US Dollar under pressure, Brazil’s Lula urges countries to ditch USD in trade – by eren_fxstreet DollarIndex Macroeconomics Currencies

inflation data from the United States, growing expectations for a Federal Reserve policy shift amid signs of economic slowdown and loudening calls to move away from the USD in trade transactions have been causing the currency to lose its value.

The Fed will publish Industrial Production figures for March and the University of Michigan’s will release the preliminary Consumer Sentiment Survey for April. The US Bureau of Labor Statistics reported on Wednesday that the Consumer Price Index declined to 5% on a yearly basis in March from 6% in February. This reading came in below the market expectation of 5.2%. Furthermore, the Core CPI, which excludes volatile food and energy prices, rose by 0.4% on a monthly basis, down from a 0.5% increase recorded in February.

San Francisco Federal Reserve Bank President Mary Daly said on Wednesday that the strength of the US economy and elevated inflation suggests that they have more work to do on rate hikes. The US Bureau of Labor Statistics reported on Friday, April 7, that Nonfarm Payrolls in the US rose by 236,000 in March, slightly below the market expectation of 240,000. February’s print of 311,000 got revised higher to 326,000 from 311,000.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

GBP/USD refreshes weekly high, around 1.2470 amid softer US CPI-inspired USD sell-offGBP/USD refreshes weekly high, around 1.2470 amid softer US CPI-inspired USD sell-off – by hareshmenghani GBPUSD Inflation Fed Recession Currencies

GBP/USD refreshes weekly high, around 1.2470 amid softer US CPI-inspired USD sell-offGBP/USD refreshes weekly high, around 1.2470 amid softer US CPI-inspired USD sell-off – by hareshmenghani GBPUSD Inflation Fed Recession Currencies

Weiterlesen »

USD/CHF slips below mid-0.8900s, lowest since June 2021 amid softer USD/recession fearsUSD/CHF slips below mid-0.8900s, lowest since June 2021 amid softer USD/recession fears – by hareshmenghani USDCHF Fed Inflation Recession Currencies

USD/CHF slips below mid-0.8900s, lowest since June 2021 amid softer USD/recession fearsUSD/CHF slips below mid-0.8900s, lowest since June 2021 amid softer USD/recession fears – by hareshmenghani USDCHF Fed Inflation Recession Currencies

Weiterlesen »

GBP/USD jumps to 1.2535 area, highest since June 2022 amid notable USD supplyThe GBP/USD pair gains positive traction for the third successive day on Thursday and climbs to the 1.2530 area, or its highest level since June 2022,

GBP/USD jumps to 1.2535 area, highest since June 2022 amid notable USD supplyThe GBP/USD pair gains positive traction for the third successive day on Thursday and climbs to the 1.2530 area, or its highest level since June 2022,

Weiterlesen »

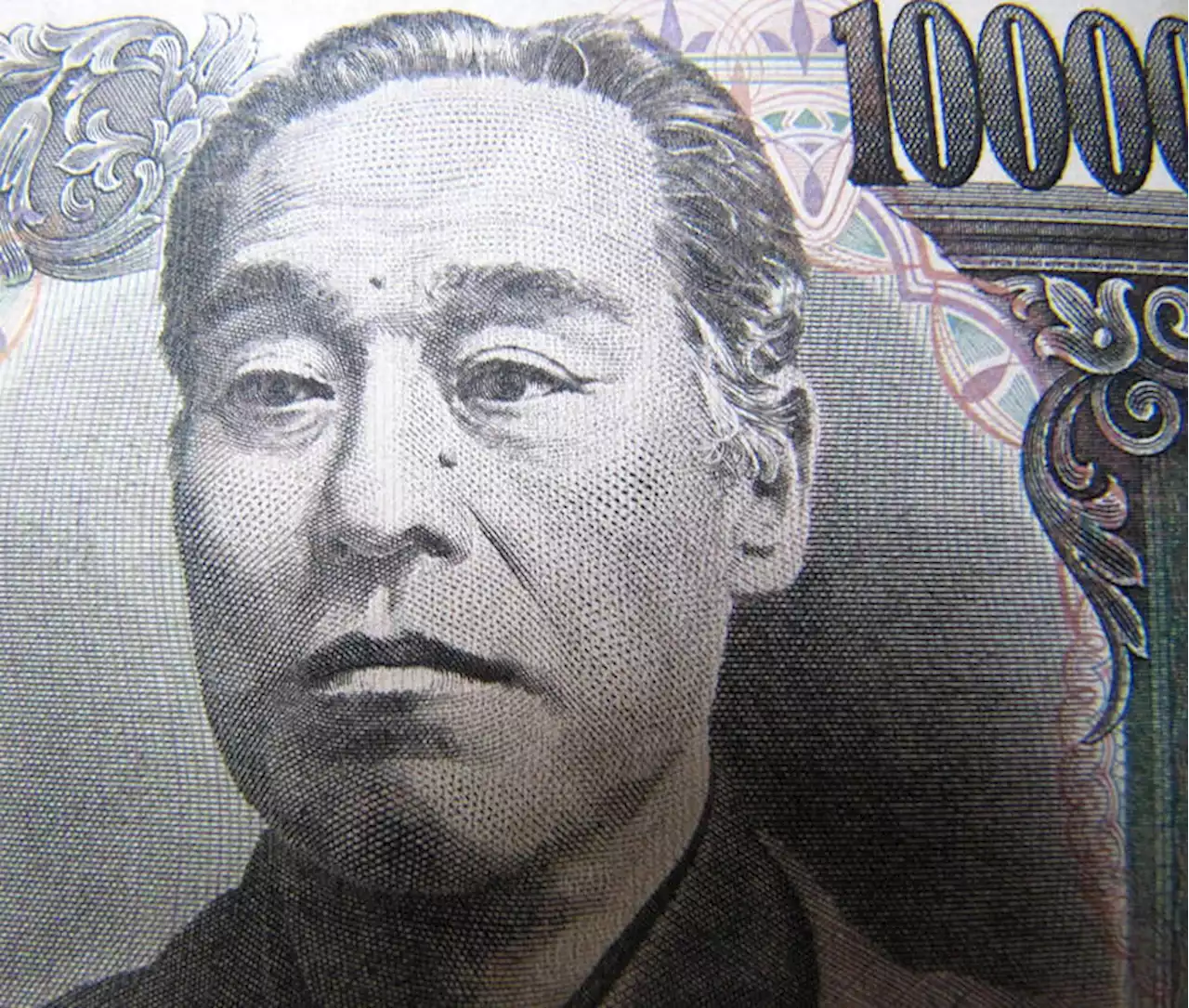

USD/JPY drops to 132.00 neighbourhood, erases weekly gains amid broad-based USD weaknessUSD/JPY drops to 132.00 neighbourhood, erases weekly gains amid broad-based USD weakness – by hareshmenghani USDJPY UnitedStates PPI Fed Currencies

USD/JPY drops to 132.00 neighbourhood, erases weekly gains amid broad-based USD weaknessUSD/JPY drops to 132.00 neighbourhood, erases weekly gains amid broad-based USD weakness – by hareshmenghani USDJPY UnitedStates PPI Fed Currencies

Weiterlesen »

Gold Price Forecast: XAU/USD bulls cheer downbeat US Treasury bond yields, US DollarGold price (XAU/USD) remains sidelined around $2,015, mildly bid during the three-day uptrend, as broad-based US Dollar weakness joins downbeat United

Gold Price Forecast: XAU/USD bulls cheer downbeat US Treasury bond yields, US DollarGold price (XAU/USD) remains sidelined around $2,015, mildly bid during the three-day uptrend, as broad-based US Dollar weakness joins downbeat United

Weiterlesen »

USD/CNH stays pressured towards 6.8750 on upbeat China trade numbers, downbeat US DollarUSD/CNH stays pressured towards 6.8750 on upbeat China trade numbers, downbeat US Dollar – by anilpanchal7 USDCNY ForeignTrade YieldCurve RiskAversion Fed

USD/CNH stays pressured towards 6.8750 on upbeat China trade numbers, downbeat US DollarUSD/CNH stays pressured towards 6.8750 on upbeat China trade numbers, downbeat US Dollar – by anilpanchal7 USDCNY ForeignTrade YieldCurve RiskAversion Fed

Weiterlesen »