The app that allows laypeople to interact with the stock market cited redundant positions for the layoffs, but doesn’t mention plummeting share price.

Robinhood’s band of merry men is rapidly shrinking, as the investment app’s CEO announced they were laying off 9% of the company in aRobinhood CEO Vlad Tenev wrote that from 2020 through 2021, the company went through a period of “hyper growth” due to low interest rates and fiscal stimulus.

“We grew net funded accounts from 5M to 22M and revenue from approximately $278 million in 2019 to over $1.8 billion in 2021,” Tenev wrote in his post. “To meet customer and market demands, we grew our headcount almost six times from 700 to nearly 3,800 in that time period.” That rapid increase in employees led to “some duplicate roles and job functions, and more layers and complexity than are optimal,” according to Tenev.

The company CEO said they currently have $6 billion in the bank, and they still expect to expand its brokerage, crypto, and spending/saving services. Yet the company’s shares are at an all-time low, even before the company announced its mass layoffs.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

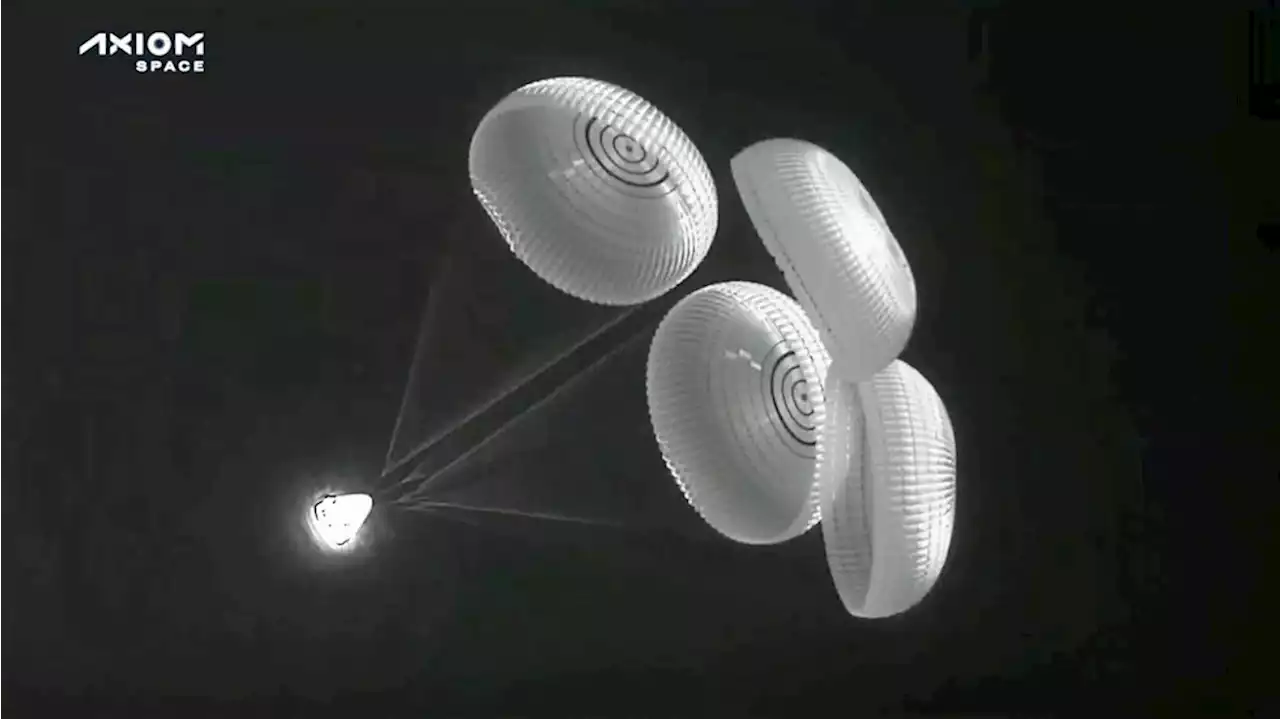

Rich trio back on Earth after charter trip to International Space StationThree rich businessmen returned from the International Space Station with their astronaut escort Monday, wrapping up a pricey trip that marked NASA’s debut as a B&B host.

Rich trio back on Earth after charter trip to International Space StationThree rich businessmen returned from the International Space Station with their astronaut escort Monday, wrapping up a pricey trip that marked NASA’s debut as a B&B host.

Weiterlesen »

This Protein-Packed Salad Features A Unique Nutrient-Rich IngredientYou may not hear 'snack' and think 'salad'—but this recipe for Chickpea & Samphire Salad is the perfect blend of snackable with something fresh and nutrient-dense. 🥗

This Protein-Packed Salad Features A Unique Nutrient-Rich IngredientYou may not hear 'snack' and think 'salad'—but this recipe for Chickpea & Samphire Salad is the perfect blend of snackable with something fresh and nutrient-dense. 🥗

Weiterlesen »

Rich Lowry: Let Disney be an exampleRich Lowry writes that Disney should be an example.

Rich Lowry: Let Disney be an exampleRich Lowry writes that Disney should be an example.

Weiterlesen »

Rich trio back on Earth after charter trip to space stationThree rich businessmen are back on Earth after a pricey trip to the International Space Station, wrapping up a 17-day chartered flight that marked the first time NASA opened its space hatches to tourists. The trip cost the trio $55 million apiece.

Rich trio back on Earth after charter trip to space stationThree rich businessmen are back on Earth after a pricey trip to the International Space Station, wrapping up a 17-day chartered flight that marked the first time NASA opened its space hatches to tourists. The trip cost the trio $55 million apiece.

Weiterlesen »

Asia wealth slump renders bank hype a little richUBS’s pre-tax profit from private banking in the region slumped 38% in the first quarter. Lockdown pains should ease eventually, but China’s “common prosperity” agenda may undermine the highly touted opportunity. Hiring blitzes by Citi, HSBC and others could be hard to justify.

Asia wealth slump renders bank hype a little richUBS’s pre-tax profit from private banking in the region slumped 38% in the first quarter. Lockdown pains should ease eventually, but China’s “common prosperity” agenda may undermine the highly touted opportunity. Hiring blitzes by Citi, HSBC and others could be hard to justify.

Weiterlesen »

Breakingviews - Asia wealth slump renders bank hype a little richAsian private banking is in danger of turning from a boon into a boondoggle. Some of the problems dragging down wealth-management earnings in the region for UBS and other Western banks may prove temporary, but China’s “common prosperity” agenda risks undermining the much-hyped opportunity. A recent hiring blitz looks harder to justify.

Breakingviews - Asia wealth slump renders bank hype a little richAsian private banking is in danger of turning from a boon into a boondoggle. Some of the problems dragging down wealth-management earnings in the region for UBS and other Western banks may prove temporary, but China’s “common prosperity” agenda risks undermining the much-hyped opportunity. A recent hiring blitz looks harder to justify.

Weiterlesen »