The IRS is raising the alarm about identity theft-related scams this tax season.

"If they have enough information, all they need to do is go into a system and act like they're you," said Rodrick Benton, Assistant Special Agent in Charge of IRS Criminal Investigation’s Houston Field Office.was sentenced for stealing more than $700,000 by using stolen information to obtain fraudulent tax refunds.for a similar crime. They allegedly claimed over $100 million in false tax refunds.

Benton says there are two main ways your information can be compromised, fraudulent tax preparers and malware."Obtained naturally, through the course of business, they get personal identification information, Social Security numbers, DL addresses, and they may sell a list to buyers - fraudsters and individuals whose sole purpose is to steal your identities and use your identities to obtain illicit funds," said Benton.

While this scheme can affect anyone, sometimes fraudsters target wealthier individuals who are paying estimated tax withholdings throughout the year. "They can see this in the system, and they will file a return…they’ll say, ‘I didn't make as much money as I thought I would, I paid a quarter of a million dollars in withholdings, but I only made a quarter of a million dollars, therefore, I'm due a refund because I paid in all this money during the year,'" said Benton. "So that is a scheme that we see a lot now."

To prevent identity theft fraud this tax season, keep private information secure and research tax preparers ahead of time.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

IRS Seeks to Tax NFTs Like Other CollectiblesNFTs will be taxed like the underlying assets until final rules are agreed on how to treat digital proofs of ownership held in retirement accounts

IRS Seeks to Tax NFTs Like Other CollectiblesNFTs will be taxed like the underlying assets until final rules are agreed on how to treat digital proofs of ownership held in retirement accounts

Weiterlesen »

IRS to formalize tax treatment of NFTs as collectibles, similar to other artThe U.S. tax agency said it plans to define most NFTs as a collectibles, akin to gems and cards, until the “further guidance is issued.”

IRS to formalize tax treatment of NFTs as collectibles, similar to other artThe U.S. tax agency said it plans to define most NFTs as a collectibles, akin to gems and cards, until the “further guidance is issued.”

Weiterlesen »

Argentine Tax Authority AFIP Detects Irregularities in 184 Digital Wallet Tax Statements – Taxes Bitcoin NewsThe AFIP announced that it had discovered a series of irregularities involving at least 184 taxpayers, who failed to refer to their digital and cryptocurrency holdings in tax statements.

Argentine Tax Authority AFIP Detects Irregularities in 184 Digital Wallet Tax Statements – Taxes Bitcoin NewsThe AFIP announced that it had discovered a series of irregularities involving at least 184 taxpayers, who failed to refer to their digital and cryptocurrency holdings in tax statements.

Weiterlesen »

Don’t confuse your income tax refund for your N.J. ANCHOR payment despite what it is calledIncome tax refund checks say on the top: “Property Tax Relief Fund,” confusing some taxpayers.

Don’t confuse your income tax refund for your N.J. ANCHOR payment despite what it is calledIncome tax refund checks say on the top: “Property Tax Relief Fund,” confusing some taxpayers.

Weiterlesen »

Is your tax preparer cheating? IRS warns about fraudulent returnsThe IRS is warning current tax filers should be concerned about tax preparers filing false returns for their clients. MORE ⬇️

Is your tax preparer cheating? IRS warns about fraudulent returnsThe IRS is warning current tax filers should be concerned about tax preparers filing false returns for their clients. MORE ⬇️

Weiterlesen »

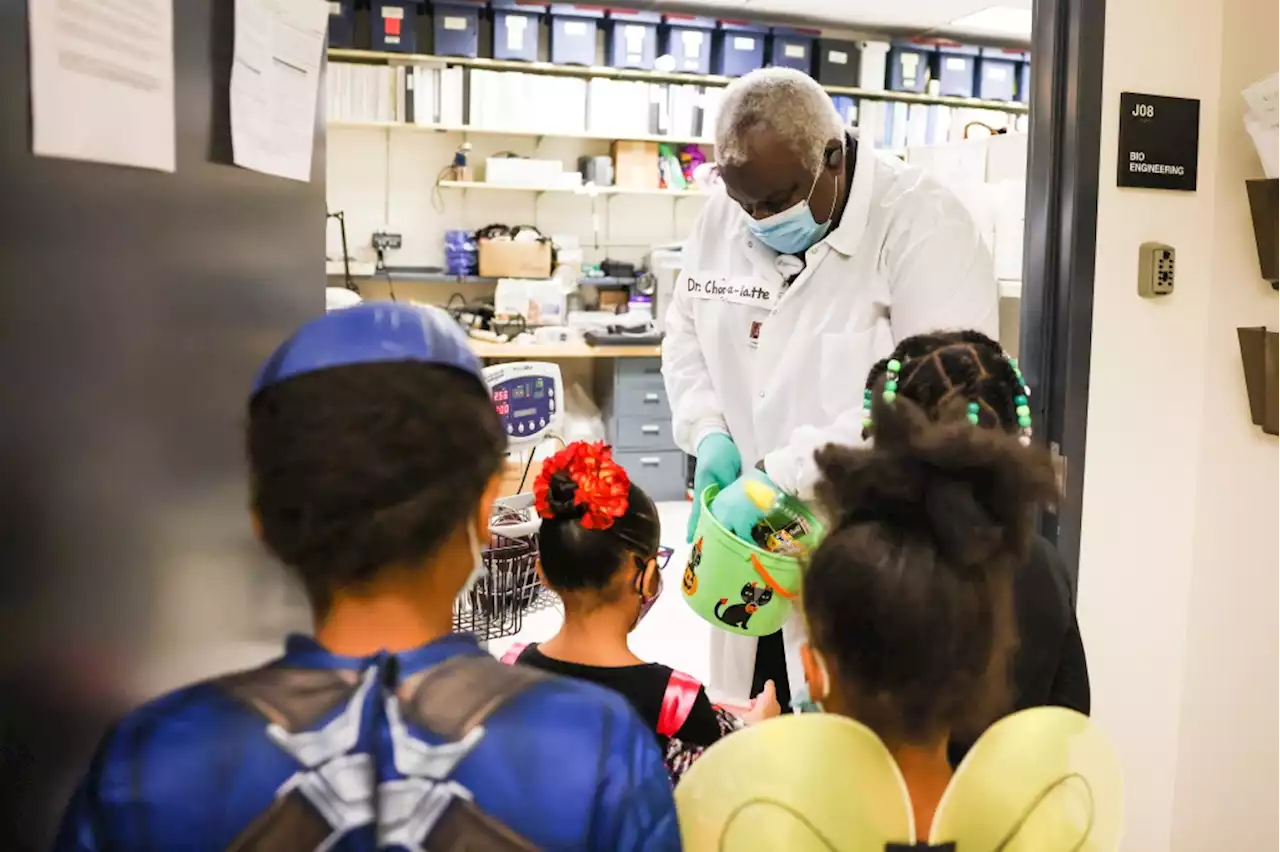

Colorado’s nonprofit hospitals would be required to spend more on “community benefit” under new billThe bill would set that each nonprofit hospital spend at least 3% of its revenue from treating patients on community benefit, unless its federal and state tax exemptions are worth less than that

Colorado’s nonprofit hospitals would be required to spend more on “community benefit” under new billThe bill would set that each nonprofit hospital spend at least 3% of its revenue from treating patients on community benefit, unless its federal and state tax exemptions are worth less than that

Weiterlesen »