GBP/USD holds steady near mid-1.3500s, 100-DMA as traders await the key NFP report By HareshMenghani GBPUSD RiskAppetite Fed NFP Currencies

Following the previous day's modest pullback and the subsequent bounce from sub-1.3500 levels, the GBP/USD pair managed to regain positive traction on Friday amid modest US dollar weakness. A generally positive tone around the equity markets was seen as a key factor that undermined the safe-haven greenback and extended some support to the major.

The British pound was further underpinned by hopes that the Omicron outbreak won't derail the UK economy and rising bets for additional interest rate hikes by the. That said, the worsening COVID-19 situation in Britain could act as a headwind for the sterling and keep a lid on any further gains for the GBP/USD pair, at least for now.

Investors also seemed reluctant to place aggressive bets, rather preferred to wait on the sidelines ahead of Friday's release of the closely watched US monthly jobs data. The popularly knownreport, due later during the early North American session, will be looked upon to reinforce growing market expectations about a faster policy tightening by the Fed.

It is worth recalling that the December 14-15 FOMC monetary policy meeting minutes released on Wednesday indicated that the US central bank could hike interest rates earlier than anticipated. Hence, a stronger reading would reaffirm hawkish Fed expectations, which should be enough to provide a fresh lift to the USD and prompt some selling around the GBP/USD pair.

Apart from this, the broader market risk sentiment will influence the USD price dynamics. Traders will further take cues from developments surrounding the coronavirus saga to grab some short-term opportunities around the GBP/USD pair.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

GBP/USD Price Analysis: Acceptance above 100-DMA/1.3600 to set the stage for further gainsGBP/USD Price Analysis: Acceptance above 100-DMA/1.3600 to set the stage for further gains By HareshMenghani GBPUSD Technical Analysis Majors Currencies

GBP/USD Price Analysis: Acceptance above 100-DMA/1.3600 to set the stage for further gainsGBP/USD Price Analysis: Acceptance above 100-DMA/1.3600 to set the stage for further gains By HareshMenghani GBPUSD Technical Analysis Majors Currencies

Weiterlesen »

GBP/USD hovering between 1.3500-1.3550 levels post-hakwish Fed minutes as traders await Friday’s US jobs reportGBP/USD continues to trade on the back foot on Thursday as the US session gets underway, despite a weaker than expected US December ISM Services PMI s

GBP/USD hovering between 1.3500-1.3550 levels post-hakwish Fed minutes as traders await Friday’s US jobs reportGBP/USD continues to trade on the back foot on Thursday as the US session gets underway, despite a weaker than expected US December ISM Services PMI s

Weiterlesen »

EUR/USD Forex Signal: Rectangle Formation Ahead of NFPsThe EUR/USD held steady even as an energy crisis in the European Union continued.

EUR/USD Forex Signal: Rectangle Formation Ahead of NFPsThe EUR/USD held steady even as an energy crisis in the European Union continued.

Weiterlesen »

USD/MXN slides below the 100-DMA hovering around 20.4400 after Banxico’s minutesOn Thursday, during the New York session, the Mexican peso advances in the North American session, trading at 20.4387 at the time of writing. The mark

USD/MXN slides below the 100-DMA hovering around 20.4400 after Banxico’s minutesOn Thursday, during the New York session, the Mexican peso advances in the North American session, trading at 20.4387 at the time of writing. The mark

Weiterlesen »

USD/JPY subdued to the south of 116.00 level as focus turns to Friday’s key US jobs reportAfter briefly moving back above the 116.00 level on Wednesday, but failing to test Tuesday’s multi-year high at 116.40, USD/JPY has gradually slipped

USD/JPY subdued to the south of 116.00 level as focus turns to Friday’s key US jobs reportAfter briefly moving back above the 116.00 level on Wednesday, but failing to test Tuesday’s multi-year high at 116.40, USD/JPY has gradually slipped

Weiterlesen »

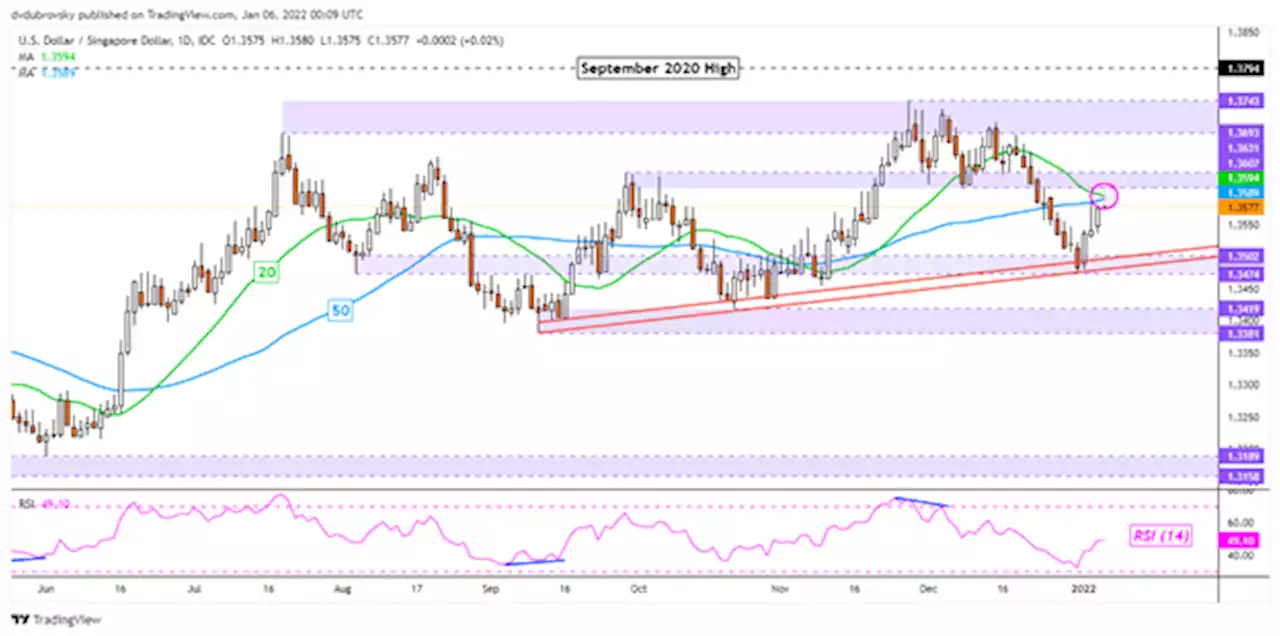

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

Weiterlesen »