Bitcoin is looking to move on from a historically bad April, but the U.S. Federal Reserve could determine its next direction. (Reporting via WilliamSuberg)

In the event, 102 was little problem for DXY, which may stand to gain even more should the Fed rate hike decision be on the upper end of the spectrum.

“The development of the USD is highly dependent on the Fed’s course of action. The rising inflation and potential 50bps rate hike in early May could strengthen the DXY,” Glassnode added.along with crypto in USD terms in recent weeks, with a particular focus on the fate of the Japanese yen. Japan, unlike the U.S., continues to print vast amounts of liquidity, devaluing its currency even further.

The result is Illiquid Supply Change reaching levels not seen since late 2020 when BTC/USD began to exhibit signs of a “supply shock” as market participants piled into what was already a solidly “hodled” asset class. “This number is reaching peak high numbers, which we’ve also seen in 2020 . Ultimately, a large number of coins are ‘illiquid,’ which adds to the potential of a possible supply shock,” Cointelegraph contributor Michaël van de PoppeContinuing, Van de Poppe argued that the indicator “tells a lot” and could even take some of the fear out of a dip to $30,000.

“Yes, the market can still make a new lower low in which the bear market continues and a hit of $30K can be reached. But, fundamentally, the data tells a lot,” he added.In what could be a silver lining under current circumstances, crypto sentiment is already pointing higher this week, even as traditional market sentiment remains nervous.

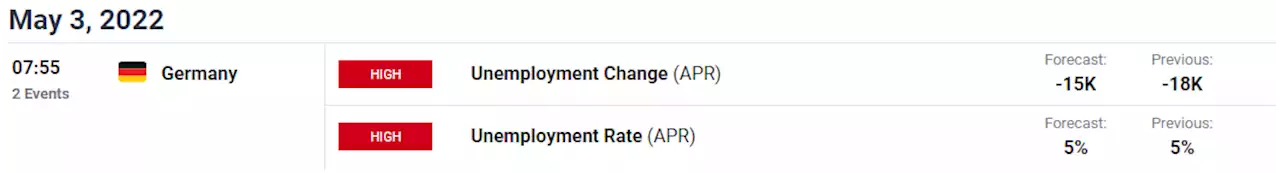

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

With an 'Aggressive' Fed Rate Hike Expected Next Week, Stocks and Crypto Markets Lose Billions – Market Updates Bitcoin NewsThis Wednesday, Federal Reserve policymakers are expected to raise the benchmark interest rate aggressively. Economics Gold Stocks Crypto

With an 'Aggressive' Fed Rate Hike Expected Next Week, Stocks and Crypto Markets Lose Billions – Market Updates Bitcoin NewsThis Wednesday, Federal Reserve policymakers are expected to raise the benchmark interest rate aggressively. Economics Gold Stocks Crypto

Weiterlesen »

USD/JPY bears have moved in ahead of the big day, the FedUSD/JPY was on the back foot on Friday and was trading at a low of 129.31 as the pair corrects in a W-formation. For the open, the pair is steady ahea

USD/JPY bears have moved in ahead of the big day, the FedUSD/JPY was on the back foot on Friday and was trading at a low of 129.31 as the pair corrects in a W-formation. For the open, the pair is steady ahea

Weiterlesen »

Euro Forecast: EUR/USD Selloff Stalls Ahead of Fed Rate DecisionThe Federal Reserve interest rate decision is likely to sway EUR/USD as the central bank is widely expected to normalize monetary policy at a faster pace. Get your weekly Euro forecast from DavidJSong here:

Euro Forecast: EUR/USD Selloff Stalls Ahead of Fed Rate DecisionThe Federal Reserve interest rate decision is likely to sway EUR/USD as the central bank is widely expected to normalize monetary policy at a faster pace. Get your weekly Euro forecast from DavidJSong here:

Weiterlesen »

US Dollar Index struggles to defend 103.00 as traders brace for Fed, NFPUS Dollar Index (DXY) drops towards 103.00 during Monday’s Asian session, extending the previous day’s pullback from a 20-year high, as an absence of

US Dollar Index struggles to defend 103.00 as traders brace for Fed, NFPUS Dollar Index (DXY) drops towards 103.00 during Monday’s Asian session, extending the previous day’s pullback from a 20-year high, as an absence of

Weiterlesen »

Jobs report, Fed decision, CVS earnings top week aheadFOX Business takes a look at the upcoming events that are likely to move financial markets in the coming days.

Jobs report, Fed decision, CVS earnings top week aheadFOX Business takes a look at the upcoming events that are likely to move financial markets in the coming days.

Weiterlesen »