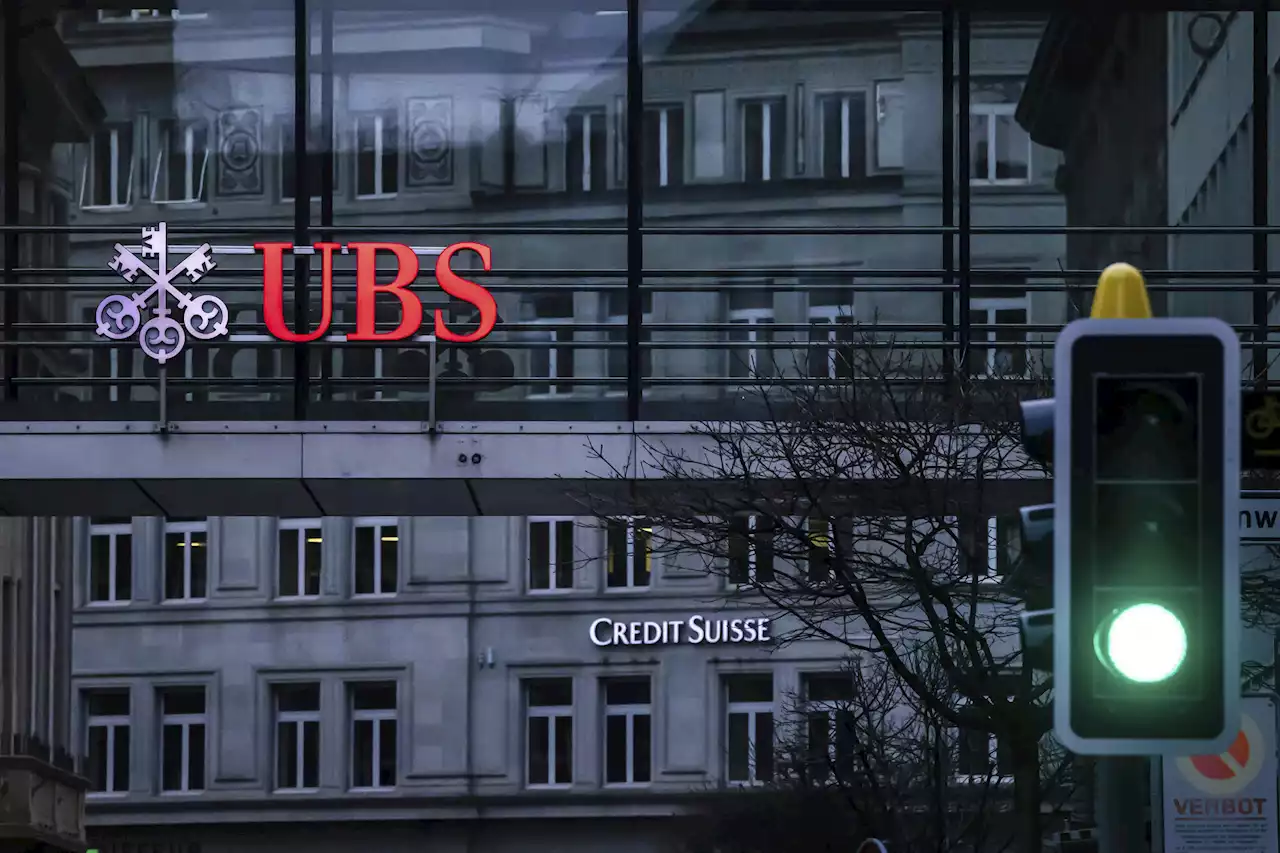

UBS just reshuffled its leadership ranks after buying Credit Suisse. See the new power players in charge of the $1.7 trillion Swiss banking behemoth.

Credit Suisse vet Michael Ebert now has a leadership role at UBS.formerly co-head of Markets at Credit Suisse will now join the Investment Bank Management Forum as Head of Credit Suisse for the Investment Bank reporting to me. Mike will play a critical role in ensuring operational continuity and client focus while supporting the integration process of the Investment Bank. In addition, I've asked him to take on the newly created role of Head of Americas for the Investment Bank.

The bank also plans to welcome a slew of new bankers from Barclays, where it has been on a hiring spree. It has hireda consumer retail banker, and TMT bankers Laurence Braham, Richard Hardegree, Richard Casavechia, Ozzie Ramos, Jason Williams, Neil Meyer, and Ken TittleThe new lineup of wealth management leadership includes a long-time Credit Suisse executive that left the firm to"chill, relax and recharge" last fall. UBS global wealth management presidentrevealed the appointments to its critical wealth business in an internal memo titled"Becoming a global wealth powerhouse." Of the appointments, only five come from Credit Suisse.

he said he wanted to spend some time"slowly skiing, reading, and doing some online courses" and recharging before going back to work. He will also jointly lead the firm's integration team with UBS chief operating officer for wealth,Members of the current Credit Suisse wealth management leadership team will report to both Yves-Alain and to their respective UBS global wealth management regional leader.

The $2 trillion America's business, which includes the US and Latin America, will continue to be led by longtime UBS executiveAfter UBS agreed to buy Credit Suisse, the bank said also made a number of changes to its C-Suite. It tapped

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

UBS to impose restrictions on Credit Suisse bankers after takeover complete, FT saysUBS AG is set to impose tight restrictions on Credit Suisse bankers, including a ban on new clients from high-risk countries and on complex financial products, the Financial Times said on Sunday, citing people with knowledge of the matter.

UBS to impose restrictions on Credit Suisse bankers after takeover complete, FT saysUBS AG is set to impose tight restrictions on Credit Suisse bankers, including a ban on new clients from high-risk countries and on complex financial products, the Financial Times said on Sunday, citing people with knowledge of the matter.

Weiterlesen »

UBS says it has completed the takeover of stricken rival Credit SuisseSwiss bank UBS released an open letter Monday saying that it had formally completed the takeover of its rival Credit Suisse.

UBS says it has completed the takeover of stricken rival Credit SuisseSwiss bank UBS released an open letter Monday saying that it had formally completed the takeover of its rival Credit Suisse.

Weiterlesen »

UBS completes Credit Suisse takeover to become wealth management behemothUBS on Monday said it had completed its emergency takeover of embattled local rival Credit Suisse , creating a giant Swiss bank with a balance sheet of $1.6 trillion and greater muscle in wealth management.

UBS completes Credit Suisse takeover to become wealth management behemothUBS on Monday said it had completed its emergency takeover of embattled local rival Credit Suisse , creating a giant Swiss bank with a balance sheet of $1.6 trillion and greater muscle in wealth management.

Weiterlesen »

UBS says its takeover of Credit Suisse is now completeUBS announced the finalization of the deal for its rival Credit Suisse in an open letter to Swiss and other international newspapers.

UBS says its takeover of Credit Suisse is now completeUBS announced the finalization of the deal for its rival Credit Suisse in an open letter to Swiss and other international newspapers.

Weiterlesen »

Explainer: UBS has Swiss mountain to climb with Credit SuisseWith its Credit Suisse takeover officially wrapped up, UBS must now make good on its promise that the government-orchestrated rescue will deliver both for shareholders and Swiss taxpayers.

Explainer: UBS has Swiss mountain to climb with Credit SuisseWith its Credit Suisse takeover officially wrapped up, UBS must now make good on its promise that the government-orchestrated rescue will deliver both for shareholders and Swiss taxpayers.

Weiterlesen »

UBS completes takeover of Credit Suisse in deal meant to stem global financial turmoilUBS says it has completed its takeover of embattled rival Credit Suisse. The announcement comes nearly three months after the Swiss government hastily arranged a rescue deal to combine the country’s two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil. A statement from the bank on Monday said that “UBS has completed the acquisition of Credit Suisse today, crossing an important milestone.” UBS had said last week that it expected to complete the acquisition worth 3 billion Swiss francs ($3.3 billion) as early as Monday.

UBS completes takeover of Credit Suisse in deal meant to stem global financial turmoilUBS says it has completed its takeover of embattled rival Credit Suisse. The announcement comes nearly three months after the Swiss government hastily arranged a rescue deal to combine the country’s two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil. A statement from the bank on Monday said that “UBS has completed the acquisition of Credit Suisse today, crossing an important milestone.” UBS had said last week that it expected to complete the acquisition worth 3 billion Swiss francs ($3.3 billion) as early as Monday.

Weiterlesen »