Liquidity mining can be much more than just a risky way of passively making money on crypto capital. - web3 web3ecosystems

Liquidity mining can be much more than a risky way of passively making money. Here is how it can be reshaped to bring more value and stability to the entire crypto market.Of course, this clickbait statement is too far from reality: the death of liquidity mining would mean the inevitable end of the whole DeFi sector.

Then if we go more granular and group the crypto liquidity into CEX and DEX categories, here is what we'd have:except for the “blue chips,” liquidity is often thin or even faked, which inevitably incurs the risk of higher slippage. For that, liquidity providers participate in the distribution of trading fees, can stake protocol tokens, and get various extra rewards set forth by a particular liquidity mining program.To understand more comprehensively what liquidity mining is, we should look at why it was actually invented.

for automated P2P digital asset trading. It is the fundamental carrier of DeFi. There is no DeFi without liquidity mining. When liquidity is supplied to a pool, a liquidity provider gets a protocol’s tokens in proportion to how much liquidity they deposited to the pool. Some protocols allow for staking LP tokens while the liquidity is locked up in the contract.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

FTX Agrees to Sell Itself to Rival Binance Amid Liquidity Scare at Crypto ExchangeIt's a stunning outcome. After days of speculation, Binance has agreed to buy rival cryptocurrency exchange FTX_Official. Here's what you need to know 👉

FTX Agrees to Sell Itself to Rival Binance Amid Liquidity Scare at Crypto ExchangeIt's a stunning outcome. After days of speculation, Binance has agreed to buy rival cryptocurrency exchange FTX_Official. Here's what you need to know 👉

Weiterlesen »

FTX's token plunges 80% on liquidity concerns, wiping out over $2 billion in valueFTT, the native token of crypto exchange FTX, lost most of its value on Tuesday, following news that rival Binance had plans to acquire the company.

FTX's token plunges 80% on liquidity concerns, wiping out over $2 billion in valueFTT, the native token of crypto exchange FTX, lost most of its value on Tuesday, following news that rival Binance had plans to acquire the company.

Weiterlesen »

Bitcoin price swings to over $20K as Binance helps FTX ‘liquidity crunch’Volatility is back with a bang. Turmoil over crypto exchange FTX has punished markets further and sees Bitcoin battling support.

Bitcoin price swings to over $20K as Binance helps FTX ‘liquidity crunch’Volatility is back with a bang. Turmoil over crypto exchange FTX has punished markets further and sees Bitcoin battling support.

Weiterlesen »

Yuga Labs, Circle, SkyBridge Among Investments FTX Ventures Made Prior to Liquidity IssuesWhat will happen to FTX_Official's venture capital arm after binance acquisition offer? FTX Ventures invested in some of the biggest names in crypto. BrandyBetz reports

Yuga Labs, Circle, SkyBridge Among Investments FTX Ventures Made Prior to Liquidity IssuesWhat will happen to FTX_Official's venture capital arm after binance acquisition offer? FTX Ventures invested in some of the biggest names in crypto. BrandyBetz reports

Weiterlesen »

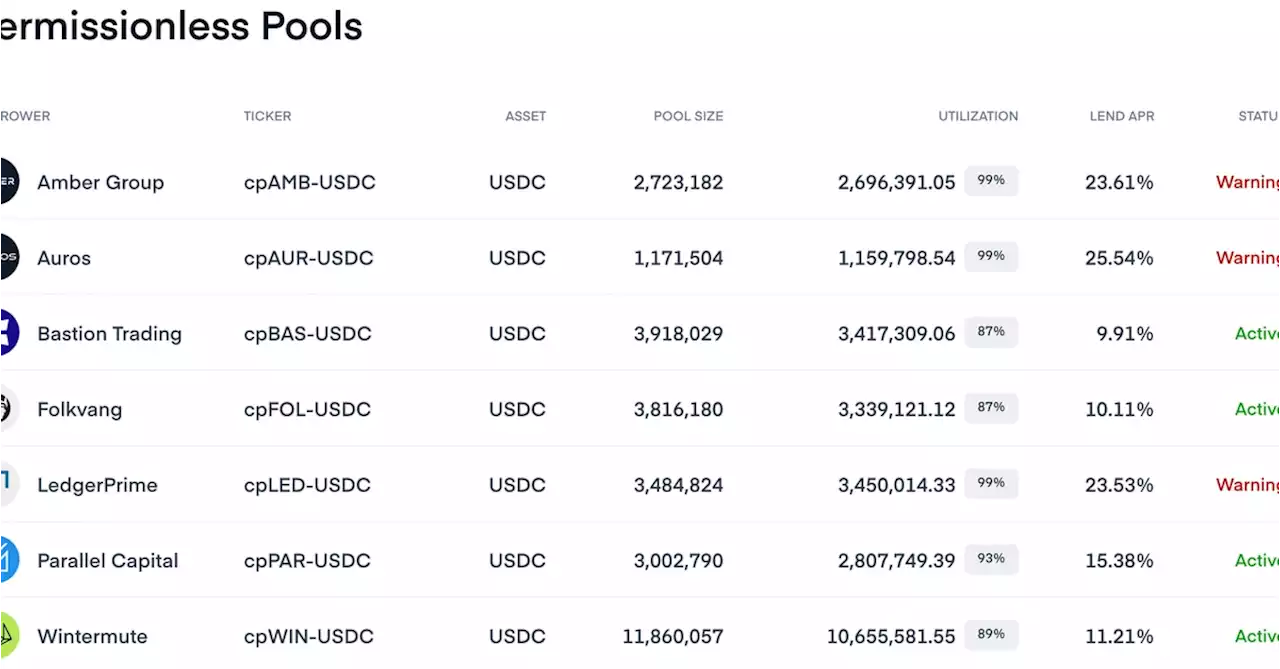

Liquidity Crunch Spreads to Crypto Lending as Institutional Borrowers Max Out Credit PoolsMultiple crypto investments firms drained almost the max amount of available credit from their credit pools on lending protocol Clearpool, receiving a “warning” label. They faced higher interest rates on their loans. sndr_krisztian reports

Liquidity Crunch Spreads to Crypto Lending as Institutional Borrowers Max Out Credit PoolsMultiple crypto investments firms drained almost the max amount of available credit from their credit pools on lending protocol Clearpool, receiving a “warning” label. They faced higher interest rates on their loans. sndr_krisztian reports

Weiterlesen »

Binance CEO shares ‘two big lessons’ after FTX’s liquidity crunchAfter FTX shared that it was in the midst of a “liquidity crunch” and was set to be acquired by Binance, Changpeng Zhao shared two lessons for crypto companies.

Binance CEO shares ‘two big lessons’ after FTX’s liquidity crunchAfter FTX shared that it was in the midst of a “liquidity crunch” and was set to be acquired by Binance, Changpeng Zhao shared two lessons for crypto companies.

Weiterlesen »