Thousands of homeowners with tracker mortgages will see their mortgage payments increase by an average of £50 per month following the Bank of England’s decision to raise its base rate again.

Thousands of homeowners with tracker mortgages will see their mortgage payments increase by an average of £50 per month following the Bank of England’s decision to raise its base rate again.

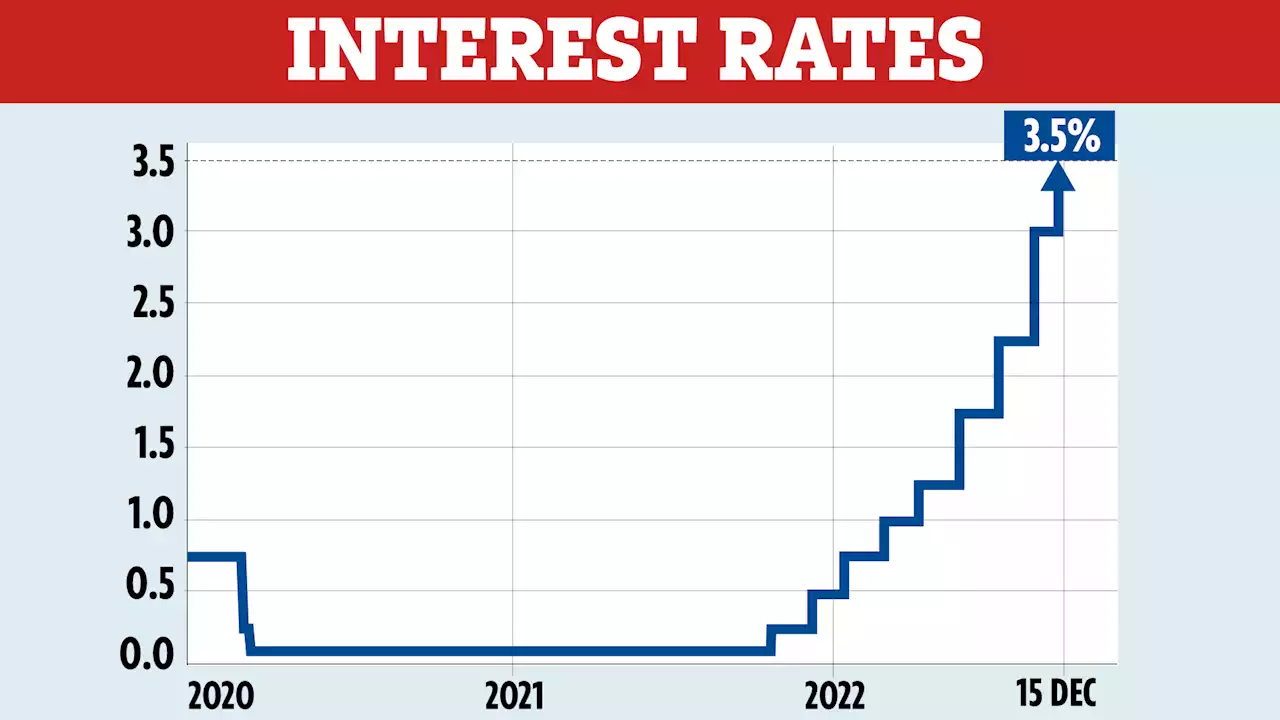

Following today’s decision by the Bank to increase its base rate to 3.5 per cent, UK Finance estimates that the average tracker mortgage repayment will increase by £50 per month. The latest base rate increase from the Bank of England is the ninth consecutive rise since December last year, with the rate now at its highest level for 14 years as the Bank attempts to curb rising inflation.

The average five-year fixed rate deal was 5.8 per cent in December, compared with 6.3 per cent in November, she said. However, people with a fixed rate mortgage will still see a huge hike in their monthly payments if they are coming to the end of a fixed-rate deal in the coming months, as deals are far more expensive than they have been in recent years when the base rate sat at 0.1 per cent.found the average person with a fixed rate loan due to expire at the end of 2023 is facing an increase in their average monthly repayments of around £250 because they will have to refinance on to a higher rate.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Pensioner says Christmas ruined by Reborn Monkey 'scammer' selling doll for £50Pensioner says Christmas ruined by Reborn Monkey 'scammer' selling popular doll for £50 each

Pensioner says Christmas ruined by Reborn Monkey 'scammer' selling doll for £50Pensioner says Christmas ruined by Reborn Monkey 'scammer' selling popular doll for £50 each

Weiterlesen »

Millions face £3,000 bill rise as Bank of England set to hike ratesMILLIONS of households face £3,000 a year bill hikes as interest rates are set to rise again this week. Four million mortgage holders are set to see their monthly payments jump by the end…

Millions face £3,000 bill rise as Bank of England set to hike ratesMILLIONS of households face £3,000 a year bill hikes as interest rates are set to rise again this week. Four million mortgage holders are set to see their monthly payments jump by the end…

Weiterlesen »

Bank of England interest rates raised to 3.5 per cent reaching 14-year highBank of England interest rates have been raised to 3.5 per cent, reaching a 14-year high.

Bank of England interest rates raised to 3.5 per cent reaching 14-year highBank of England interest rates have been raised to 3.5 per cent, reaching a 14-year high.

Weiterlesen »

Bank of England imposes ninth consecutive interest rate rise to tackle inflation'This is a slight improvement on the bleakness of the situation only a few months ago.' Sky's economics and data editor EdConwaySky gives his analysis on the BoE's decision to raise the interest rate from 3% to 3.5%. 📺 Sky 501 and YouTube

Bank of England imposes ninth consecutive interest rate rise to tackle inflation'This is a slight improvement on the bleakness of the situation only a few months ago.' Sky's economics and data editor EdConwaySky gives his analysis on the BoE's decision to raise the interest rate from 3% to 3.5%. 📺 Sky 501 and YouTube

Weiterlesen »

Bank of England hikes interest rates again to 3.5% – what it means for your cashMILLIONS of households face bill hikes after the Bank of England (BoE) upped its base rate. The rate has gone up by 50 basis points from 3% to 3.5% as expected. It’s the ninth time in a row t…

Bank of England hikes interest rates again to 3.5% – what it means for your cashMILLIONS of households face bill hikes after the Bank of England (BoE) upped its base rate. The rate has gone up by 50 basis points from 3% to 3.5% as expected. It’s the ninth time in a row t…

Weiterlesen »

Bank of England raises interest rates to 3.5 per cent\n\t\t\tKeep abreast of significant corporate, financial and political developments around the world.\n\t\t\tStay informed and spot emerging risks and opportunities with independent global reporting, expert\n\t\t\tcommentary and analysis you can trust.\n\t\t

Weiterlesen »