Yield farming = making more crypto with your crypto.

, and others. Some protocols will mint tokens that represent your deposited coins in the system. For example, if you deposit DAI into Compound, you’ll get cDAI, or Compound DAI. If you deposit ETH to Compound, you’ll get cETH.

It’s also worth keeping in mind that these are only estimations and projections. Even short-terms rewards are quite difficult to estimate accurately. Why? Yield farming is a highly competitive and fast-paced market, and the rewards can fluctuate rapidly. If a yield farming strategy works for a while, many farmers will jump on the opportunity, and it may stop yielding high returns.

Yield farming isn’t as easy as it seems, and if you don’t understand what you’re doing, you’ll likely lose money. We’ve just discussed how your collateral can be liquidated. But what other risks do you need to be aware of?. Due to the nature of DeFi, many protocols are built and developed by small teams with limited budgets. This can increase the risk of smart contract bugs.

As we’ve discussed before, DeFi protocols are permissionless and can seamlessly integrate with each other. This means that the entire DeFi ecosystem is heavily reliant on each of its building blocks. This is what we refer to when we say that these applications are composable – they can easily work together.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Yield App’s New Referral Program Offers a Massive Bonus – Sponsored Bitcoin NewsYield App, a thriving digital wealth platform, recently unveiled its hotly anticipated Referral Program and it was worth the wait. With up to 1,000 $YLD

Yield App’s New Referral Program Offers a Massive Bonus – Sponsored Bitcoin NewsYield App, a thriving digital wealth platform, recently unveiled its hotly anticipated Referral Program and it was worth the wait. With up to 1,000 $YLD

Weiterlesen »

Don’t Wait To Buy I-Bonds Or You'll Risk Losing Out On An 8.54% Yield For A Full YearSeriously check out U.S. Treasury I bonds that will pay over 8.5% if you have extra cash or bonds you don't need for at least a year.

Don’t Wait To Buy I-Bonds Or You'll Risk Losing Out On An 8.54% Yield For A Full YearSeriously check out U.S. Treasury I bonds that will pay over 8.5% if you have extra cash or bonds you don't need for at least a year.

Weiterlesen »

Don’t Wait To Buy I-Bonds Or You'll Risk Losing Out On An 8.54% Yield For A Full YearSeriously check out U.S. Treasury I bonds that will pay over 8.5% if you have extra cash or bonds you don't need for at least a year.

Don’t Wait To Buy I-Bonds Or You'll Risk Losing Out On An 8.54% Yield For A Full YearSeriously check out U.S. Treasury I bonds that will pay over 8.5% if you have extra cash or bonds you don't need for at least a year.

Weiterlesen »

Don’t Wait To Buy I-Bonds Or You'll Risk Losing Out On An 8.54% Yield For A Full YearSeriously check out U.S. Treasury I bonds that will pay over 8.5% if you have extra cash or bonds you don't need for at least a year.

Don’t Wait To Buy I-Bonds Or You'll Risk Losing Out On An 8.54% Yield For A Full YearSeriously check out U.S. Treasury I bonds that will pay over 8.5% if you have extra cash or bonds you don't need for at least a year.

Weiterlesen »

Uniswap Launches Swap Widget — Devs Can Embed the Dex With 'One Line of Code' – Defi Bitcoin NewsUniswap Labs, the company behind the popular decentralized finance (defi) protocol, Uniswap, launched a tool called the Swap Widget.

Uniswap Launches Swap Widget — Devs Can Embed the Dex With 'One Line of Code' – Defi Bitcoin NewsUniswap Labs, the company behind the popular decentralized finance (defi) protocol, Uniswap, launched a tool called the Swap Widget.

Weiterlesen »

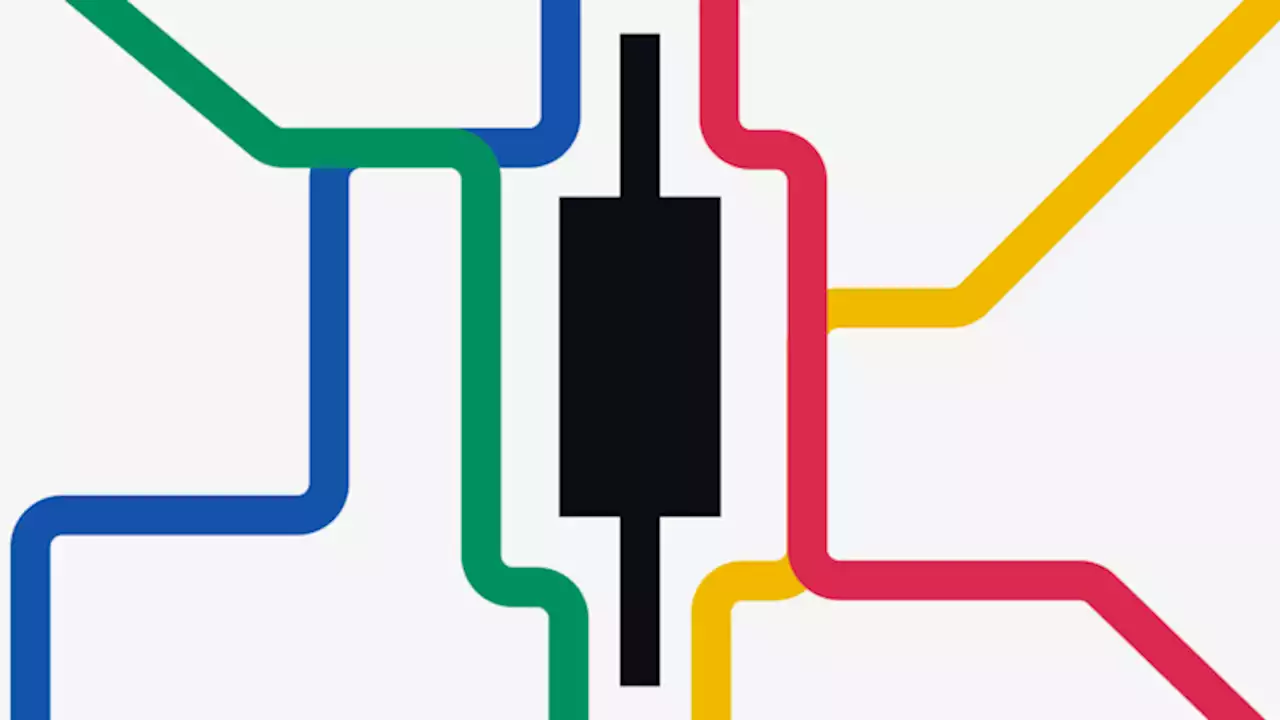

A Beginner's Guide to Candlestick Charts | Binance AcademyCandlestick charts are one of the most fundamental tools in technical analysis. Learn how to master them to become a better investor or trader.

A Beginner's Guide to Candlestick Charts | Binance AcademyCandlestick charts are one of the most fundamental tools in technical analysis. Learn how to master them to become a better investor or trader.

Weiterlesen »