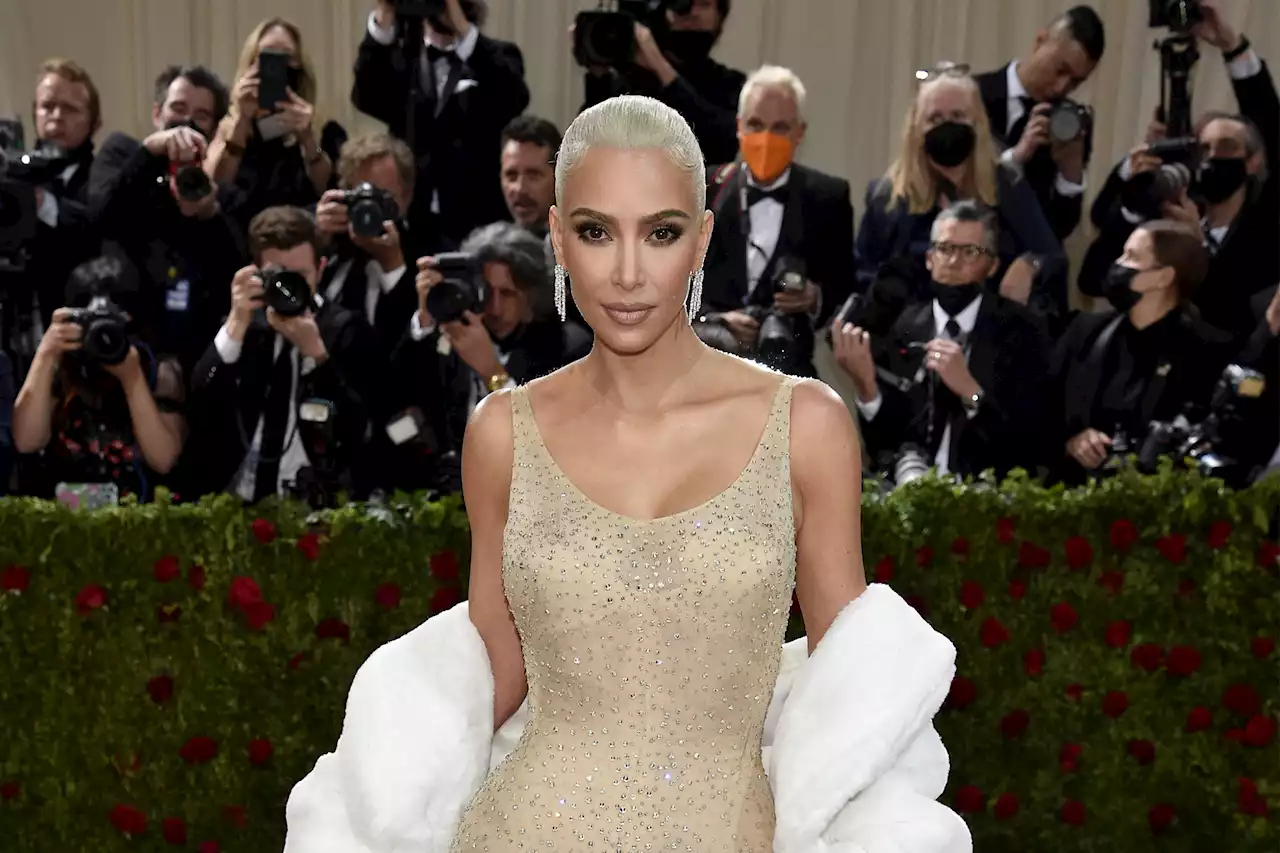

Kim Kardashian’s crypto misadventure has landed her in hot water with federal regulators.

, asking her millions of followers: “ARE YOU INTO CRYPTO??? THIS IS NOT FINANCIAL ADVICE BUT SHARING WHAT MY FRIENDS JUST TOLD ME ABOUT THE ETHEREUM MAX TOKEN.”

The post included a link to EthereumMax’s website, which had instructions for potential investors to purchase EMAX tokens, the SEC statement said.Kardashian agreed to pay $1.26 million in penalties, which includes her promotional payment, and to cooperate with the commission's investigation “without admitting or denying the SEC’s findings,” the statement said.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Kim Kardashian to pay $1.26M to settle SEC crypto chargesThe SEC alleged that the celebrity billionaire used her Instagram account to tout EthereumMax’s token, EMAX, without adding any disclaimer that she was being given $250,000 to publish the posts.

Kim Kardashian to pay $1.26M to settle SEC crypto chargesThe SEC alleged that the celebrity billionaire used her Instagram account to tout EthereumMax’s token, EMAX, without adding any disclaimer that she was being given $250,000 to publish the posts.

Weiterlesen »

Kim Kardashian pays over $1M to settle SEC charges related to crypto promo on InstagramThe SEC said Kim Kardashian failed to disclose that she was paid $250,000 to publish a post on her Instagram about EMAX tokens — a crypto asset security offered by EthereumMax.

Kim Kardashian pays over $1M to settle SEC charges related to crypto promo on InstagramThe SEC said Kim Kardashian failed to disclose that she was paid $250,000 to publish a post on her Instagram about EMAX tokens — a crypto asset security offered by EthereumMax.

Weiterlesen »

Kim Kardashian Pays $1.26M to Settle SEC Charges For Promoting EthereumMaxBREAKING: SECGov has charged KimKardashian for unlawfully touting EthereumMax without disclosing the payment she received. By OKnightCrypto

Kim Kardashian Pays $1.26M to Settle SEC Charges For Promoting EthereumMaxBREAKING: SECGov has charged KimKardashian for unlawfully touting EthereumMax without disclosing the payment she received. By OKnightCrypto

Weiterlesen »

Kim Kardashian Charged by SEC for Crypto Promo, Agrees to Pay $1.26 MillionKim Kardashian failed to tell her followers she was paid to promote a crypto asset -- a mistake that's now cost her $1.26 million and charges from the Securities and Exchange Commission.

Kim Kardashian Charged by SEC for Crypto Promo, Agrees to Pay $1.26 MillionKim Kardashian failed to tell her followers she was paid to promote a crypto asset -- a mistake that's now cost her $1.26 million and charges from the Securities and Exchange Commission.

Weiterlesen »

Kim Kardashian settles SEC crypto charge, to pay $1.26 millionKim Kardashian has agreed to settle charges of unlawfully touting a crypto security and to pay $1.26 million in penalties and associated fees, the U.S. Securities and Exchange Commission said on Monday.

Kim Kardashian settles SEC crypto charge, to pay $1.26 millionKim Kardashian has agreed to settle charges of unlawfully touting a crypto security and to pay $1.26 million in penalties and associated fees, the U.S. Securities and Exchange Commission said on Monday.

Weiterlesen »