The Internal Revenue Service is working with a company called ID.me as a third-party gatekeeper for accessing services on IRS.gov.

SHARE

The IRS will soon require taxpayers to use facial recognition to access their online accounts. Users will need to submit a combination of documents and even a video selfie to ID.me, a third-party company, to verify their identity.The additional verification will not be required to file taxes or submit a payment, the IRS clarified in a statement,.

The process might be a barrier even for the tech-savvy, as Brian Krebs, who runs the Krebs on Security blog, found. In hisabout the ID.me system, Krebs details having to re-enter his personal information several times before being asked to join a video call and was told the wait time was over three hours to do so.

The IRS is not the first government agency to use ID.me. Some states, like Colorado and New York, started using the service to identify recipients of unemployment benefits in 2021. Some applicants reportedly experienced

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

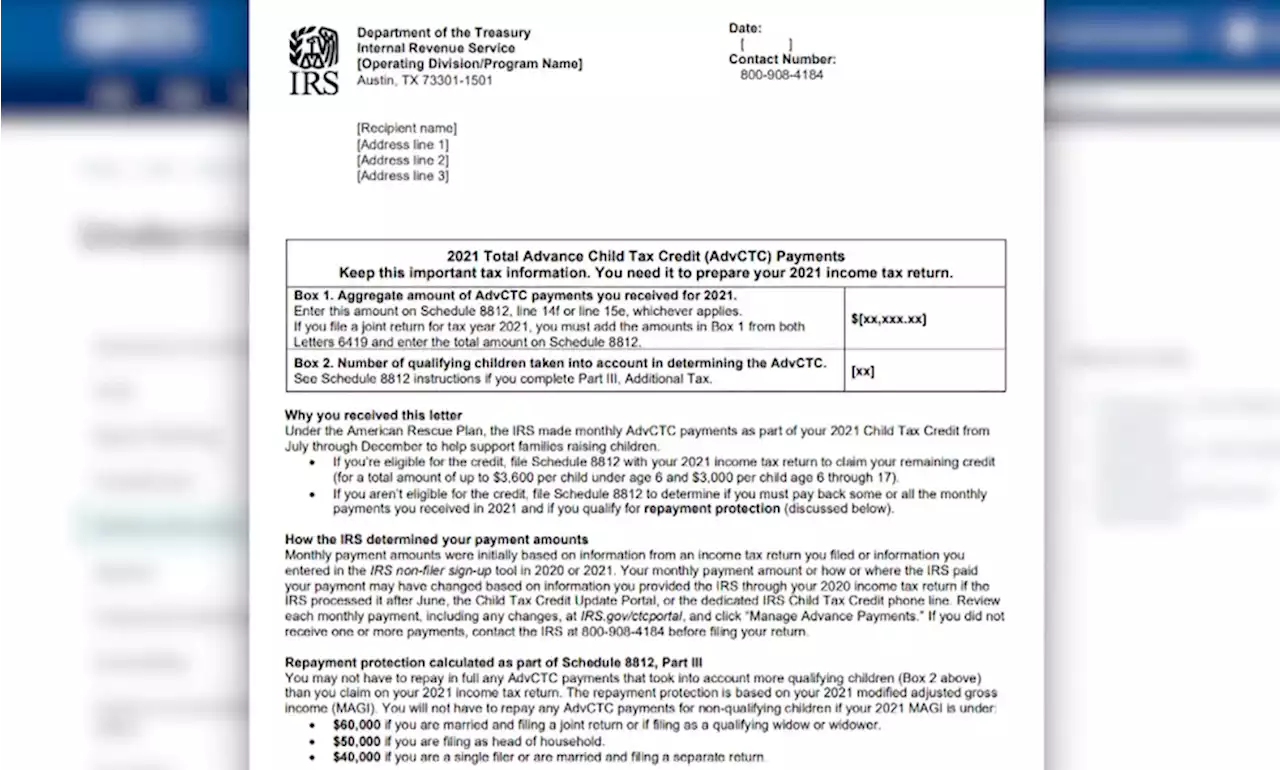

IRS warns some taxpayers may have received incorrect Child Tax Credit letterThe issue could create tax refund delays for parents if they rely on faulty information to complete their tax returns.

IRS warns some taxpayers may have received incorrect Child Tax Credit letterThe issue could create tax refund delays for parents if they rely on faulty information to complete their tax returns.

Weiterlesen »

Tax Experts Warn You to Prepare for a Smaller IRS Refund — Best LifeWith several changes going into effect for this year's tax season, experts say some taxpayers should expect a smaller refund from the IRS.

Tax Experts Warn You to Prepare for a Smaller IRS Refund — Best LifeWith several changes going into effect for this year's tax season, experts say some taxpayers should expect a smaller refund from the IRS.

Weiterlesen »

The IRS faces backlogs from last year as a new tax filing season beginsThe IRS is 'in the roughest shape it's been in in 50 years,' says former commissioner Mark Everson. The agency, he says, is understaffed, has more work than it can handle and is underfunded.

The IRS faces backlogs from last year as a new tax filing season beginsThe IRS is 'in the roughest shape it's been in in 50 years,' says former commissioner Mark Everson. The agency, he says, is understaffed, has more work than it can handle and is underfunded.

Weiterlesen »

Taxpayers face overloaded IRS as filing season opens MondayAn IRS worker shortage, an enormous workload from administering pandemic-related programs and stalled legislation that would have given the agency billions of dollars for more expeditiously processing returns will combine to cause taxpayers pain this filing season.

Taxpayers face overloaded IRS as filing season opens MondayAn IRS worker shortage, an enormous workload from administering pandemic-related programs and stalled legislation that would have given the agency billions of dollars for more expeditiously processing returns will combine to cause taxpayers pain this filing season.

Weiterlesen »

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

Weiterlesen »

Biden's IRS reporting device for third-party payment processors 'will affect your taxes,' says Grover NorquistAmericans for Tax Reform President Grover Norquist discusses Biden's latest IRS push and the impact it will have on independent contractors and those who have a 'side hustle.'

Biden's IRS reporting device for third-party payment processors 'will affect your taxes,' says Grover NorquistAmericans for Tax Reform President Grover Norquist discusses Biden's latest IRS push and the impact it will have on independent contractors and those who have a 'side hustle.'

Weiterlesen »