Wall Street ended sharply lower on Thursday on worries that the Federal Reserve's aggressive fight against inflation could hobble the U.S. economy, and as investors fretted about a rout in global currency and debt markets

The S&P 500

touched lows last seen in November 2020. Down more than 8% in September, the benchmark is on track for its worst September since 2008.A sell-off in U.S. Treasuries resumed as Fed officials gave no indication the U.S. central bank would moderate or change its plans to aggressively raise interest rates to bring down high inflation.

Cleveland Fed President Loretta Mester said she does not see distress in U.S. financial markets that would alter the central bank's campaign to lower inflation through rate hikes that have taken the Fed funds rate to a range of 3.0% to 3.25%.showed the number of Americans filing new claims for unemployment benefits fell to a five-month low last week as the labor market remains resilient despite the Fed's aggressive interest rate hikes.

"Good news is bad news in that today's job number again reiterates that the Fed has a long way to go," said Phil Blancato, head of Ladenburg Thalmann Asset Management in New York. "The fear in the marketplace is that the Fed is going to push us into a very deep recession, which will cause an earnings recession, which is why the market is selling off.", with $20.8 billion worth of shares exchanged during the session. The shares declined 6.8%.

Volume on U.S. exchanges was relatively heavy, with 11.6 billion shares traded, compared with an average of 11.4 billion shares over the previous 20 sessions.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

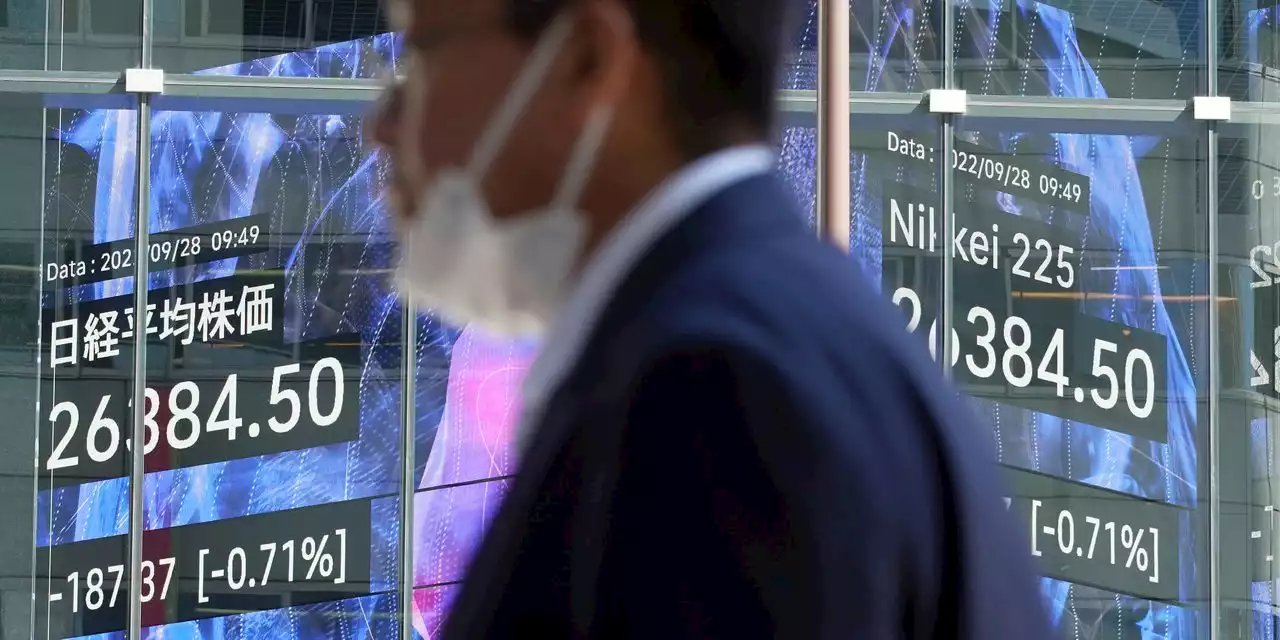

Asian markets sharply lower after wobbly day on Wall StreetAsian shares tumbled Wednesday after a wobbly day ended with mixed results on Wall Street as markets churn over the prospect of a possible recession.

Asian markets sharply lower after wobbly day on Wall StreetAsian shares tumbled Wednesday after a wobbly day ended with mixed results on Wall Street as markets churn over the prospect of a possible recession.

Weiterlesen »

Breakingviews - Wall Street sends regulators a poop emojiWhat’s the best response to an inconvenient, impractical rule? For Wall Street brokerages, one answer is simply to flout it. Eleven of the biggest names in finance just paid $1.8 billion to the U.S. Securities & Exchange Commission and the Commodity Futures Trading Commission over employees’ unapproved use of platforms like WhatsApp. It manages to be both trivial and disturbing.

Breakingviews - Wall Street sends regulators a poop emojiWhat’s the best response to an inconvenient, impractical rule? For Wall Street brokerages, one answer is simply to flout it. Eleven of the biggest names in finance just paid $1.8 billion to the U.S. Securities & Exchange Commission and the Commodity Futures Trading Commission over employees’ unapproved use of platforms like WhatsApp. It manages to be both trivial and disturbing.

Weiterlesen »

Biden not focusing on Wall Street means he's not focused on America's prosperity: Rep. Carlos GimenezRep. Carlos Gimenez, R-Fla., called out Biden for not focusing on the stock market selloff, arguing the president is not tied to the reality of how people retire.

Biden not focusing on Wall Street means he's not focused on America's prosperity: Rep. Carlos GimenezRep. Carlos Gimenez, R-Fla., called out Biden for not focusing on the stock market selloff, arguing the president is not tied to the reality of how people retire.

Weiterlesen »

Wall Street Firms Pay Small Penalty for Failing to Preserve TextsWall Street Firms Pay Ridiculously Small Penalty for Failing to Preserve Texts

Wall Street Firms Pay Small Penalty for Failing to Preserve TextsWall Street Firms Pay Ridiculously Small Penalty for Failing to Preserve Texts

Weiterlesen »

U.S. fines 16 Wall Street firms $1.8 bln for talking deals, trades on personal appsU.S. regulators on Tuesday fined 16 financial firms, including Barclays , Bank of America , Citigroup , Credit Suisse , Goldman Sachs , Morgan Stanley and UBS , a combined $1.8 billion after staff discussed deals and trades on their personal devices and apps.

U.S. fines 16 Wall Street firms $1.8 bln for talking deals, trades on personal appsU.S. regulators on Tuesday fined 16 financial firms, including Barclays , Bank of America , Citigroup , Credit Suisse , Goldman Sachs , Morgan Stanley and UBS , a combined $1.8 billion after staff discussed deals and trades on their personal devices and apps.

Weiterlesen »