The Pound has been torn between Omicron optimism and Fed hawkishness GBP GBPUSD $GBP $GBPUSD

ing week, featuring all-important US inflation and retail sales data, GDP from the UK and a covid-watch. : The Federal Reserve's meeting minutes from the December decision were decidedly hawkish. Members saw rate hikes coming sooner and at a faster pace – in addition to signaling a potential reduction of the balance sheet. The prospects of withdrawing money from markets sent stocks down and the dollar up.above 1.

: With every day that passes by, there is more evidence that the Omicron COVID-19 variant is less virulent than previous strains such as Delta. The variant is highly contagious, therefore still threatening to overwhelm the National Health Service , but markets are encouraged by the government's reluctance to impose new restrictions.

Moreover, cases in the Greater London area – where Omicron first landed – have begun falling, providing hope that the tsunami would wash away relatively quickly. Politicians are reluctant to announce bad news over the holiday season . Still, such a move becomes more likely ahead of "Blue Monday" – the third Monday of January, which is arguably the most-depressing period of the year.

Growing pressure on hospitals could still force Prime Minister Boris Johnson into another U-turn. That would pound the pound. On the other hand, optimism from London and its surroundings is a ray of light that could help sterling shine. The British economic calendar remains relatively light, yet November's monthly Gross Domestic Product data is set to stir sterling. After posting a meager growth rate of 0.1% in October, output may have increased faster in the following month.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

GBP/USD Forecast: Bearish pressure could increase below 1.3480GBP/USD has reversed its direction after rising to its highest level in nearly two months at 1.3600 late Wednesday as the dollar's market valuation co

GBP/USD Forecast: Bearish pressure could increase below 1.3480GBP/USD has reversed its direction after rising to its highest level in nearly two months at 1.3600 late Wednesday as the dollar's market valuation co

Weiterlesen »

GBP/USD hovering between 1.3500-1.3550 levels post-hakwish Fed minutes as traders await Friday’s US jobs reportGBP/USD continues to trade on the back foot on Thursday as the US session gets underway, despite a weaker than expected US December ISM Services PMI s

GBP/USD hovering between 1.3500-1.3550 levels post-hakwish Fed minutes as traders await Friday’s US jobs reportGBP/USD continues to trade on the back foot on Thursday as the US session gets underway, despite a weaker than expected US December ISM Services PMI s

Weiterlesen »

GBP/USD holds steady near mid-1.3500s, 100-DMA as traders await the key NFP reportThe GBP/USD pair maintained its bid tone, around the 1.3540-50 area through the first half of the European session, albeit seemed struggling to break

GBP/USD holds steady near mid-1.3500s, 100-DMA as traders await the key NFP reportThe GBP/USD pair maintained its bid tone, around the 1.3540-50 area through the first half of the European session, albeit seemed struggling to break

Weiterlesen »

GBP/USD Forecast: British Pound Testing Top of ChannelThe GBPUSD has had a volatile couple of days over the last 48 hours, as we are testing the top of the major downtrend line and the top of a major down trending channel.

GBP/USD Forecast: British Pound Testing Top of ChannelThe GBPUSD has had a volatile couple of days over the last 48 hours, as we are testing the top of the major downtrend line and the top of a major down trending channel.

Weiterlesen »

Conagra Brands CEO says inflation won't go away even after Covid omicron wave passes'It's not quite that simple. I don't think if omicron goes away it immediately solves inflation,' Conagra Brands CEO Sean Connolly told CNBC's Jim Cramer.

Conagra Brands CEO says inflation won't go away even after Covid omicron wave passes'It's not quite that simple. I don't think if omicron goes away it immediately solves inflation,' Conagra Brands CEO Sean Connolly told CNBC's Jim Cramer.

Weiterlesen »

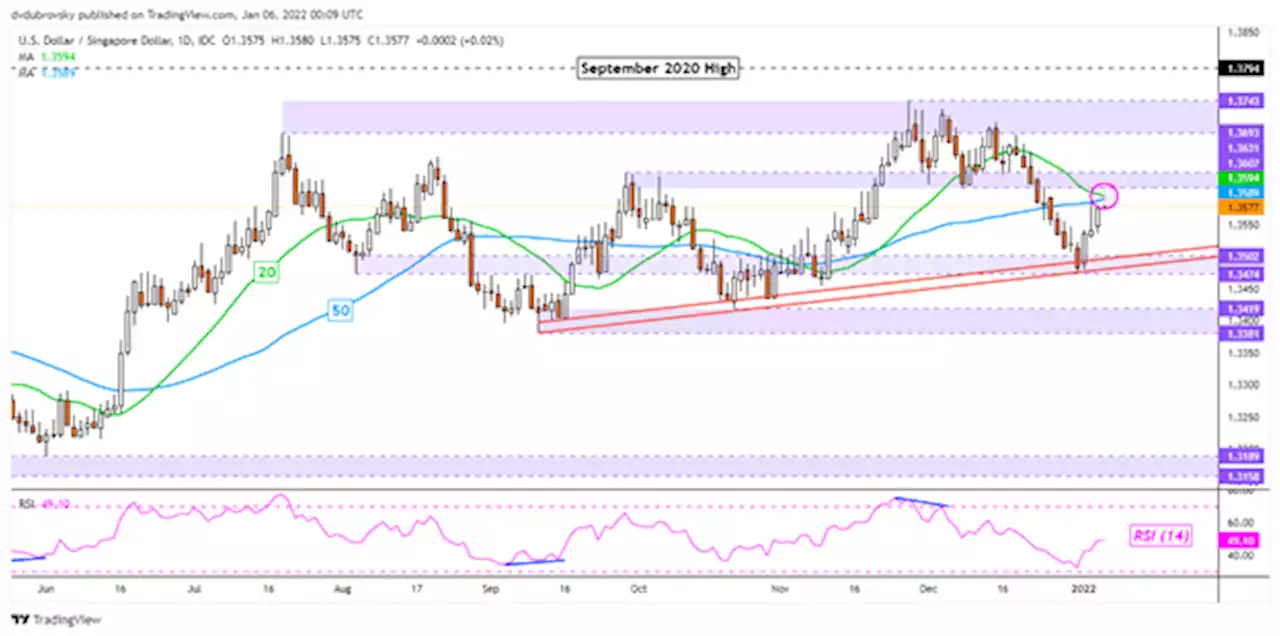

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

Weiterlesen »