Tether had previously confirmed having no exposure to SVB or Silverbank.

The banking sector could potentially undergo a much-needed revamp, but until then, investors appear to be scrambling for a safety net. As the traditional financial world is rocked by the Credit Suisse chaos and the failure of a series of US banks, investors have flocked to the largest stablecoin, Tether .

USDC is the second-largest stablecoin and is also widely used in decentralized finance . While the latest turns of events did not transpire into a Terra-like catastrophe, the threat was massive, and this has further aggravated the stablecoin crisis. This has resulted in USDC’s market cap falling by nearly 21% so far this year.A similar trend was seen in Binance USD as well, which had its fair share of setbacks with the regulatory agencies in the US this year.

Tether’s market cap, on the other hand, has reached levels last seen in May 2022. In fact, USDT has continued to follow a steady upward trajectory since the massive drop that month and even managed to surge past $77 billion. It was up by over 17% year-to-date as traders are relying on the asset more than ever.The sentiment in stablecoins has taken a sharp reversal from last year when investors spooked by the Terra crash rushed to redeem billions of tether and switch to USDC.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Tether (USDT) Largely Outperforms BUSD and USDC, Here's WhyTether $USDT keeps growing, while $BUSD shuts down, here's why, per VanEck's gaborgurbacs. cz_binance $USDC

Tether (USDT) Largely Outperforms BUSD and USDC, Here's WhyTether $USDT keeps growing, while $BUSD shuts down, here's why, per VanEck's gaborgurbacs. cz_binance $USDC

Weiterlesen »

Fashion Brand Guess Now Accepts Bitcoin (BTC), Tether (USDT) in LuganoBitcoin (BTC), Tether (USDT) now accepted by global fashion brand Guess $BTC BTC

Fashion Brand Guess Now Accepts Bitcoin (BTC), Tether (USDT) in LuganoBitcoin (BTC), Tether (USDT) now accepted by global fashion brand Guess $BTC BTC

Weiterlesen »

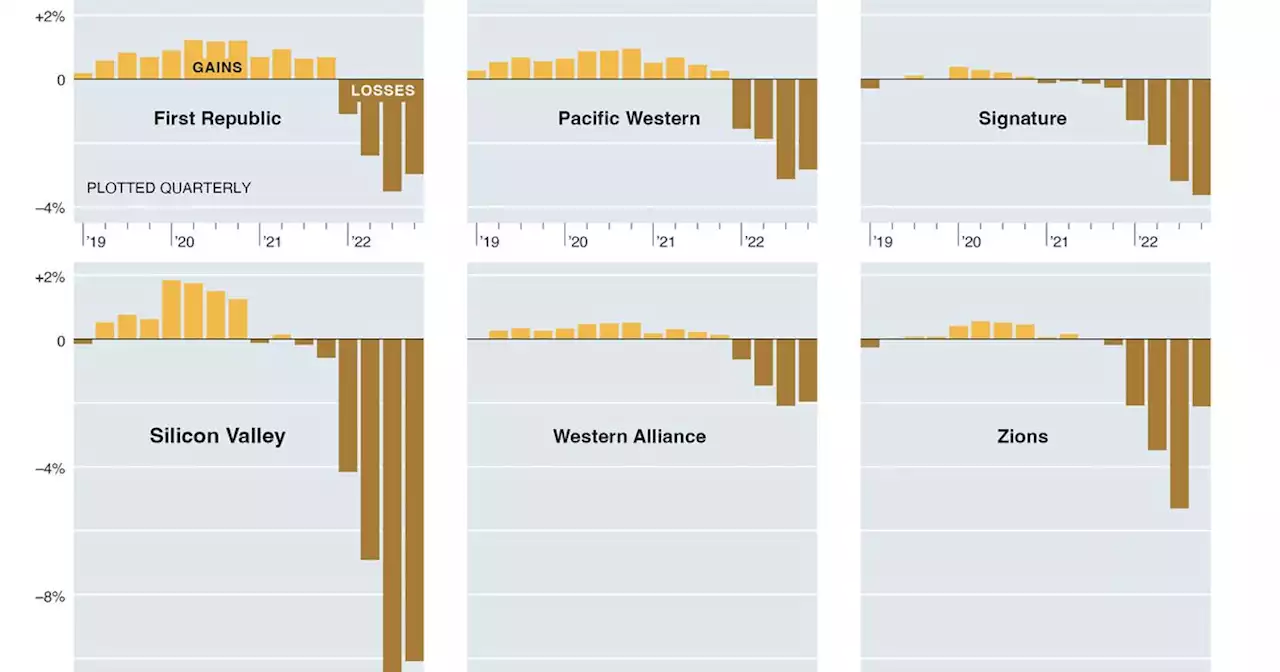

From SVB to Signature to Zions, why people are worried about banksFifteen years ago, the world careened into a devastating financial crisis, precipitated by the collapse of the American housing market. Today, a different culprit is stressing the financial system: rapidly rising interest rates.

From SVB to Signature to Zions, why people are worried about banksFifteen years ago, the world careened into a devastating financial crisis, precipitated by the collapse of the American housing market. Today, a different culprit is stressing the financial system: rapidly rising interest rates.

Weiterlesen »

Yellen defends government intervention to avoid another SVBAccording to the Treasury Secretary, the intervention was also aimed at preserving the “important role” of small to mid-size lenders in the U.S economy.

Yellen defends government intervention to avoid another SVBAccording to the Treasury Secretary, the intervention was also aimed at preserving the “important role” of small to mid-size lenders in the U.S economy.

Weiterlesen »

SVB's implosion leads founders to reevaluate VC relationshipsThe SVB fallout has been a wake up call for startup founders. Many are rethinking their VC relationships: 'There's certain people I wouldn't want to take money from now.'

Weiterlesen »

SVB Financial Group accuses FDIC of cutting it off from cashSVB Financial Group said on Tuesday the U.S. Federal Deposit Insurance Corporation had taken 'improper actions' to cut it off from cash held at its former subsidiary Silicon Valley Bank, which was seized by regulators to stem a national bank run.

SVB Financial Group accuses FDIC of cutting it off from cashSVB Financial Group said on Tuesday the U.S. Federal Deposit Insurance Corporation had taken 'improper actions' to cut it off from cash held at its former subsidiary Silicon Valley Bank, which was seized by regulators to stem a national bank run.

Weiterlesen »