Proposition II poses a simple question to Colorado voters, or at least as simple as a tax measure can be: Can the state keep nearly $23.7 million to pay mostly for preschool programs, or does it ne…

Proposition II poses a simple question to Colorado voters, or at least as simple as a tax measure can be: Can the state keep nearly $23.7 million to pay mostly for preschool programs, or does it need to return that money to tobacco wholesalers and distributors?. State analysts projected that Prop. EE would generate about $186.5 million in new taxes during the first year; instead, the state collected $208 million.

Tax rates on other tobacco products and on nicotine products would increase from 50% of the price to 56% in mid-2024 and 62% in mid-2027. The preschool program currently provides at least 15 hours per week of education to nearly 50,000 3- and 4-year-old Coloradans. Proposition EE passed three years ago with more than two-thirds of the vote.Proposition II is just the latest question put to voters under TABOR to allow the state to keep all the money raised by taxes that previously won voters’ approval. Arguments summarized by the Blue Book include that the measure will maintain tax rates and increases set by Prop.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Former Arlington educator advocating for residents to vote 'yes' on proposition to help struggling retired teachers'It won't cost anybody anything. There's no new taxes. And that's the first thing that people want to know,' said Jeanne Paul Turner.

Former Arlington educator advocating for residents to vote 'yes' on proposition to help struggling retired teachers'It won't cost anybody anything. There's no new taxes. And that's the first thing that people want to know,' said Jeanne Paul Turner.

Weiterlesen »

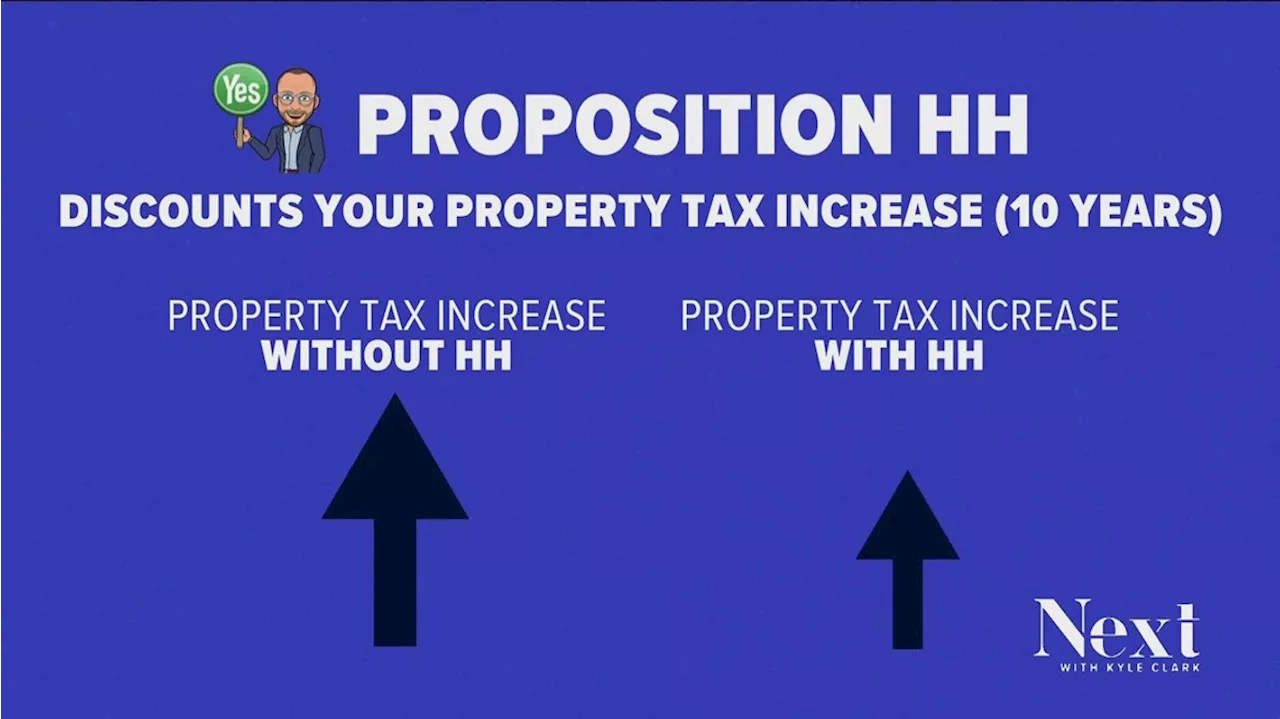

What does my vote on Proposition HH mean?A 'yes' on Proposition HH means a lot of things, but let's be clear on what it doesn't do for you and your property taxes.

What does my vote on Proposition HH mean?A 'yes' on Proposition HH means a lot of things, but let's be clear on what it doesn't do for you and your property taxes.

Weiterlesen »

Editorial: The Denver Post’s endorsement on Proposition IIA quirk of the Taxpayer’s Bill of Rights requires that even if voters agree to a tax increase – in this case about $176 million in new tobacco and nicotine taxes approved by voters in 2020 – if it …

Editorial: The Denver Post’s endorsement on Proposition IIA quirk of the Taxpayer’s Bill of Rights requires that even if voters agree to a tax increase – in this case about $176 million in new tobacco and nicotine taxes approved by voters in 2020 – if it …

Weiterlesen »

Texas’ Proposition 4 would cut property taxes for homeowners, businessesProposition 4 could usher in a bevy of property tax changes. That includes using $12.7 billion from a record state budget surplus to lower school district taxes.

Texas’ Proposition 4 would cut property taxes for homeowners, businessesProposition 4 could usher in a bevy of property tax changes. That includes using $12.7 billion from a record state budget surplus to lower school district taxes.

Weiterlesen »

Texas proposition lets voters decide whether to cut property taxes for homeowners and businessesTexas voters could sign off on a package of property tax cuts for homeowners and businesses, cuts in school districts’ tax rates and other tax changes.

Texas proposition lets voters decide whether to cut property taxes for homeowners and businessesTexas voters could sign off on a package of property tax cuts for homeowners and businesses, cuts in school districts’ tax rates and other tax changes.

Weiterlesen »

Texas Proposition 9 could give retired educators an increase in their pension checksTexans are voting on constitutional amendments. One would implement a cost-of-living adjustment to the Teacher Retirement System of Texas.

Texas Proposition 9 could give retired educators an increase in their pension checksTexans are voting on constitutional amendments. One would implement a cost-of-living adjustment to the Teacher Retirement System of Texas.

Weiterlesen »