical H4 supportAs per the prior analysis from the start of the week, EUR/USD Price Analysis: Bulls eye a 50% mean reversion near 0.9950, the price moved into the key

Weiterlesen »

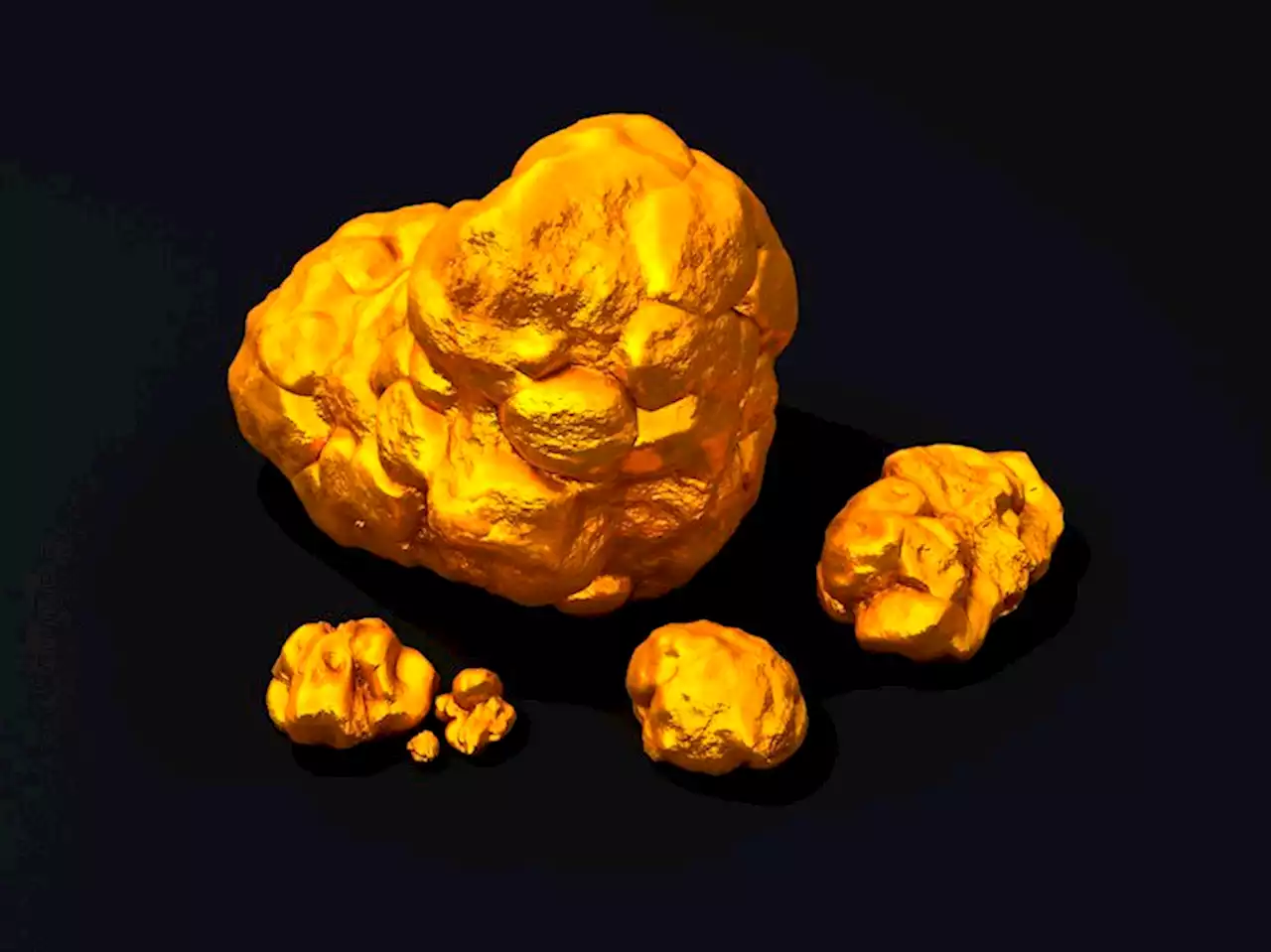

Gold Price Forecast: XAU/USD establishes below $1,700, more weakness likely ahead of Fed Powell’s speechGold Price Forecast: XAU/USD establishes below $1,700, more weakness likely ahead of Fed Powell’s speech – by Sagar_Dua24 Gold XAUUSD Fed Inflation DollarIndex

Gold Price Forecast: XAU/USD establishes below $1,700, more weakness likely ahead of Fed Powell’s speechGold Price Forecast: XAU/USD establishes below $1,700, more weakness likely ahead of Fed Powell’s speech – by Sagar_Dua24 Gold XAUUSD Fed Inflation DollarIndex

Weiterlesen »

Gold Price Forecast: XAU/USD pokes monthly resistance above $1,700, Fed’s Powell eyedGold price (XAU/USD) grinds higher as bulls attack a short-term key hurdle surrounding $1,718 during the initial hour of Thursday’s Asian session. The

Gold Price Forecast: XAU/USD pokes monthly resistance above $1,700, Fed’s Powell eyedGold price (XAU/USD) grinds higher as bulls attack a short-term key hurdle surrounding $1,718 during the initial hour of Thursday’s Asian session. The

Weiterlesen »