Today is the big day, the FOMC is expected to hike rates by 25 basis points while initiating lift-off. This will be the first rate hike since before the pandemic. Get your market update from JStanleyFX here:

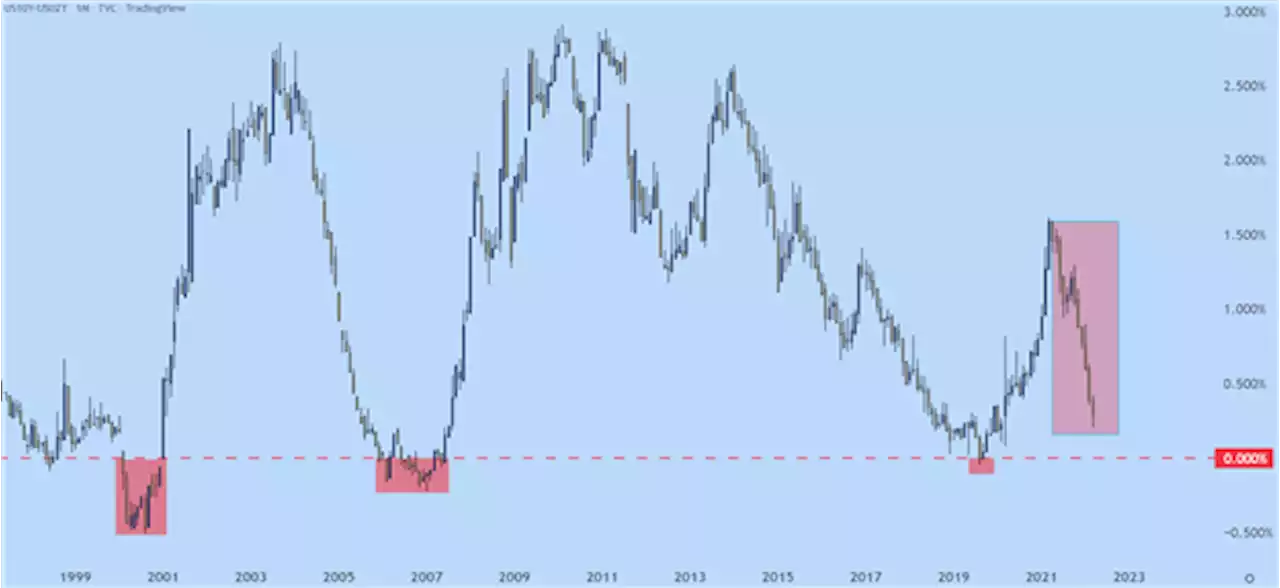

is expected to hike rates by 25 basis points while initiating lift-off. This will be the first rate hike since before the pandemic. The Fed cut thrice in 2019 and when the pandemic hit in Q1, 2020, the bank triggered a plethora of liquidity programs that helped U.S. markets to find support and, eventually, put in one of the largest and most extended rallies that any of us have ever seen.

For today, we’re looking for a simple 25 basis point hike and with a 96% probability of such, it would probably be far more disappointing if anything else happened. Just a month ago there were strong probabilities of a 50 basis point hike today, largely in response to the still-aggressive inflation that’s printing in the U.S..

But, with that being said, its that outlook that will likely be the big driver from today’s rate decision. This is a quarterly meeting, meaning that the Fed will issue updated guidance and forecasts, sharing their opinions on where inflation will move and how rates will be adjusted in response to this.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

US Retail Sales Preview: Relentless shopper may provide dollar-selling opportunity ahead of the FedEven war cannot stop America's shopping spree – and retail sales figures for February capture the time before Russia invaded Ukraine. There is room fo

US Retail Sales Preview: Relentless shopper may provide dollar-selling opportunity ahead of the FedEven war cannot stop America's shopping spree – and retail sales figures for February capture the time before Russia invaded Ukraine. There is room fo

Weiterlesen »

USD/JPY Technical Outlook: US Fed and BoJ Central Bank PreviewTomorrow marks a rather significant day in financial markets as the Federal Reserve Bank is scheduled to announce its first rate hike since the pandemic. Get your market update from RichardSnowFX here:

USD/JPY Technical Outlook: US Fed and BoJ Central Bank PreviewTomorrow marks a rather significant day in financial markets as the Federal Reserve Bank is scheduled to announce its first rate hike since the pandemic. Get your market update from RichardSnowFX here:

Weiterlesen »

Gold Falls as Commodity Pullback Saps Inflation Expectations Ahead of FOMCGold prices are on the move lower after a new wave of Covid lockdowns across China sent commodity prices lower. That hurt gold-friendly inflation expectations ahead of this week's FOMC decision. Get your market update from FxWestwater here:

Gold Falls as Commodity Pullback Saps Inflation Expectations Ahead of FOMCGold prices are on the move lower after a new wave of Covid lockdowns across China sent commodity prices lower. That hurt gold-friendly inflation expectations ahead of this week's FOMC decision. Get your market update from FxWestwater here:

Weiterlesen »

S\u0026P 500 Forecast: Index Recovers Ahead of FOMCThe S\u0026P 500 initially fell on Tuesday only to find buyers underneath and recover.

S\u0026P 500 Forecast: Index Recovers Ahead of FOMCThe S\u0026P 500 initially fell on Tuesday only to find buyers underneath and recover.

Weiterlesen »

BTC/USD Forex Signal: Range-Bound Ahead of FOMC DecisionThe BTC/USD pair remained in a tight range in the overnight as the consolidation phase continued as investors waited for the upcoming Fed decision.

BTC/USD Forex Signal: Range-Bound Ahead of FOMC DecisionThe BTC/USD pair remained in a tight range in the overnight as the consolidation phase continued as investors waited for the upcoming Fed decision.

Weiterlesen »

FOMC Hikes - USD Spikes, SPX Snaps, Bring on the PresserThe FOMC announces a 25-basis point rate hike, the first since 2018. This is lift-off as the Fed begins to pare back pandemic stimulus, largely in response to still-aggressive inflation.

FOMC Hikes - USD Spikes, SPX Snaps, Bring on the PresserThe FOMC announces a 25-basis point rate hike, the first since 2018. This is lift-off as the Fed begins to pare back pandemic stimulus, largely in response to still-aggressive inflation.

Weiterlesen »