The issue could create tax refund delays for parents if they rely on faulty information to complete their tax returns.

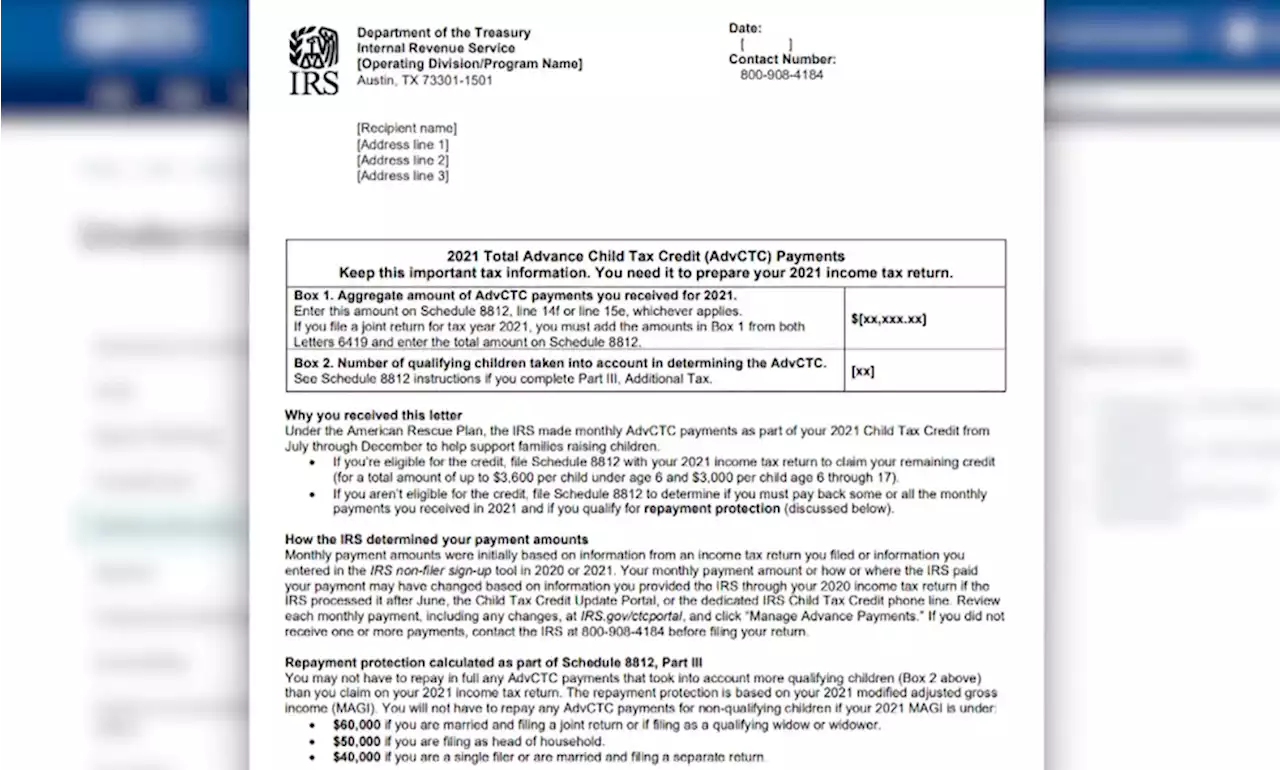

urging people to refer to those forms — letter 6419 — when filling out their tax returns. But on Monday, the agency warned that some of those letters may include incorrect information.

The IRS said it is unclear how many people received erroneous letters, but said it could be a small group of taxpayers who moved or changed bank accounts in December. In those cases, the checks may have been undeliverable, or the direct deposits bounced from the bank where an account was closed, said Ken Corbin, the IRS chief taxpayer experience officer, on a conference call with reporters. Taxpayers who are concerned the letter they received isn't correct should check IRS.

Filing an inaccurate return — such as by guessing how much you received from the advanced CTC payments — could"create an expensive delay," he added. Reporting accurate data about the advanced CTC payments is important because the enhanced tax credit paid half in advance, with the other half to be paid through taxpayers' refund after they file their 2021 tax return. For instance, families with children under 6 are entitled to $3,600 in tax credits, with $1,800 paid in monthly checks from July through December 2021.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

Weiterlesen »

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Weiterlesen »

IRS ‘Fumble’ Means Extra Tax Reporting For Businesses In More Than 30 StatesMost states are requiring businesses to report their non-employee compensation directly, rather than through the federal-state combined tax reporting program.

IRS ‘Fumble’ Means Extra Tax Reporting For Businesses In More Than 30 StatesMost states are requiring businesses to report their non-employee compensation directly, rather than through the federal-state combined tax reporting program.

Weiterlesen »

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Weiterlesen »

IRS: Tax-filing season begins on MondayTax filing season begins Monday and the IRS is advising you to file as soon as possible.

IRS: Tax-filing season begins on MondayTax filing season begins Monday and the IRS is advising you to file as soon as possible.

Weiterlesen »

Taxpayers face overloaded IRS as filing season opens MondayU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Taxpayers face overloaded IRS as filing season opens MondayU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Weiterlesen »