European Markets Look Set to Rise After Record ECB Rate Hike

by the European Central Bank and further comments from Federal Reserve Chair Jerome Powell.

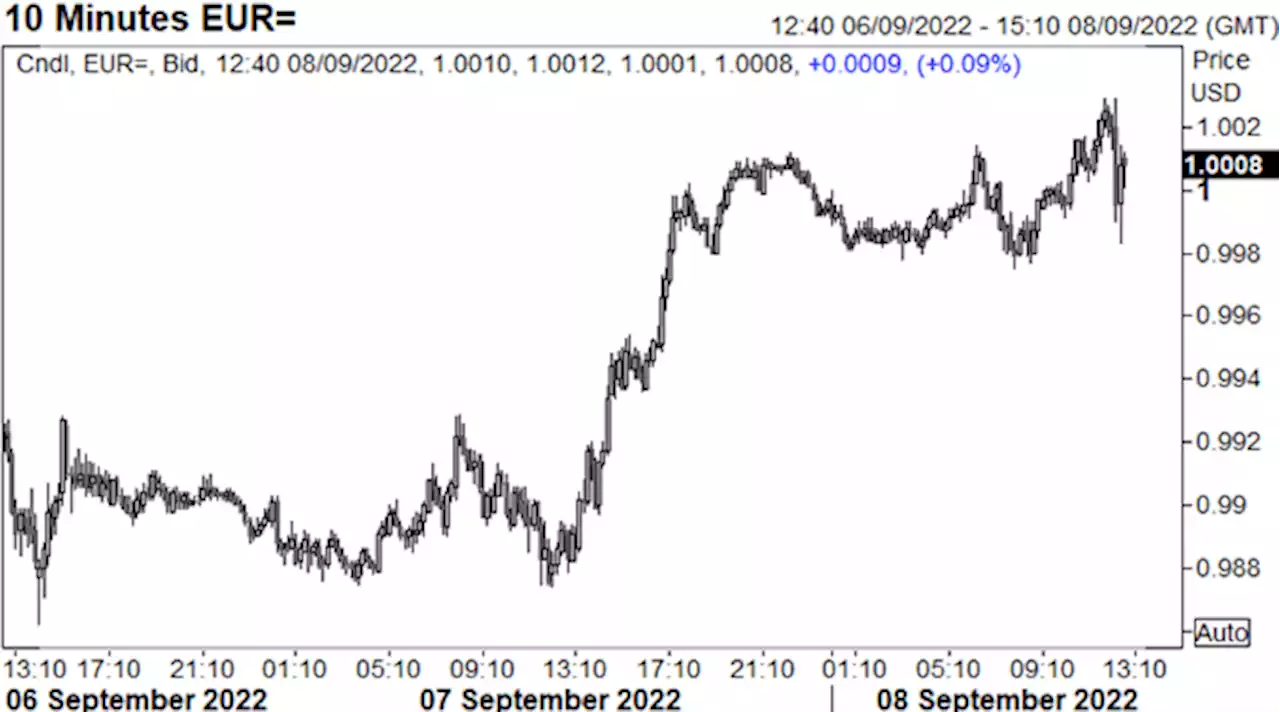

On Thursday, the European Central Bank announced a 75 basis point interest rate rise, taking its benchmark deposit rate to 0.75%. The bank also revised up its inflation expectations — to an average 8.1% in 2022 — and said it expects to hike rates further as"inflation remains far too high and is likely to stay above target for an extended period."raise rates to tackle inflation"until the job is done.

"History cautions strongly against prematurely loosening policy," Powell said at the Cato Institute, a libertarian think tank based in Washington, D.C."I can assure you that my colleagues and I are strongly committed to this project and we will keep at it until the job is done."Download NBC 5 Dallas-Fort Worth

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

European Markets Set to Rebound After Wall Street Rally; ECB ‘Jumbo' Rate Hike a PossibilityEuropean markets are heading for a higher open on Thursday following a rebound on Wall Street that lifted global sentiment.

European Markets Set to Rebound After Wall Street Rally; ECB ‘Jumbo' Rate Hike a PossibilityEuropean markets are heading for a higher open on Thursday following a rebound on Wall Street that lifted global sentiment.

Weiterlesen »

ECB Delivers Unprecedented 75bps Hike to Dampen Record Inflation, EURUSD FadesThe ECB has raised all three key interest rates by 75bps to weigh on record levels of inflation in the Euro Area. Get your market update from JMcQueenFX here:

ECB Delivers Unprecedented 75bps Hike to Dampen Record Inflation, EURUSD FadesThe ECB has raised all three key interest rates by 75bps to weigh on record levels of inflation in the Euro Area. Get your market update from JMcQueenFX here:

Weiterlesen »

EUR/USD clings to mild losses near parity as ECB hawks, Fed’s Powell flex musclesEUR/USD portrays the typical pre-event anxiety as it takes rounds to 0.9990-1.000 during early Thursday morning in Europe. Also keeping pair traders o

EUR/USD clings to mild losses near parity as ECB hawks, Fed’s Powell flex musclesEUR/USD portrays the typical pre-event anxiety as it takes rounds to 0.9990-1.000 during early Thursday morning in Europe. Also keeping pair traders o

Weiterlesen »

EUR/USD: ECB to reinforce euro weakness if delivers another 50 bps hike – MUFGThe next key event for the euro in the week ahead will be the European Central Bank’s (ECB) upcoming policy meeting on Thursday. Economists at MUFG Ba

EUR/USD: ECB to reinforce euro weakness if delivers another 50 bps hike – MUFGThe next key event for the euro in the week ahead will be the European Central Bank’s (ECB) upcoming policy meeting on Thursday. Economists at MUFG Ba

Weiterlesen »