Will rate hikes be tempered? And what about investor appetite as cap rates rise?

As 2022 began, the yield on 10-year Treasuries was 1.73%. Also referred to as T-bills, their going rate today is 3.4%.

Let’s say you were quite cautious, aka risk-averse, but wanted some return on your cash and bought a pile of these government issues. If you planned to redeem the bonds in 2030, no problem. The return would be there, along with your principal amount. This very over-simplified example is partially what caused Silicon Valley Bank to fail and be seized by federal regulators. When the run on deposits occurred last week, the bank was forced to take a loss on its bond portfolio in order to cash out investors.

We’ve now experienced a couple of months of strong job numbers paired with increasing wages and a resilient consumer who refuses to stop spending.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

First Republic Bank Exploring Sale Amid Banking Sector ChaosThe troubled bank has been in turmoil since the collapse of Silicon Valley Bank.

First Republic Bank Exploring Sale Amid Banking Sector ChaosThe troubled bank has been in turmoil since the collapse of Silicon Valley Bank.

Weiterlesen »

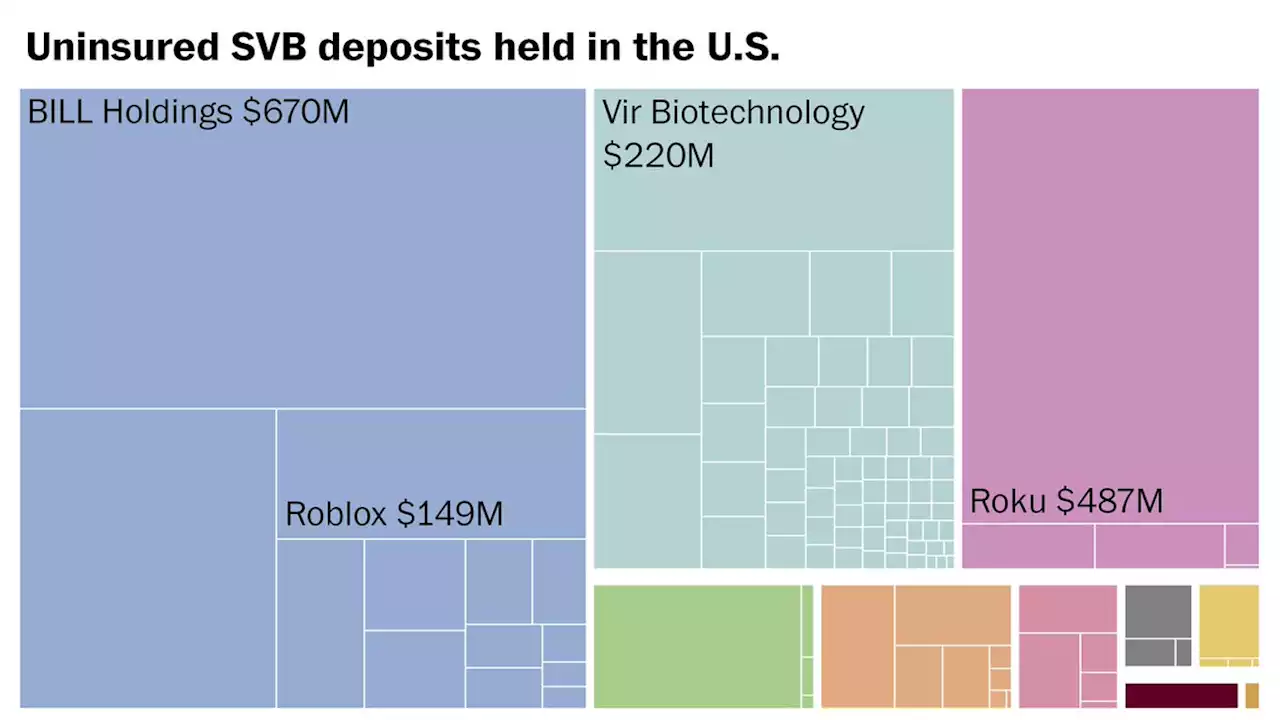

These companies had billions of dollars at risk in Silicon Valley BankSee the billions of dollars of unprotected deposits and other holdings that companies had at Silicon Valley Bank, before federal financial regulators stepped in to secure the deposits likely averting a meltdown in the U.S. banking sector.

These companies had billions of dollars at risk in Silicon Valley BankSee the billions of dollars of unprotected deposits and other holdings that companies had at Silicon Valley Bank, before federal financial regulators stepped in to secure the deposits likely averting a meltdown in the U.S. banking sector.

Weiterlesen »

![]() Biden's claim that Silicon Valley Bank bailout wouldn't cost taxpayers contradicts fiscal reality: economistThe Biden administration has insisted taxpayers will not be on the hook for the recent bailout of SVB, but a Heritage economist says that 'doesn't pass the smell test.'

Biden's claim that Silicon Valley Bank bailout wouldn't cost taxpayers contradicts fiscal reality: economistThe Biden administration has insisted taxpayers will not be on the hook for the recent bailout of SVB, but a Heritage economist says that 'doesn't pass the smell test.'

Weiterlesen »

Yellen tells Congress that U.S. banking system still ‘sound’ after collapse of Silicon Valley BankTreasury Secretary Janet Yellen told lawmakers Thursday that the nation’s banking system “remains sound” and that Americans shouldn’t worry about their deposits, a week after the second-largest bank collapse in U.S. history.

Yellen tells Congress that U.S. banking system still ‘sound’ after collapse of Silicon Valley BankTreasury Secretary Janet Yellen told lawmakers Thursday that the nation’s banking system “remains sound” and that Americans shouldn’t worry about their deposits, a week after the second-largest bank collapse in U.S. history.

Weiterlesen »

![]() Silicon Valley Bank’s implosion leaves a gaping hole for start-upsThe tech world relied on Silicon Valley Bank for everything from mortgages to credit cards. Its implosion has left them reeling.

Silicon Valley Bank’s implosion leaves a gaping hole for start-upsThe tech world relied on Silicon Valley Bank for everything from mortgages to credit cards. Its implosion has left them reeling.

Weiterlesen »