U.S. regulators are considering retaining securities owned by Signature Bank and Silicon Valley Bank which sank in value due to rising interest rates, Bloomberg News reported on Friday.

The move could facilitate the process of takeovers which became more challenging due to declining value of the assets, the report said, citing people familiar with the matter.

The amount covered at Signature could range from $20 billion to $50 billion, while for Silicon Valley Bank it could be between $60 billion and $120 billion, the report added. FDIC, Signature Bank, Silicon Valley Bank did not immediately respond to Reuters requests for comment.filed for a court-supervised reorganizationFinancial stocks have lost billions of dollars in value since the collapse of Silicon Valley Bank and Signature Bank last week, while credit stress has worsened for Wall Street's biggest banks.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

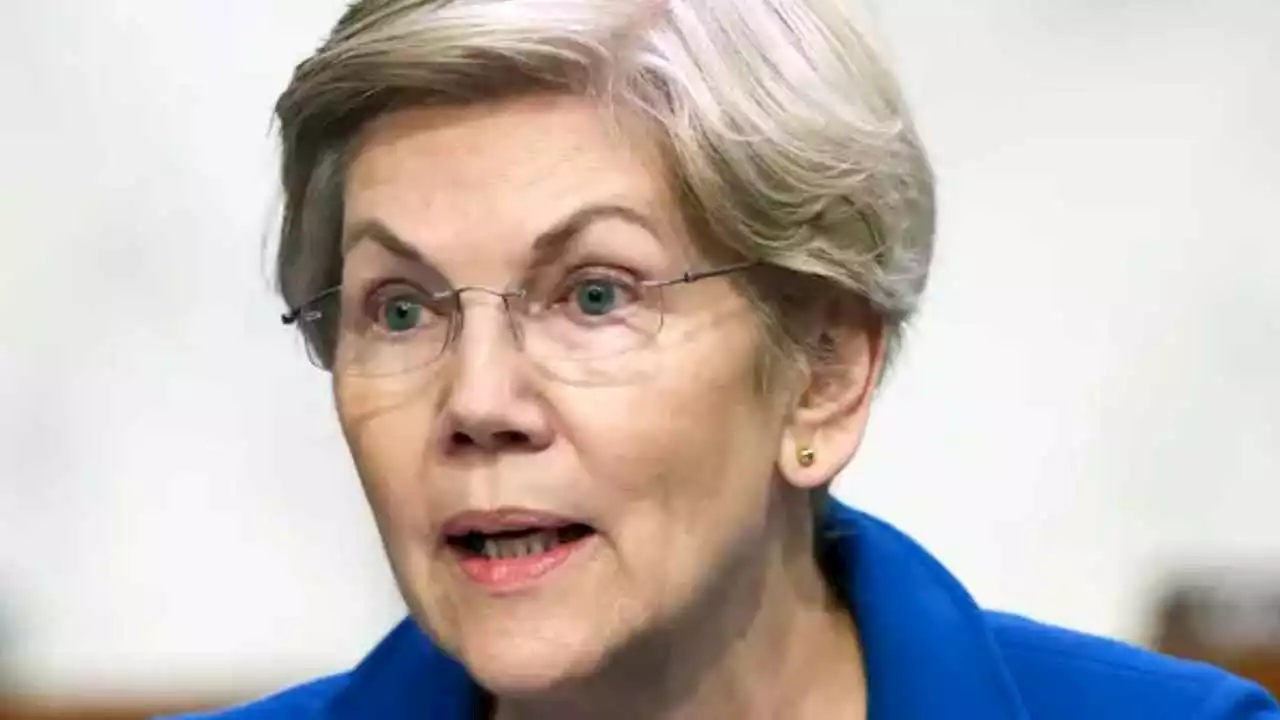

US Senator: Signature Bank Collapsed Because It Embraced Crypto Customers Without Sufficient Safeguards – Regulation Bitcoin NewsU.S. Senator Elizabeth Warren claims that Signature Bank failed because it “embraced crypto customers with insufficient safeguards.' cryptocurrency

US Senator: Signature Bank Collapsed Because It Embraced Crypto Customers Without Sufficient Safeguards – Regulation Bitcoin NewsU.S. Senator Elizabeth Warren claims that Signature Bank failed because it “embraced crypto customers with insufficient safeguards.' cryptocurrency

Weiterlesen »

First Republic Bank weighing options including sale - Bloomberg NewsU.S. private lender First Republic Bank is exploring strategic options including a sale, Bloomberg reported on Wednesday, citing people with knowledge of the matter.

First Republic Bank weighing options including sale - Bloomberg NewsU.S. private lender First Republic Bank is exploring strategic options including a sale, Bloomberg reported on Wednesday, citing people with knowledge of the matter.

Weiterlesen »

Why Barney Frank Went to Work for Signature Bank“What’s the matter with you? You really believe that nobody who has regulatory experience should be on a bank board?” IChotiner speaks with the former congressman Barney Frank.

Why Barney Frank Went to Work for Signature Bank“What’s the matter with you? You really believe that nobody who has regulatory experience should be on a bank board?” IChotiner speaks with the former congressman Barney Frank.

Weiterlesen »

Exclusive: U.S. regulator eyes Friday bids for SVB, Signature Bank-sourcesRegulators at the U.S. Federal Deposit Insurance Corp (FDIC) have asked banks interested in acquiring failed lenders Silicon Valley Bank and Signature Bank to submit bids by March 17, people familiar with the matter said on Wednesday.

Exclusive: U.S. regulator eyes Friday bids for SVB, Signature Bank-sourcesRegulators at the U.S. Federal Deposit Insurance Corp (FDIC) have asked banks interested in acquiring failed lenders Silicon Valley Bank and Signature Bank to submit bids by March 17, people familiar with the matter said on Wednesday.

Weiterlesen »

Exclusive: U.S. regulator eyes Friday bids for SVB, Signature BankRegulators at the U.S. Federal Deposit Insurance Corp (FDIC) have asked banks interested in acquiring failed lenders Silicon Valley Bank and Signature Bank to submit bids by March 17, people familiar with the matter said on Wednesday.

Exclusive: U.S. regulator eyes Friday bids for SVB, Signature BankRegulators at the U.S. Federal Deposit Insurance Corp (FDIC) have asked banks interested in acquiring failed lenders Silicon Valley Bank and Signature Bank to submit bids by March 17, people familiar with the matter said on Wednesday.

Weiterlesen »

Signature Bank’s Prospective Buyers Must Agree to Give Up All Crypto Business: ReportThe Federal Deposit Insurance Corporation (FDIC) has reportedly asked banks interested in acquiring the shuttered New York institution to submit bids by Friday.

Signature Bank’s Prospective Buyers Must Agree to Give Up All Crypto Business: ReportThe Federal Deposit Insurance Corporation (FDIC) has reportedly asked banks interested in acquiring the shuttered New York institution to submit bids by Friday.

Weiterlesen »