We will have to wait until March for the Federal Reserve to explicate its monetary predictions, but the central bank's announcement that it would raise the federal funds rate by a quarter percentage point made clear that markets got it wrong — again.

Reiterating its steadfast commitment to bring inflation down to the 2% benchmark, the announcement repeated the same refrain it has since the start of its tightening campaign:"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

The decisions announced for February and telegraphed in the future are perfectly in line with the Fed's prediction in December. At the end of last year, the committee estimated that interest rates would surpass 5% and stay there through this entire year. Well, interest rates are now just 25 basis points to 50 basis points away from that projection.

And yet, investors refused to believe the Fed. As late as Wednesday afternoon, markets had priced in some 50 basis points of rate cuts at some point this year. Even with unemployment too low and nominal wages too high,"experts" had once again deluded themselves into believing that Powell would bend to their demands and defy December's Federal Open Market Committee expectations.

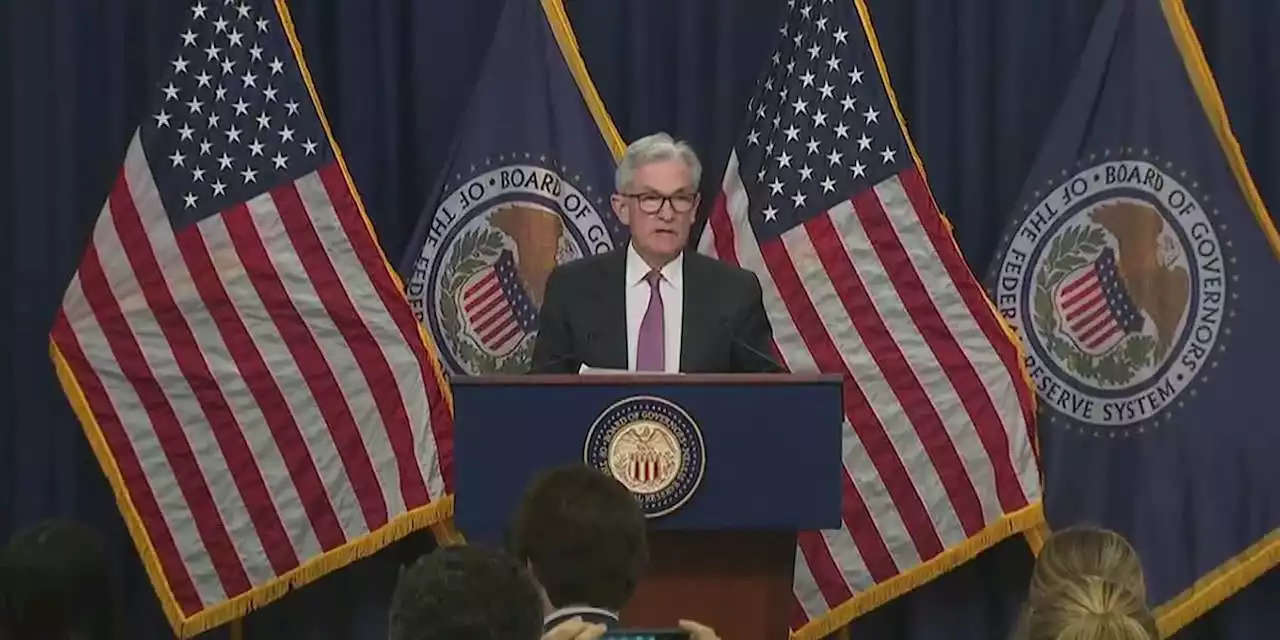

Wall Street may be ready to declare victory on inflation, but luckily for the nation, the Fed is not. If Powell's press conference provided any promise for the rest of the year, the war between the two is nowhere near over.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Stock futures tick lower as traders await the Federal Reserve's latest rate hike decisionHere's how stocks are trading ahead of the Federal Reserve's Wednesday meeting.

Stock futures tick lower as traders await the Federal Reserve's latest rate hike decisionHere's how stocks are trading ahead of the Federal Reserve's Wednesday meeting.

Weiterlesen »

Federal Reserve Lifts Interest Rates Another 25 Basis PointsWith today's 25 basis point hike, federalreserve has raised interest rates by a total of 4.5% over the last year. 'Shifting to a slower pace will better allow the committee to assess the economy's progress toward our goals,' Chair Jerome Powell says.

Federal Reserve Lifts Interest Rates Another 25 Basis PointsWith today's 25 basis point hike, federalreserve has raised interest rates by a total of 4.5% over the last year. 'Shifting to a slower pace will better allow the committee to assess the economy's progress toward our goals,' Chair Jerome Powell says.

Weiterlesen »

Gold Price Forecast: XAU/USD bulls could emerge ahead of Federal ReserveThe Gold price has drifted lower for a third day and is testing structure as we head towards key events this week, including the Federal Reserve and t

Gold Price Forecast: XAU/USD bulls could emerge ahead of Federal ReserveThe Gold price has drifted lower for a third day and is testing structure as we head towards key events this week, including the Federal Reserve and t

Weiterlesen »

USD/JPY Price Analysis: Bears eye a test of 130.00 pre Federal ReserveUSD/JPY is under pressure in Tokyo but the bulls are moving in from a support area as the following charts will illustrate. Meanwhile, the US Dollar r

USD/JPY Price Analysis: Bears eye a test of 130.00 pre Federal ReserveUSD/JPY is under pressure in Tokyo but the bulls are moving in from a support area as the following charts will illustrate. Meanwhile, the US Dollar r

Weiterlesen »

Federal Reserve raises key interest rate 0.25%, signals more hikes likelyWhile there are some signs inflation is decelerating, officials warn that the Fed isn't likely to back off its rate hikes anytime soon.

Federal Reserve raises key interest rate 0.25%, signals more hikes likelyWhile there are some signs inflation is decelerating, officials warn that the Fed isn't likely to back off its rate hikes anytime soon.

Weiterlesen »

Federal Reserve raises its key rate for 8th timeThe central bank’s latest move put its benchmark short-term rate in a range of 4.5% to 4.75%, its highest level in about 15 years.

Federal Reserve raises its key rate for 8th timeThe central bank’s latest move put its benchmark short-term rate in a range of 4.5% to 4.75%, its highest level in about 15 years.

Weiterlesen »