The Federal Reserve launched a high-risk effort to tame the worst inflation since the early 1980s, raising its benchmark short-term interest rate and signaling up to six additional rate hikes this year.

The central bank, in a policy statement, along with quarterly projections and remarks by Chair Jerome Powell at a news conference, pointed to a somewhat more aggressive approach to rate hikes than many analysts had expected.

The Fed also released a set of quarterly economic projections Wednesday that underscored the potential for extended interest rate increases in the months ahead. Seven hikes would raise its short-term rate to between 1.75% and 2% at the end of 2022. Fed officials also forecast four more rate increases in 2023, which would boost its benchmark rate to 2.8%.

after the pandemic struck. And many economists say the Fed has made its task riskier by waiting too long to begin raising rates. At his news conference, Powell said he believed that inflation would slow later this year as supply chain bottlenecks clear and more Americans return to the job market, easing upward pressure on wages.

The Fed’s forecast for numerous additional rate hikes in the coming months initially disrupted a strong rally on Wall Street, weakening stock gains and sending bond yields up. But stock prices more than recovered their gains soon after the press conference began.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Embattled Biden Pick Withdraws Nomination for Fed ReserveSarah Bloom Raskin faced criticism from Republicans (and former coal businessman Joe Manchin) for her belief that climate change should be factored into economic decisions.

Embattled Biden Pick Withdraws Nomination for Fed ReserveSarah Bloom Raskin faced criticism from Republicans (and former coal businessman Joe Manchin) for her belief that climate change should be factored into economic decisions.

Weiterlesen »

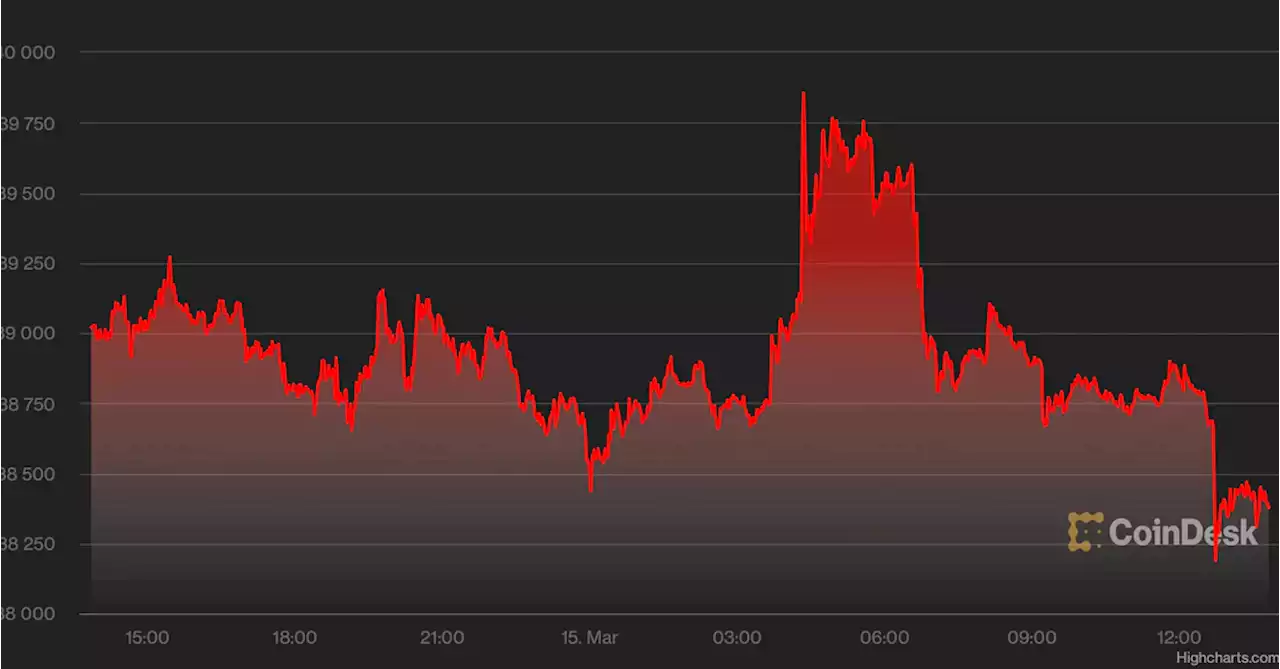

Bitcoin Breakout Elusive as Traders Price in 7 Fed Rate Hikes For 2022Bitcoin narrowly misses a breakout above $40,000 as traders ramp up Fed rate hike bets. reports godbole17

Bitcoin Breakout Elusive as Traders Price in 7 Fed Rate Hikes For 2022Bitcoin narrowly misses a breakout above $40,000 as traders ramp up Fed rate hike bets. reports godbole17

Weiterlesen »

BREAKING: Bitcoin Unfazed as Fed Hikes Interest Rates for the First Time Since 2018⬇ -9 BREAKING: Bitcoin Unfazed as Fed Hikes Interest Rates for the First Time Since 2018 $BTC bitcoin

BREAKING: Bitcoin Unfazed as Fed Hikes Interest Rates for the First Time Since 2018⬇ -9 BREAKING: Bitcoin Unfazed as Fed Hikes Interest Rates for the First Time Since 2018 $BTC bitcoin

Weiterlesen »

BREAKING: Bitcoin Unfazed as Fed Hikes Interest Rates for the First Time Since 2018The Federal Reserve has raised interested rates for the first time in years

BREAKING: Bitcoin Unfazed as Fed Hikes Interest Rates for the First Time Since 2018The Federal Reserve has raised interested rates for the first time in years

Weiterlesen »

Analysis: Investors adjust as Fed hikes, worry about clouds on horizonInvestors are racing to work out how much monetary policy tightening the economy can handle as the U.S. Federal Reserve embarks on its rate-hike cycle, with some expecting an even steeper path ahead as others fret over possible missteps.

Analysis: Investors adjust as Fed hikes, worry about clouds on horizonInvestors are racing to work out how much monetary policy tightening the economy can handle as the U.S. Federal Reserve embarks on its rate-hike cycle, with some expecting an even steeper path ahead as others fret over possible missteps.

Weiterlesen »

Understanding why the Fed will raise interest rates to fight higher pricesThe Fed is expected to raise interest rates for the first time in almost four years, hoping to get control of the highest inflation in decades. It may seem a contradiction, when everything's expensive, to make it more expensive to borrow money to pay for things. That's exactly how this problem is supposed to be fixed.

Understanding why the Fed will raise interest rates to fight higher pricesThe Fed is expected to raise interest rates for the first time in almost four years, hoping to get control of the highest inflation in decades. It may seem a contradiction, when everything's expensive, to make it more expensive to borrow money to pay for things. That's exactly how this problem is supposed to be fixed.

Weiterlesen »