'Cutting child poverty was not worth it if it could even be theorized that rich people might end up slightly less rich.'

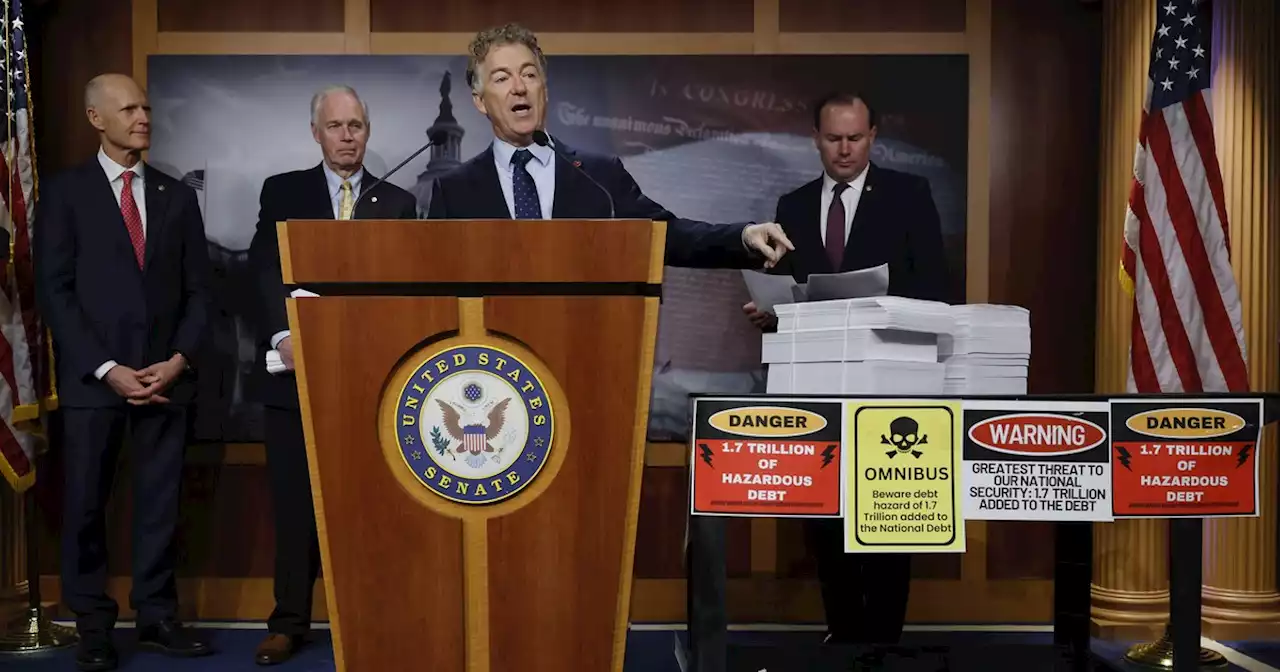

Late Monday afternoon, Congressional leaders announced their long-awaited omnibus spending package which will fund the government through September 2023. The good news: the bill does not include needless corporate tax giveaways. The bad news: it also leaves out any expansion of the Child Tax Credit.

Ultimately, the conservative position on the credit triumphed. The credit was not worth the cost if it cost, well anything. This fall, as lobbyists descended on the Hill to pressure Congress into passing a set of corporate tax breaks before the year’s end, some progressive activists and lawmakers settled on a strategy to make any potential tax package at least mildly palatable: Tax breaks for businesses must be paired with an extension of the Child Tax Credit enhancements that were enacted in 2021.

Those enhancements increased the credit from $2,000 to $3,000 and to $3,600 for children under age 6, but more significantly, they removed limits on the refundable part of the credit, which helps families who most need it. Under permanent law , the tax code actually states that certain families make too little money to receive the full credit. That is, a credit which is supposed to help children is denied to them if they are too poor.

Given the enormous success of the 2021 credit, many progressive groups were at least open to an unsavory package of tax breaks for big businesses if lawmakers would in turn help children and families by enhancing the Child Tax Credit. The tax package pushed by corporate lobbyists included a

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Opinion | Why Congress' Jan. 6 plotters are sleeping easy tonightThe Jan. 6 committee's referral of Kevin McCarthy, Jim Jordan, and other Republicans is necessary — but won't end well.

Opinion | Why Congress' Jan. 6 plotters are sleeping easy tonightThe Jan. 6 committee's referral of Kevin McCarthy, Jim Jordan, and other Republicans is necessary — but won't end well.

Weiterlesen »

Congress needs to act on immigration now – before it’s too late | OpinionMore than seven-in-ten evangelical Christians want significant immigration reforms this year.

Congress needs to act on immigration now – before it’s too late | OpinionMore than seven-in-ten evangelical Christians want significant immigration reforms this year.

Weiterlesen »

McConnell Hails 'Strong Outcome' for GOP as Omnibus Excludes Poverty-Cutting Child Tax Credit\u0022Our child poverty epidemic is a choice made by the so-called pro-life party,\u0022 said Democratic Rep. Barbara Lee.

McConnell Hails 'Strong Outcome' for GOP as Omnibus Excludes Poverty-Cutting Child Tax Credit\u0022Our child poverty epidemic is a choice made by the so-called pro-life party,\u0022 said Democratic Rep. Barbara Lee.

Weiterlesen »

Child Online Privacy Protections Cut From Congress’ Spending Bill Despite Last-Minute PushA pair of bills designed to strengthen online protections for children was left out of a fiscal year 2023 spending plan Congress is aiming to pass this week.

Child Online Privacy Protections Cut From Congress’ Spending Bill Despite Last-Minute PushA pair of bills designed to strengthen online protections for children was left out of a fiscal year 2023 spending plan Congress is aiming to pass this week.

Weiterlesen »

Corner Wrench: Stop cutting corners when you spot tire troubleStop cutting corners when you spot tire trouble — via drivingdotca CornerWrench Automotive

Corner Wrench: Stop cutting corners when you spot tire troubleStop cutting corners when you spot tire trouble — via drivingdotca CornerWrench Automotive

Weiterlesen »

Spending bill funds kids’ summer meals by cutting emergency food stampsLawmakers have until the end of Friday to approve the roughly $1.7 trillion omnibus package, which includes more money for summer school meals but cuts pandemic food stamps benefits.

Spending bill funds kids’ summer meals by cutting emergency food stampsLawmakers have until the end of Friday to approve the roughly $1.7 trillion omnibus package, which includes more money for summer school meals but cuts pandemic food stamps benefits.

Weiterlesen »