Buyers are just more jittery these days.

Share on email About 16% of pending home sales fell through in September as mortgage rates climbed to new highs, according to new data from Redfin.Typically, homebuyers sign sales agreements with a contingency that lets them back out of the deal if, say, there's an issue with an inspection or something's off in the appraisal.

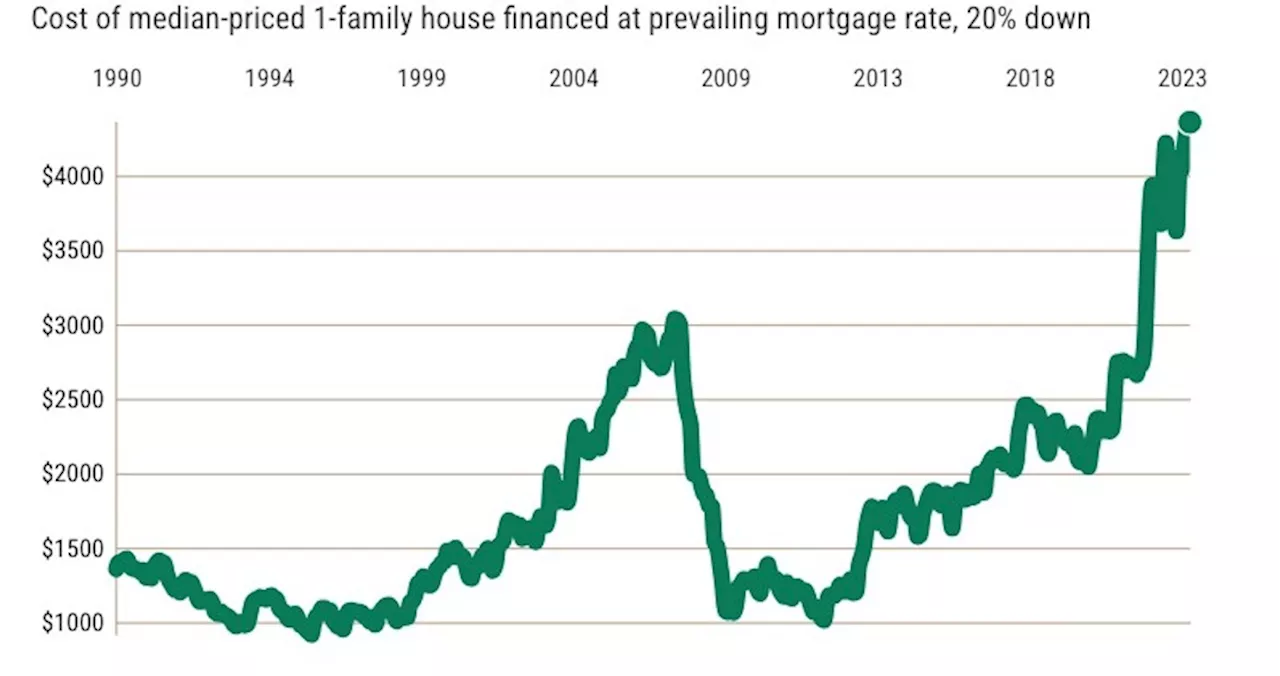

But deals can also fall apart because surging mortgage rates suddenly mean the buyer can no longer afford the house — perhaps because they didn't lock in a rate when they went into contract, or their rate lock expired.now. Meanwhile, home sellers, locked into low mortgage rates, are less likely to make concessions to nervous buyers, said Daryl Fairweather, Redfin's chief economist. They're not "super-motivated.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Stocks and homes are still pricey because buyers think inflation will stay highIf you expect 4% or 5% inflation, current interest rates don’t seem so steep

Stocks and homes are still pricey because buyers think inflation will stay highIf you expect 4% or 5% inflation, current interest rates don’t seem so steep

Weiterlesen »

Less home for more money: Home prices rise as buyers swallow higher interest ratesEven with interest rates at their highest level in 23 years, undeterred buyers are scrambling over a limited number of prices on the market, pushing up prices.

Less home for more money: Home prices rise as buyers swallow higher interest ratesEven with interest rates at their highest level in 23 years, undeterred buyers are scrambling over a limited number of prices on the market, pushing up prices.

Weiterlesen »

Graphite buyers to boost imports ahead of China's curbsGraphite buyers to boost imports ahead of China's curbs - analysts

Graphite buyers to boost imports ahead of China's curbsGraphite buyers to boost imports ahead of China's curbs - analysts

Weiterlesen »

EUR/USD Forecast: Buyers could take action once 1.0600 is confirmed as supportFollowing a quiet Asian session, EUR/USD gained traction and turned positive on the day slightly above 1.0600. In case the pair manages to stabilize a

EUR/USD Forecast: Buyers could take action once 1.0600 is confirmed as supportFollowing a quiet Asian session, EUR/USD gained traction and turned positive on the day slightly above 1.0600. In case the pair manages to stabilize a

Weiterlesen »

High prices, interest rates contribute to tough market for first-time homebuyersHigh home sales prices and mortgage interest rates are squeezing out first-time home buyers from entering the market, especially as incomes have not kept up, housing experts say.

High prices, interest rates contribute to tough market for first-time homebuyersHigh home sales prices and mortgage interest rates are squeezing out first-time home buyers from entering the market, especially as incomes have not kept up, housing experts say.

Weiterlesen »

California house payments jump 127% in pandemic era with rates at 23-year highBuyer gets $4,717 payment on median $843,340 house at this week’s 7.63% average rate.

California house payments jump 127% in pandemic era with rates at 23-year highBuyer gets $4,717 payment on median $843,340 house at this week’s 7.63% average rate.

Weiterlesen »