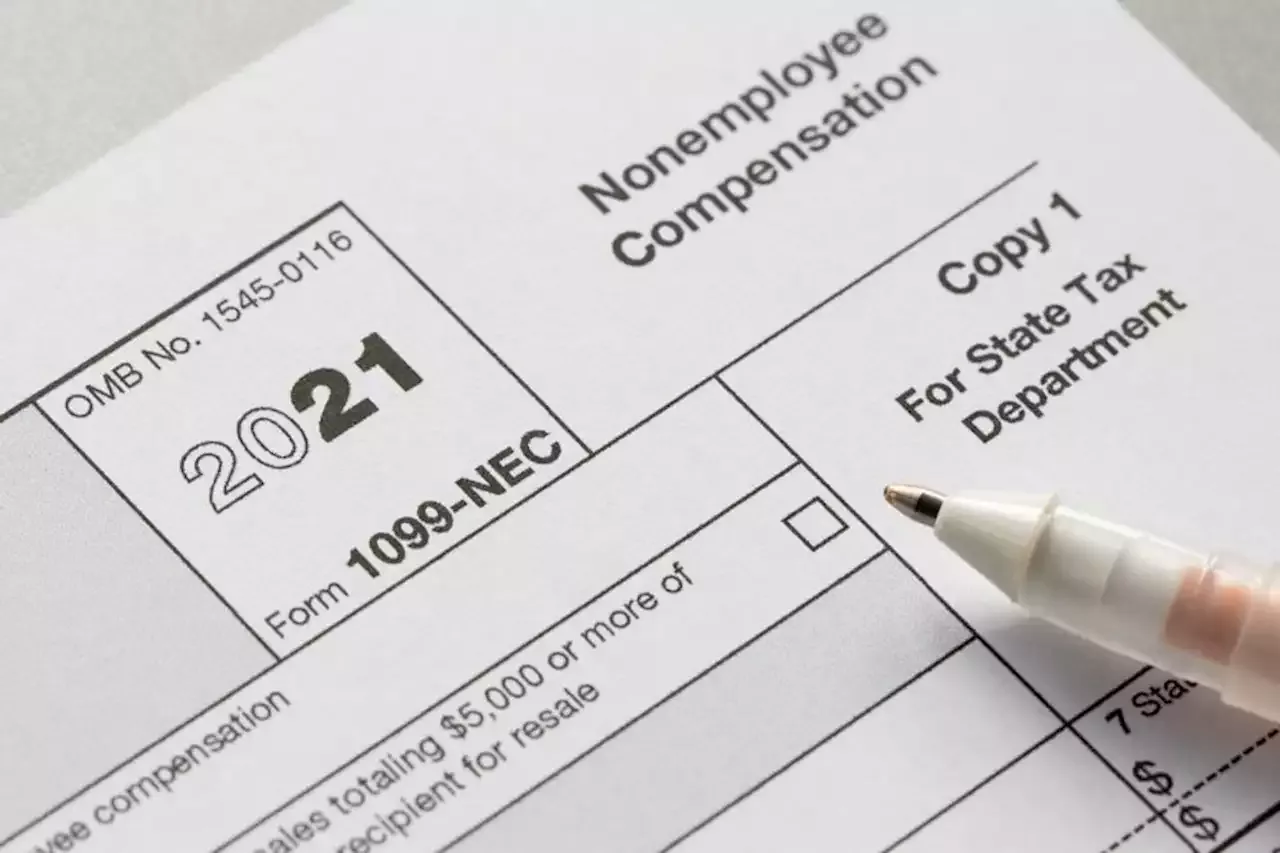

Most states are requiring businesses to report their non-employee compensation directly, rather than through the federal-state combined tax reporting program.

... [+]getty

The beauty of Combined Federal State Filing is that you don’t have to report the same information twice for your federal and state/local taxes. But last year, the IRS didn’t include its new form for reporting non-employee compensation in the program. The form is used by business like Uberand Doordash that hire independent contractors to do work. As a result, 36 states that participate in the combined tax reporting program scrambled to enact their own direct reporting requirement.

For tax year 2021, the form is included in the sharing program. But now that states have their own reporting systems in place, they’re reluctant to scrap them. “The IRS really fumbled [when] they failed to include it in that sharing program,” said Sovos tax expert Wendy Walker. “By having 36 states go out and build their own requirements last year, why would they want to shift back over to the IRS’ sharing program this year? If they did, it means they would have to wait longer to get that information, which doesn’t make sense.”to report their non-employee compensation directly, according to my analysis and information from Sovos.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

IRS to start requiring facial recognition scans to access tax returnsThe Internal Revenue Service is going to start requiring users of its online tax payment system to provide a selfie to a third-party company in order to access their accounts.

IRS to start requiring facial recognition scans to access tax returnsThe Internal Revenue Service is going to start requiring users of its online tax payment system to provide a selfie to a third-party company in order to access their accounts.

Weiterlesen »

Don't Throw Out a Child Tax Credit Letter From the IRS — Best LifeThe IRS is sending some taxpayers a letter about the child tax credit. Make sure you keep a copy for when you're filing your taxes.

Don't Throw Out a Child Tax Credit Letter From the IRS — Best LifeThe IRS is sending some taxpayers a letter about the child tax credit. Make sure you keep a copy for when you're filing your taxes.

Weiterlesen »

IRS will require taxpayers to sign up with ID.me to access their online accountsStarting this summer, an ID.me account will be required to view a tax transcript or pull up payment history on IRS.gov.

IRS will require taxpayers to sign up with ID.me to access their online accountsStarting this summer, an ID.me account will be required to view a tax transcript or pull up payment history on IRS.gov.

Weiterlesen »

IRS service 'not what the American public deserves,' White House saysWhite House press secretary Jen Psaki says the current level of customer service at the IRS is 'not what the American public deserves'

IRS service 'not what the American public deserves,' White House saysWhite House press secretary Jen Psaki says the current level of customer service at the IRS is 'not what the American public deserves'

Weiterlesen »

IRS Will Soon Require a Selfie to Access Some of Its Online Tools and ApplicationsStarting summer 2022, the IRS is requiring taxpayers to create an account with identity verification company ID.me to access certain tools and applications.

IRS Will Soon Require a Selfie to Access Some of Its Online Tools and ApplicationsStarting summer 2022, the IRS is requiring taxpayers to create an account with identity verification company ID.me to access certain tools and applications.

Weiterlesen »

Tax season nightmare ahead for understaffed IRSThe IRS will start accepting 2021 tax returns in less than a week, and the filing delays and administrative headaches to come might eclipse last year's nightmare, according to an independent advocacy agency within the IRS.

Tax season nightmare ahead for understaffed IRSThe IRS will start accepting 2021 tax returns in less than a week, and the filing delays and administrative headaches to come might eclipse last year's nightmare, according to an independent advocacy agency within the IRS.

Weiterlesen »